When Stablecoins Start Building Chains: Is There Still a Chance for Ethereum?

In the crypto market, stablecoins have long been the quiet “invisible giants”—their market cap keeps growing, silently handling cross-border remittances, transaction settlements, and compliance pilots, acting like the “lubricant” for crypto capital flow. This year, however, a milestone change hit: stablecoin issuers are no longer content with “riding on others’ chains” but are building their own.

In August, Circle announced its native blockchain Arc; soon after, Stripe-led Tempo revealed more details. Two stablecoin giants taking this step simultaneously raises questions: Why do stablecoins need dedicated blockchains? Will this threaten general-purpose blockchains like Ethereum and Solana? And what opportunities await retail investors?

Stablecoin Blockchains: Not Just “Another Chain”, But a “Settlement Highway”

If Ethereum and Solana are “all-purpose app malls” (focused on decentralized applications), stablecoin blockchains are more like “payment and settlement highways”, with distinct features:

- Stablecoins as “Toll Fees”: Transaction fees are paid in stablecoins, with transparent and predictable costs—no need to buy volatile tokens for Gas.

- Optimized for “Money Flow”: Not aiming to “do everything”, but to “transfer stably, settle quickly, and comply smoothly”, aligning with real-world financial needs (e.g., cross-currency settlement, forex matching).

- Built-in “Compliance Interfaces”: Easy to connect with banks and payment institutions, reducing gray areas and making it usable for traditional financial players.

In short, stablecoin blockchains are a “vertical integration model”—controlling key links from stablecoin issuance, settlement to application. While facing early cold-start pressure, they gain long-term scale effects and话语权.

5 Key Projects: Different Paths, One Goal

Stablecoin blockchains have unique strategies, but all aim to integrate stablecoins into daily financial cycles:

1. Arc (Circle): USDC’s “Exclusive Track”

As the world’s second-largest stablecoin issuer, Circle launched Arc to break free from Ethereum’s fee constraints. Arc highlights: USDC as Gas (no exchange rate risk for fees), sub-1-second transaction confirmation (ideal for large-scale settlements), and enterprise accounting privacy under compliance. This is Circle’s key step from “stablecoin issuer” to “financial infrastructure provider”.

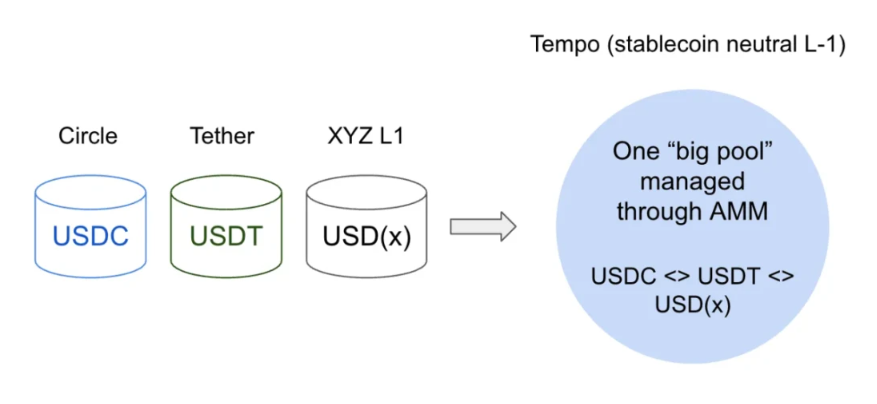

2. Tempo (Stripe + Paradigm): “Payment-First” Neutral Chain

Tempo solves pain points of traditional blockchains: unstable fees, insufficient performance, and being too “crypto-native”. It supports any stablecoin as Gas (via built-in AMM swaps), targets 100k TPS + sub-second confirmation, and is EVM-compatible (easy for developers to migrate). Partners include Visa, Deutsche Bank, and Shopify—ambitious to become a “on-chain payroll system” prototype, challenging traditional payment giants.

3. Stable (Tether): USDT’s “Home Advantage”

Designed specifically for USDT, focusing on “real-world adoption”: USDT directly as Gas (peer-to-peer transfers with zero Gas), sub-second confirmation (serving small and large payments), and a wallet connected to bank cards and merchants. The goal is simple: make USDT flow smoother in cross-border remittances and merchant payments.

4. Plasma (Bitcoin Sidechain): Leveraging BTC Security, Zero-Fee Transfers

As a Bitcoin sidechain, Plasma uses BTC’s security as a “backbone”. Its biggest draw is zero-fee USDT transfers, support for stablecoins or ecosystem tokens as Gas, and EVM compatibility. In July, its token $XPL’s public sale was 7x oversubscribed, and Binance’s airdrop was snapped up in an hour—retail investors can still profit early.

5. Converge: The “Connector” for Institutions and RWA

More than a settlement chain, it aims to bridge RWA (Real-World Assets) and DeFi. Highlights include ultra-high performance (100ms block times), USDe/USDtb as Gas, and institutional-grade security. Partners like Aave and Pendle target institutional capital needs directly.

Will Stablecoin Blockchains “Kill” Ethereum?

In the short term, impact is limited. Stablecoin blockchains are “payment/settlement tools”, while Ethereum and Solana are “open innovation platforms”—the former focuses on deterministic settlement (high-frequency, low-risk payments), the latter on ecosystem innovation (DeFi, NFTs). For example, TRON may be affected (99% of its stablecoins are USDT; if Stable chain matures, its advantage fades), but Ethereum (with security and composability) and Solana (with high performance) remain irreplaceable.

Retail Opportunities: Where to “Get On Board” Early?

Though focused on B2B, stablecoin blockchains offer retail chances:

- Ecosystem Incentives: New chains often run bounty programs and transaction mining. Arc may launch a public testnet in autumn—early participation matters.

- Node Staking: Tech-savvy users can watch node validation (e.g., Converge requires ENA staking).

- Testnet Airdrops: Early users may get airdrops. Tempo and Plasma testnets are live—stay tuned.

- Long-Term Allocation: Invest in related stocks (e.g., Circle, Coinbase) or early tokens (e.g., Plasma’s $XPL).

Conclusion: A “Solid Narrative” for the Next Bull Market?

Stablecoin blockchains won’t crazy the crypto market overnight, but they’re quietly building “utilities for crypto finance”: shorter settlement paths, stable fees, and smoother compliance interfaces. Focusing on “how money flows efficiently”, the core lies in: ensuring settlement certainty, providing stable cross-currency liquidity, and connecting real payment scenarios.

This may not be “sexy”, but it could be the most solid narrative for the next bull market. Projects that deliver on these will be more than “blockchains”—they might become the backbone of next-gen crypto finance.

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”