Is the Endgame of Stablecoins Public Chains? New Attempts by the Big Three

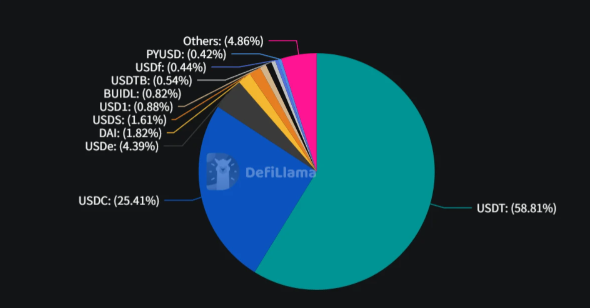

In the evolution of the crypto market, stablecoins have always been the most crucial infrastructure. From the earliest USDT to today’s USDC, DAI, and the emerging USDe, stablecoins have become the core carrier of trading volume and liquidity. However, an accelerating trend is emerging: stablecoin issuers are no longer content with just being “tokens” but are starting to build their own public chains. To date, the “Big Three” stablecoin issuers—Tether (issuer of USDT), Circle (issuer of USDC), and Ethena (issuer of USDe)—have all launched new initiatives. Tether began supporting Plasma, a Bitcoin sidechain focused on stablecoin scenarios, in late 2024, and announced Stable, a new L1 chain backed by Bitfinex and the USDT 0 unified liquidity protocol, in early June this year. Circle, which just completed its IPO, revealed Arc, a self-developed chain for stablecoin finance and programmable money. Ethena’s Converge, supported by USDe, will launch its testnet this fall.

Why Are Stablecoins Building Public Chains?

Previously, stablecoins mostly operated on Ethereum, Solana, and other major public chains. While this model leverages the liquidity of open ecosystems, it also means heavy reliance on underlying technical rules and transaction fee capture. As the crypto market expands, stablecoin issuers are reevaluating this landscape: Do they need fully controlled underlying infrastructure to further consolidate their market position? From an industry perspective, three core logics drive this trend:

Stablecoins as Ecological Gateways

In the crypto world, stablecoins act as “digital dollars,” essential for nearly all on-chain activities. Buying Bitcoin requires USDT or USDC; DeFi mining pools are denominated in stablecoins; many even use stablecoins as daily digital wallets. With daily trading volumes often surpassing Bitcoin’s, stablecoins are the cornerstone of crypto liquidity. Owning a public chain alongside stablecoin issuance means controlling both “monetary authority” and “financial infrastructure,” solidifying their position.

Strategic Value of the Settlement Layer

Public chains are essentially giant “toll booths,” with fees on every transaction. Currently, USDT transactions on Ethereum cost several to tens of dollars, profits pocketed by Ethereum. With daily USDT trading volumes in the tens of billions, fee revenue is astronomical. TRON became a top chain largely by offering nearly free USDT transfers, attracting users from Ethereum. If Tether had built its own chain, these users and revenues could have been retained. With a native chain, issuers capture fees, offer cheaper transfers, and control pricing power—no longer “renting” infrastructure but optimizing it for their needs.

Ecological Stickiness and Bargaining Power

In crypto, users follow developers. Solana attracted projects and users with low fees and speed. A stablecoin issuer with its own chain can actively attract developers via tools, token incentives, or permanent low fees. Once scaled, network effects take hold, transforming issuers from “mints” into platform-level enterprises. Critically, this boosts bargaining power: Today, Circle and Tether often plead with traditional banks, but with a thriving chain (millions of users, thousands of apps), they gain leverage—even prompting traditional institutions to seek partnerships.

Directions and Differentiation of the Big Three’s Public Chains

Plasma: Secured by Bitcoin, Built for Stablecoin Payments

Plasma is a blockchain designed specifically for stablecoin payments—think “Stablecoin Alipay.” Its standout feature is deep Bitcoin integration: Users can directly use native Bitcoin in smart contracts without wrapped tokens. Conveniently, fees can be paid with USDT or Bitcoin, eliminating the need to buy native tokens first. The goal: Make stablecoin payments as simple as WeChat transfers. Developers building payment apps can leverage Plasma’s infrastructure instead of building from scratch, aiming to speed up, cheapen, and secure stablecoin payments while lowering barriers for users and developers.

Converge: Blending Traditional Finance and DeFi Innovation

Converge is a unique blockchain with “dual nature”: It can be a fully open DeFi playground or a strictly compliant financial platform, with users choosing modes. Imagine retail users freely trading/earning in DeFi, while banks/funds conduct regulated digital asset business on the same chain—separate yet mutually beneficial. Fees are payable in USDe/USDtb, ensuring cost control. This design suits projects targeting both retail and institutions: Retail enjoys DeFi yields/innovation; institutions operate compliantly.

Stable: USDT-Powered L1 for Institutions

Stable is a blockchain built entirely around USDT, serving hundreds of millions of USDT users. Its key innovation: USDT as network “blood”—no fees, no need for other tokens; just USDT for transactions, like bank transfers. Privacy-focused users get encrypted transfers. It offers enterprise solutions (bulk transfers, merchant收款, debit card integration), enabling businesses to use USDT as a full payment infrastructure, not just a trading tool.

Arc: The Institutional Finance Compliance Bridge

Arc, Circle’s enterprise-focused chain, is “Wall Street’s Stablecoin Chain.” Its edge lies in Circle’s traditional finance roots, offering unmatched compliance. Businesses operate in a regulated environment, mitigating risks. Technically, USDC pays all fees, simplifying accounting. Arc also provides institutional tools: Tokenizing real estate/equity or building digital payment systems. For traditional firms wary of crypto, Arc offers a safe entry point.

Key Differences: Positioning and Growth Strategies

Plasma, Stable, and Arc position themselves as payment infrastructures, focusing on cheaper/faster stablecoin transfers—reimagining traditional payments with blockchain. Converge, however, is a DeFi innovation platform, aligning with Ethena’s DNA. Unlike USDC/USDT (backed by cash/T-bills), USDe uses a Delta-neutral strategy for stability, making Converge ideal for DeFi enthusiasts and on-chain innovators.

Growth strategies and “openness” also differ. Plasma (Bitcoin integration), Stable (zero fees), and Arc (Circle’s compliance) optimize existing frameworks, attracting traditional users via low barriers (fee-free, simplicity, compliance)—”scale first” strategies. Converge takes a different path: attracting crypto natives with higher yields/innovation, then expanding via optional compliance—”depth first.” Its “optional permission” model is visionary: Open by default (anyone bridges assets, deploys apps, uses DeFi), but compliance layers can be activated for RWA tokenization/KYC/KYB needs. This balances DeFi’s openness with traditional finance’s compliance, avoiding stifling innovation or scaring off institutions. In short: The first three use new tech for old tasks; Converge builds infrastructure for future finance.

Challenges and Outlook

Stablecoin chains demand extreme stability/security—breaches or outages could shatter trust. Ecological cold starts are another hurdle: Late entrants must use differentiation and incentives to counter Ethereum/Solana’s network effects. Looking ahead, stablecoin-chain integration will blur “currency” and “infrastructure,” evolving tokens into ecosystem operating systems. Projects balancing compliance and openness may bridge traditional and crypto finance, securing key roles in global financial infrastructure competition.

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”