The Hidden Market Makers: The Rise and Fall of Crypto Liquidity Providers

Cui Jian once sang in Fake Monk: “I want everyone to see me, but not know who I am”. In the volatile crypto market, such “invisible players” are not rare—they attract countless curious glances without revealing themselves.

From Wall Street Rebel to “Dark Pool Operator”

In 2017, a young man left Wall Street, used his savings to build mines, read whitepapers, stayed up late tuning algorithms, and recruited two colleagues from Optiver, a top market maker and high-frequency trading firm—one a trading architecture expert, the other a risk control whiz. The 2018 bear market killed countless exchanges and projects, but they survived on personal belief and algorithms. When the 2020 pandemic roiled markets, their arbitrage algorithm raked in $120,000 overnight.

This man is Evgeny Gaevoy, founder of Wintermute—now one of the world’s largest algorithm-driven crypto market makers. Based in London and fond of U.S. travel, he’s known for meme posts and bluntness: when accused of market manipulation, he shot back, “Treat me as an enemy, don’t blame me for firing back”.

Market Makers: The “Invisible Glue” of Crypto Markets

Why can’t projects just list tokens and wait for trading?

– DEX Listing: Easy! Create a trading pair (e.g., X/ETH), add initial liquidity (e.g., 1M X tokens + 100 ETH).

– CEX Listing: Harder! Exchanges like Coinbase or Binance need “constant buy-sell orders”. Market makers step in as the “always-ready traders”—buying when you sell, selling when you buy—to keep liquidity flowing.

They’re more low-key than exchanges or VCs but equally vital. Yet they’re often suspected when token prices crash: “Did the market maker dump?”

The Old Guard: From Boom to Bust

Once-dominant players now face decline:

– Alameda Research: FTX’s sister firm, once handled 20% of crypto trading in 2021. The 2022 FTX collapse exposed $10B in stolen client funds; SBF got 25 years, Alameda liquidated.

– Jump Crypto: A high-frequency trading giant, it dominated Solana and Terra in 2021. After Terra’s crash and SEC probes, it exited U.S. markets and cut 10% of staff.

– Wintermute: Rose via algorithms and OTC, lost $160M to hackers in 2022, then shifted from expansion to caution.

Kaiko data shows Bitcoin’s 2% depth (a liquidity metric) plummeted from hundreds of millions to under $100M within a week of FTX’s collapse—global crypto liquidity halved overnight.

The New Era: Rate Cuts, ETFs, and Fresh Blood

2023-2024 saw a “liquidity vacuum”, letting new players thrive:

– Macro Tailwinds: Fed rate cuts + 2024 Bitcoin halving sparked memes, AI agents, and RWA mania.

– Cash Inflows: $54.19B into Bitcoin spot ETFs, $13.64B into Ethereum ETFs (SoSoValue).

– Regulatory Shift: Post-2025 Trump administration rolled back Biden-era restrictions, launching a digital asset task force to boost compliance.

Three newcomers seized the moment:

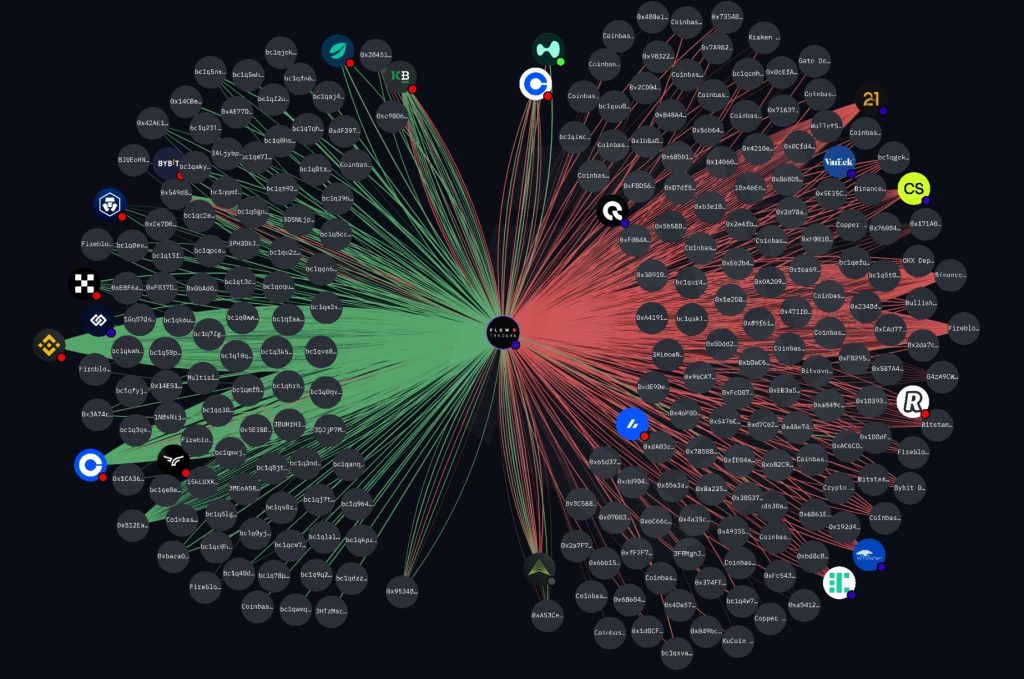

– Flow Traders: A Dutch liquidity vet, pivoted to crypto in 2023. CEO Thomas Spitz (20-year Crédit Agricole vet) leads a team of Wall Street/Silicon Valley elites. Specializes in cross-chain liquidity; Q2 2025 net trading revenue hit €143.4M (+80% YoY). It even helped Germany smoothly liquidate seized BTC.

– GSR Markets: A Hong Kong algo firm, led by Josh Riezman—one of few with UK FCA and Singapore MAS licenses. Makes markets for 30+ altcoins (RNDR, FET, WLD); Arkham data shows $143.76M in public addresses, with Binance as its main exchange.

– DWF Labs: The controversial one! Led by Andrei Grachev (with 5 Chinese tattoos), it wears 15 hats (VC, OTC, incubator…), investing in 400+ projects (2023-2025). Focuses on East Asian projects and meme coins (MANTA, LADYS), but its official address now holds <$9M.

Controversies: Feuds and Collusions

New players brought drama:

– Rivalry: At 2023 Token2049, GSR called DWF “unworthy to share the stage”; Wintermute’s CEO liked the post. Evgeny later slammed Andrei, calling DWF a “wrong market maker”.

– Project Collusion: In 2025, Movement lent 66M MOVE tokens to a market maker, which funneled them to shadow firm Rentech. A contract clause—”sell when market cap hits $5B”—led Rentech to pump and dump $38M, crashing MOVE by 86% and slashing TVL from $166M to $50M.

Conclusion: 63 Eyes in the Dark Forest

RootData tracks 63 active market makers—their trading alone can roil markets. They make trillion-dollar liquidity webs with code, no fanfare. When you chase that “mysterious big order” on-chain, you might step into their “liquidity trap”—just a ripple in their grand strategy.

63 known players shine, but how many unseen eyes lurk in crypto’s dark forest?

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”