When Tech Meets Forex Barriers: Why Stablecoin Growth Struggles to Break the ‘Traditional Rut’

‘In the crypto world, some think code and technology can solve everything. But in foreign exchange, that’s just naive,’ says Mike Robertson, CEO of forex infrastructure firm AbbeyCross. His words highlight the awkward predicament stablecoins face as they expand in payments.

Behind the Shiny Numbers: Stablecoins’ ‘Highlight Moment’

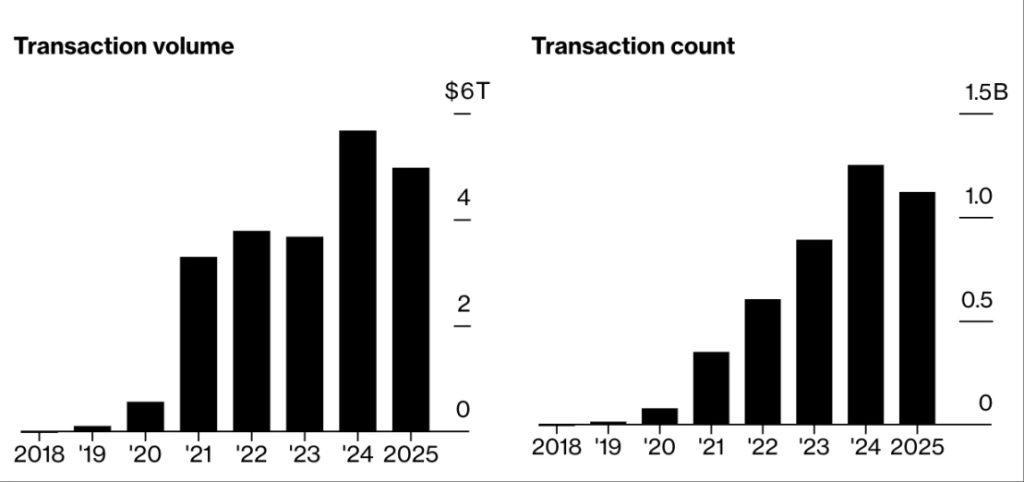

According to Visa and Allium data, as of July 2025, stablecoin transactions this year have already hit $5 trillion, with 1 billion payments—closing in on 2024’s full-year total of $5.7 trillion. What’s more, since Donald Trump was elected U.S. President in November 2024, the total market cap of these crypto assets pegged to mature currencies like the dollar has surged 47% to $255 billion.

The vision for stablecoins is to bring a faster, cheaper, more efficient future to payments, especially cross-border ones. The data seems to back up this potential, but an old question lingers: Can this technology really solve the decades-old headaches plaguing forex?

The Unavoidable ‘Forex Costs’: Stablecoins’ ‘Traditional Shackles’

Want to swap stablecoins for different fiat currencies (say, euros to Hong Kong dollars)? Don’t be surprised—you’ll run into the same ‘cost traps’ as regular exchanges: bid-ask spreads, conversion fees, intermediary charges, and slippage (the difference between expected and actual trade prices due to market swings). These costs exist in cross-border crypto transactions too, often hitting hardest when moving funds in and out of traditional financial systems—challenging the ‘low-cost’ claim of stablecoin advocates.

Why can’t tech fix this? Robertson puts it plainly: ‘Each currency has its own dynamics. And most banks and payment firms make their profits from forex trades, not fees.’ Eliminating these ‘profit chains’ with code isn’t so easy.

Finding Opportunities in ‘Non-Mainstream’ Scenarios

Despite the challenges, stablecoin growth is real. Its momentum comes from two key areas: cross-border payments underserved by traditional finance, and payments in emerging markets.

Take BVNK, a startup focused on stablecoin payment infrastructure. It ignores ‘mainstream corridors’ like GBP-USD, instead targeting ‘alternative routes’ such as Sri Lanka to Cambodia. ‘These routes used to need multiple intermediaries—expensive and slow,’ says Sagar Sarbhai, BVNK’s APAC Managing Director. ‘Stablecoins simplify the process. Costs might not be lower yet, but it’s faster, and funds are available sooner.’ Today, BVNK handles around $15 billion annually.

Another example is Conduit, which pivoted to stablecoin payments after the 2022 crypto winter. It lets users send money via local systems like Brazil’s Pix and receive via Europe’s SEPA. CEO Kirill Gertman says the firm now processes $10 billion yearly.

Giants Entering & Regulatory Tailwinds: Preparing for Takeoff?

Of course, compared to traditional giants like Visa, stablecoins are still small—Visa processed $13.2 trillion in payments in 2024, over twice the stablecoin total that year. But giants are moving: Visa launched a platform in October 2024 allowing banks to mint, burn, and transfer fiat-backed tokens (including stablecoins), targeting markets with dollar liquidity shortages and inefficient traditional systems.

Crucially, regulation is clearing the way. The U.S.’s recent GENIUS Act set clear rules for the world’s largest stablecoin market, giving banks and payment firms confidence to enter. This has spurred global regulators to draft similar frameworks for stablecoin issuers.

‘We’re just starting to see the first signs of exponential growth,’ Sarbhai says optimistically. ‘The groundwork laid in the past five years could explode in the next 12 months.’ Can stablecoins truly break forex barriers? The battle between tech and tradition continues.

Read More《当技术遇上外汇壁垒:稳定币增长为何难破「传统困局」?》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”