Crypto in US Pensions? $9 Trillion 401(k) Opens Up—What Does It Mean?

Trump’s New Policy Sends Shockwaves: Crypto Market Gets a “Massive Inflow Gateway”

On August 7th, Bloomberg reported that Trump will sign an executive order this Thursday, allowing “alternative assets” like cryptocurrencies and private equity to be included in US 401(k) pension plans. The crypto market surged in response: Bitcoin broke $115,500, Ethereum neared $4,000, and the long-awaited “altcoin season” finally seems to be kicking off as altcoins rallied across the board.

What is 401(k)? Why Is This a Big Deal?

In simple terms, 401(k) is the “retirement piggy bank” for millions of Americans, managing about $9 trillion in assets—it’s where tens of millions of people’s retirement savings are pooled and invested. Historically, it only picked “safe players” like stocks and bonds, prioritizing “security first.”

Trump’s executive order is like prying open this “conservative piggy bank”: it’s the first time high-risk, high-reward “alternative assets” (including crypto, gold, and private equity) are allowed in. Even if just 2% of 401(k) funds flow into crypto, that’s $170 billion—equivalent to two-thirds of the current market cap of US crypto spot ETFs!

This isn’t Trump’s first try. In 2020, his administration wanted to let private equity into 401(k), but it fizzled without presidential backing. This time, with the president’s direct approval, plus the Labor Department revoking Biden-era crypto restrictions in May (and even mortgage lenders now considering crypto assets), the Trump administration is clearly pushing crypto into the financial mainstream.

Policy in Action: States and Wall Street Race to “Get Ahead”

Before federal rules are final, states and institutions are already moving:

– State-level trials: North Carolina proposed letting public pensions invest up to 5% in Bitcoin; Wisconsin bought $160 million in Bitcoin ETFs (later reduced to $104 million); Michigan added $6.5 million in Bitcoin ETFs to state employees’ retirement portfolios.

– Wall Street giants jump in: Fidelity (managing $5.9 trillion) launched crypto-friendly retirement accounts last year; Blackstone is partnering with Morgan Stanley to create private equity tools for 401(k)s; BlackRock is exploring crypto ETF integration into retirement products.

Where Will the Money Go? Crypto’s New Opportunities

Even a tiny slice of the $9 trillion 401(k) pie could shake up crypto:

– Big cryptos first: Bitcoin and Ethereum spot ETFs, with strong compliance and liquidity, are likely to be the first to “catch the cash.”

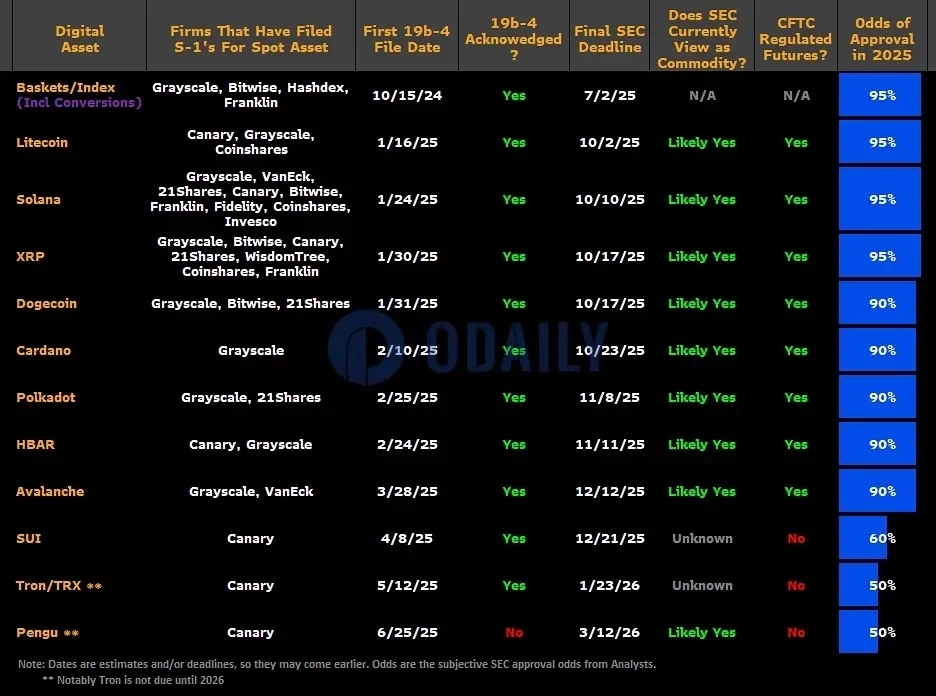

– Altcoins may follow: Projects like SOL, XRP, and LTC could benefit if they get ETF approval later—since institutions prefer “transparent, easy-to-trade” assets.

Controversy & Risks: The “Hidden Worries” Behind High Returns

Critics aren’t convinced, though:

– Experts warn: Johns Hopkins professor Jeffrey Hooke argues crypto’s volatility (Bitcoin crashed over 60% in 2022) and illiquid, high-fee private equity make them unfit for retirement savings.

– Democrats criticize: Senator Elizabeth Warren and others fear ordinary savers could become “guinea pigs” for policy experiments, calling for stricter regulation.

Conclusion: A Key Step for Crypto’s Mainstream Push?

Trump’s executive order opens a “trillion-dollar door” for crypto. But full implementation depends on Labor Department and SEC detail, which could take months or years. For investors, tracking regulatory progress and institutional money flows is now critical.

After all, this isn’t just a “cash feast”—it might be crypto’s historic turn from “niche hobby” to a key piece of the mainstream financial puzzle.

Read More《加密货币正式进入美国养老金套餐,最大增量入口开闸》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

链上探索《加密货币正式进入美国养老金套餐,最大增量入口开闸》

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”