Decoding Hong Kong’s Stablecoin Regulation: The ‘Strictness’ and ‘Flexibility’ Behind

Hong Kong is rolling out the red carpet for responsible innovators, but it’s also holding up a strict rulebook—here’s what you need to know.

Fast-Tracking to Regulation: Hong Kong’s Stablecoin Milestone

On July 29, the Hong Kong Monetary Authority (HKMA) dropped a regulatory bombshell: six key documents to finalize the stablecoin regulatory regime, set to kick off on August 1. This follows the passage of the Stablecoin Ordinance by Hong Kong’s Legislative Council on May 21, wraping up the ‘last mile’ of regulation in under three months.

The Regulatory Puzzle: How Do These Documents Fit Together?

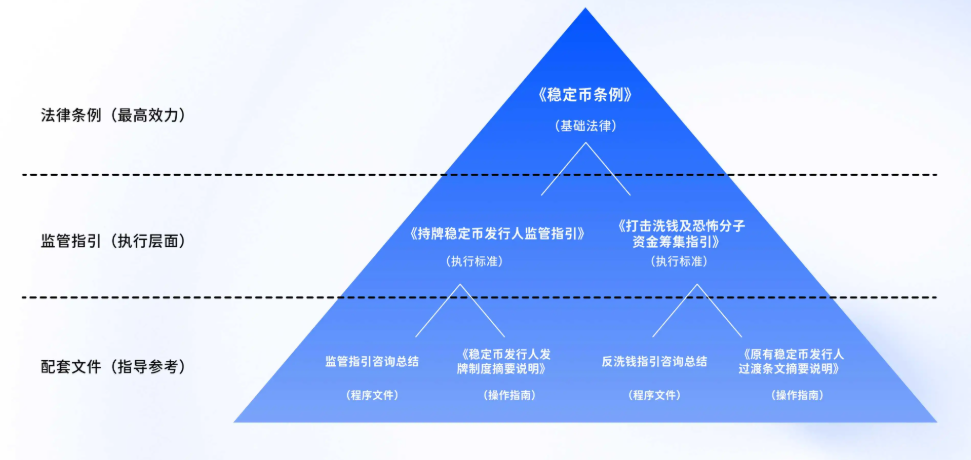

Think of Hong Kong’s stablecoin rules as a three-layer pyramid:

- 1 Law (Top Tier): The Stablecoin Ordinance (passed in May) – the foundation stone, defining what stablecoins are, who can issue them, and core regulatory principles.

- 2 Guidelines (Middle Tier): Guidance on Regulation of Licensed Stablecoin Issuers and Guidance on Anti-Money Laundering and Counter-Terrorist Financing – turning legal principles into actionable compliance standards (think capital ratios, risk management, and disclosure rules).

- 2 Explanatory Documents (Bottom Tier): Summaries of licensing procedures and transition arrangements – your user manual for applying for a license and navigating the transition period.

In short: The Ordinance sets the ‘rules of the game’, guidelines define the ‘playbook’, and explanatory docs show you ‘how to join the game’.

Spotlight: The 89-Page ‘Rulebook’ for Issuers

Let’s zoom in on the star document: the Guidance on Regulation of Licensed Stablecoin Issuers (89 pages!). It’s packed with nitty-gritty details that will make or break issuers’ compliance efforts.

Entry Ticket: HK$25 Million to Play

First hurdle: A minimum capital requirement of HK$25 million (≈US$3.2 million). That’s way steeper than the EU’s MiCA (€350k) or Japan’s (¥10 million), but it’s HKMA’s way of ensuring only serious players enter.

But money alone isn’t enough. Issuers must also pass a tough ‘fit and proper’ test: clean criminal records, relevant experience, and even board composition rules (at least 1/3 independent directors, just like public companies!). Plus, no side hustles without HKMA’s green light – stablecoin issuance is a full-time job here.

Reserves: 100% Backing (Plus a Safety Cushion)

Stablecoins must be 100% backed by reserves at all times – and then some. HKMA wants ‘appropriate over-collateralization’ to buffer against market shocks, though it stops short of a fixed ratio (issuers must run stress tests to justify their numbers).

What counts as reserves? Cash and short-term deposits, yes – but also tokenized assets (think tokenized U.S. Treasuries or bank deposits). Innovation gets a seat at the table!

And your reserves aren’t just locked up – they’re legally ringfenced via trust arrangements. Even if the issuer goes bust, users’ funds stay safe. Transparency? Try weekly reserve reports (vs. USDC’s monthly updates) and quarterly third-party audits.

Tech 101: Private Keys and Smart Contracts

HKMA isn’t just regulating finance – it’s speaking blockchain fluently. The guidance lists 12 strict rules for private key management:

- Keys for minting/burning stablecoins must stay offline (no internet access!)

- Multi-person approval for key use (no lone rangers!)

- Storage in Hong Kong or HKMA-approved locations (no offshore hiding!)

Smart contracts? They need audits by ‘qualified third parties’ before launch or upgrades – no cutting corners on security.

KYC: To Redeem, You Must Reveal

Here’s the KYC twist: You can hold stablecoins anonymously, but to redeem them for fiat, KYC is mandatory. It’s a balance between privacy and compliance – HKMA wants to prevent money laundering while keeping basic ownership flexible.

Operations: Stablecoins Go ‘Banking’?

HKMA is pushing issuers to adopt banking-style rigor:

- T+1 Redemption: No stalling – redemption requests must be processed within 1 business day (unlike Tether, which reserves the right to delay).

- Three Lines of Defense: A risk management setup borrowed from banks: business units (first line), risk/compliance teams (second line), and internal audit (third line).

- Third-Party Oversight: Even outsourcing (e.g., reserve custody or tech services) needs strict due diligence – HKMA wants full visibility, even if vendors are overseas.

Exit Plan: Hope for the Best, Prepare for the Worst

Issuers must draft a ‘business exit plan’ – a roadmap for selling reserves, handling redemptions, and transferring services if things go south. It’s like a financial will, ensuring stability even in crisis.

The HKMA’s Playbook: Strict but Smart

Hong Kong’s approach? ‘Tough love’ with a purpose. The rules are strict (high capital, tight tech controls) but flexible (embracing tokenized assets, emergency redemption buffers). Why? Because stablecoins aren’t just crypto – they’re the bridge between traditional finance and the digital economy.

The message to innovators: Come to Hong Kong, but come prepared. You’ll need deep pockets, top-tier tech, and a compliance team that eats regulations for breakfast.

For the industry, Hong Kong’s experiment is a blueprint: Regulation isn’t the enemy of innovation – it’s the guardrails that let innovation thrive safely.

Read More《解码香港金管局文件:稳定币监管背后的「严」与「活」》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”