ETH vs SOL: The 2025 Crypto War, Trillions of Capital Betting on New vs. Old Order

2021 was the “battle of Layer 1 blockchains”, 2024 became the “Meme coin carnival”. What will 2025’s crypto market focus on? Mainstream capital has the answer: With the passage of the GENIUS Act and stablecoins entering U.S. sovereign regulation, a multi-dimensional financial narrative of “Stablecoins × RWA × ETF × DeFi” is rising. At the core of this transformation is the “new vs. old order war” between Ethereum (ETH) and Solana (SOL).

Capital Bets: From “Bitcoin Faith” to “ETH/SOL Choice”

The 2025 crypto market is no longer a “rising tide lifts all boats” scenario. Capital is now concentrated on top tracks, with institutional buying clearly targeting ETH and SOL:

ETH: The “On-Chain Treasury Bond” of Institutional Assets

GameSquare raised its digital asset treasury cap to $250 million and added ETH; SharpLink Gaming holds 340,000 ETH (worth over $1.2 billion); institutions are even planning to become the “largest public ETH-producing company” via reverse mergers. ETH is being treated as a “compliant financial base”—linked to RWA, stabilizing stablecoin reserves, and preparing for spot ETFs, making it traditional capital’s “on-chain allocation target”.SOL: The “Speculative Engine” of Consumer Blockchains

DeFi Development Corp holds nearly 1 million SOL; Upexi made over $58 million in profits after buying 100,000 SOL; SOL’s Meme coin PENGU hit a $2.785 billion market cap, surpassing BONK. With low gas fees and high TPS, SOL has become a “high-performance consumer application chain”, where Meme economies, mini-games, and community points form a “high-frequency trading loop”.

In short, ETH is the “institution-taken financial engine”, while SOL is the “capital’s offensive speculative track”.

ETH: The Underestimated “Institutional Backbone”, Fulfilling Its Financial Mission

Despite past doubts about low staking yields and Layer 2 fragmentation, ETH has now become the most institutionally tied asset, supported by three pillars:

- RWA Hub: Over 70% of on-chain RWA ($2.8 billion) is issued on ETH mainnet and L2, with RWA products from BlackRock and Franklin Templeton using ETH as a “value medium”.

- Compliant Asset Anchor: WETH now accounts for 6.7% of Circle’s stablecoin reserves, with Grayscale and VanEck accelerating ETH spot ETF preparations—ETH is poised to be the next ETF focus.

- Ecosystem Dominance: ETH mainnet and L2 TVL reaches $110 billion (61% of global TVL), with 50,000+ monthly active developers—4x that of SOL.

ETH’s rise isn’t a “new story”, but the “realization of old value”—from a “gas token” to “on-chain financial infrastructure”.

SOL: The “Explosive Code” of Consumer Blockchains

SOL took a different path: instead of chasing regulatory depth, it thrives on “user activity” and “consumer scenarios”:

- Meme Coin Native Soil: Low gas fees allow users to “meme cheaply”, creating a rapid cycle of “experiment → FOMO → trading”—Meme has become SOL’s “daily consumer behavior”.

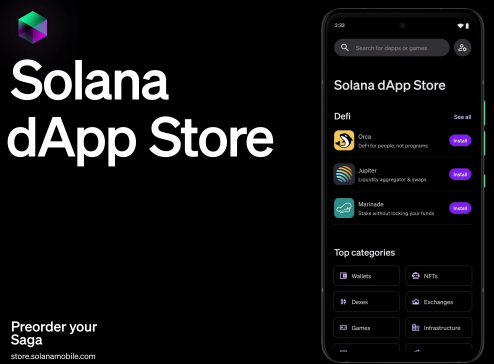

- Capital Bets on “On-Chain Hype”: Listed companies buy SOL not for technology, but to bet on “ecosystem activity”—Jupiter (DEX), Backpack (wallet), and Solana phones are building a “Web2-like closed-loop experience”.

- High-Frequency Trading Edge: SOL’s TPS, transaction frequency, and per-user interactions have surpassed Polygon and BNB Chain, making it crypto natives’ “daily active gateway”.

Policy Divergence: ETH Steady, SOL Volatile

After the GENIUS Act, policy dividends are being “differentiated”:

- ETH: The “Slow Bull” of Compliance: Benefiting from RWA and ETFs but facing SEC scrutiny on security classification, leading to a steady but long-term rise.

- SOL: The “Fast Bull” in Grey Areas: With fewer centralized issuance or complex staking, it easier enters regulatory “grey safe zones”, resulting in steep but volatile surges.

The Future: Not a Choice, but a Portfolio

ETH and SOL aren’t competing to replace each other—ETH is traditional capital’s “mid-long-term allocation”, while SOL is speculators’ “short-term burst option”. In 2025, the crypto war isn’t about “who wins”, but how these two narratives coexist as a hedge portfolio.

Read More《ETH vs SOL:2025加密战争,万亿资本押注新旧秩序》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

链上探索《ETH vs SOL:2025加密战争,万亿资本押注新旧秩序》

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”