Michael Saylor: Bitcoin-Backed Bonds with 10% Annual Yield, $9 Trillion Pension Market Ready for Battle

Corporate Bitcoin Reserve Trend Heats Up

Recently, the trend of enterprises focus on Bitcoin reserves has become increasingly evident. Several companies are accelerating their strategies, with typical cases including:

- NASDAQ-listed Profusa: Signed an equity credit agreement with Ascent Partners Fund LLC, planning to raise up to $100 million by issuing common stock, with net proceeds to be fully used for buying Bitcoin.

- H100 Group: Raised an additional approximately $54 million, which will be used to seek investment opportunities under its Bitcoin reserve strategy framework.

Beyond these cases, many traditional enterprises are also actively raising funds to build Bitcoin strategic reserves.

Pension Market: A Potential $9 Trillion ‘Battlefield’

On July 18, the Financial Times reported that the Trump administration is considering opening retirement markets (managing $9 trillion in assets) to cryptocurrencies, gold, and private equity investments. If the policy is implemented (allowing 401(k) plans to invest in alternative assets), equities of Bitcoin-heavy Listed Company may become hot pension targets, potentially more attractive than spot ETFs.

Michael Saylor: 10% Annual Yield Bitcoin-Backed Bonds Target Fixed-Income Market

Against this backdrop, Michael Saylor, founder of Strategy (formerly MicroStrategy), has highlighted the ‘BTC Credits Model’. He emphasized that Bitcoin treasury companies are ‘not competing with other Bitcoin treasury companies, but with all junk bonds and investment-grade corporate bonds’.

The Logic of Bitcoin Treasury Companies

Saylor explained that the model is simple yet powerful: issue equity or credit instruments (e.g., common stock, preferred stock, convertible bonds) to raise funds, then use all proceeds to buy Bitcoin. For instance, Strategy announced a $21 billion ATM program last year for Bitcoin purchases, while Metaplanet achieved exponential market cap growth through frequent equity issuances.

BTC Credits Model: Core Tool for Valuing Bitcoin-Denominated Assets

The model uses ‘BTC Yield’ to measure value—the percentage appreciation per Bitcoin. For example, selling $100 million in equity at 2x Net Asset Value (NAV) generates $50 million in BTC gains (without diluting shareholders). The key is ‘value-accretive transactions’: issuing securities above NAV to avoid dilution.

10% Annual Yield Bonds: ‘Killer App’ for Pension Markets

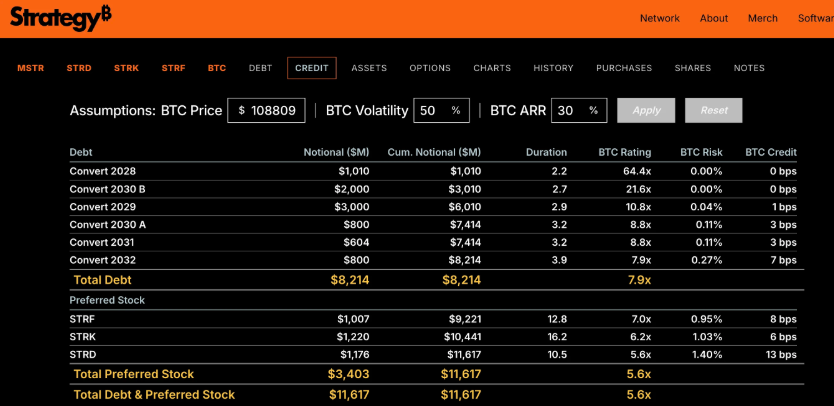

Saylor noted that Bitcoin-backed bonds target retirees seeking stable returns. Examples include Strategy’s preferred stocks:

- STRK (Strike): Offers 40% upside potential + 8% coupon dividend;

- STRF (Strife): Provides 10% annual yield.

These products use Bitcoin as collateral (typically 10x+ collateralization), offering far higher yields than traditional bonds with minimal risk. For example, Americans earning under $48,000 annually can buy such instruments for 10% tax-free returns.

Competitive Edge: ‘Perfect Collateral’ Beyond Traditional Bonds

Saylor stressed that Bitcoin-backed bonds compete in the multi-trillion corporate bond market: ‘Our collateral (Bitcoin) appreciates 55% annually, superior to any investment-grade company’s assets.’ The goal is to replace illiquid, low-yield traditional preferred stocks and junk bonds with ‘higher yield, lower risk, and stronger liquidity’ products.

Q&A with Saylor: On Mining Centralization and KYC

- Mining Centralization Concerns: Saylor believes Bitcoin mining is globalizing, shifting from China to the U.S. and then worldwide, with hash power maintained by multi-party consensus—no need for excessive worry.

- KYC and Censorship: Bitcoin’s global nature will drive Layer2-4 innovation; privacy tools (e.g., VPNs) will proliferate, and KYC rules may evolve in five years due to technological breakthroughs.

Read More《Michael Saylor:BTC抵押债券年化10%,9万亿退休金战场已就绪》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

链上探索《Michael Saylor:BTC抵押债券年化10%,9万亿退休金战场已就绪》

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”