From Real Estate Crisis to On-Chain Landlord: How PlayEstates Lets You Invest in US Property with $10 via Web3?

Imagine a Southeast Asian student becoming an “on-chain shareholder” of premium US real estate with just $10, receiving daily USDC dividends. Or a young person tracking their asset growth in real-time, like completing game quests on their phone. For the PlayEstates team in San Francisco, these moments hark back to a pivotal late-night decision four years ago.

The 2020 pandemic left William Guo, the founder, struggling with a real estate project—cash flow collapsed because overseas investors couldn’t sign contracts in person. This crisis sparked a breakthrough idea: What if blockchain could fractionalize real estate, letting global users invest and trade directly on-chain, breaking down traditional finance’s barriers and geographic limits?

Today, that idea has grown into PlayEstates, a multi-million-dollar RWA project. It attracted over 10,000 users without public marketing, and its first $350,000 assets sold out in two and a half weeks. What’s its secret?

I. “Selling Real Estate Like Pinduoduo”: An Engineer’s Evolution into an RWA Entrepreneur

William’s cross-industry background defines PlayEstates’ unique DNA. With roots in engineering, green tech, and real estate investment/development, he understands both “picking good assets” and “making them accessible to people.”

“Traditional real estate financing relies too much on offline intermediaries and complex processes—the pandemic exposed this flaw entirely,” he recalls. When launching PlayEstates in 2022, his goal was clear: Use Web3’s “decentralization” and “transparency” to let global users invest in premium US real estate at low costs.

This pragmatism shines in team building: Core members are trusted legal and compliance experts from his past ventures. “Compliance is a lifeline,” William stresses. “We refused to ‘ride first, buy tickets later’—we wanted a project that could last long-term.”

II. PNFT + OWND: Balancing Compliance and Liquidity

PlayEstates’ standout feature is innovating within regulatory boundaries:

- Delaware Series LLC Structure: Each asset is a separate “legal entity.” Even if one project fails, others remain unaffected, eliminating systemic risk. US users join via Reg D, while overseas users access through a BVI fund (Reg S), avoiding “securities NFT” disputes.

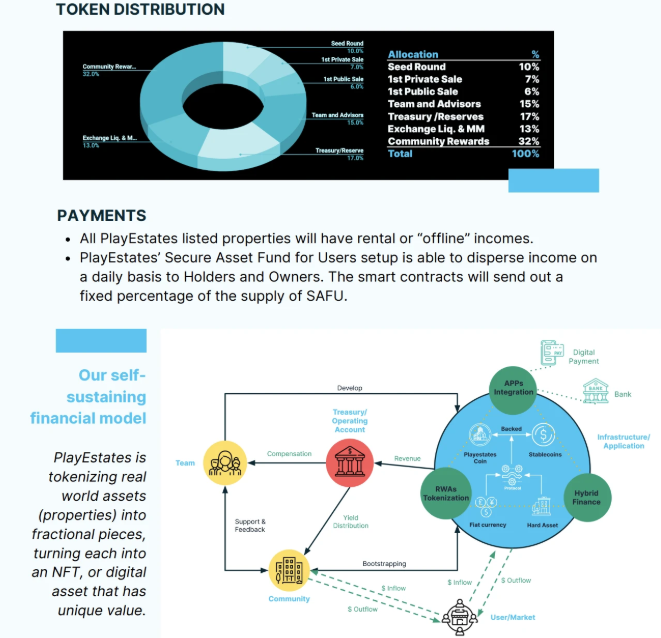

- Dual-Token Design (PNFT + OWND): KYC-compliant users hold PNFTs (property NFT certificates) for daily USDC dividends. Non-KYC users receive OWND utility tokens, which can earn returns and be traded. Compared to traditional REITs, it’s more liquid—NFTs can be resold anytime, no months-long lockups.

- Daily Dividends + SAFU Fund: Asset returns auto-settle in users’ wallets as USDC, with on-chain records for transparency. It’s like being an “on-chain landlord” collecting rent daily—maximum security.

“We’re not a ‘real estate NFT store,'” William clarifies. “Our core strength is the full-chain capability of asset acquisition, management, and compliance. Most properties on our platform come from our own fund or partner family offices—this resource is irreplicable.”

Looking ahead, it plans to expand into new assets like eco-energy and oil fields, and even open “Tokenization-as-a-Service (TaaS)” to help more institutions tokenize real-world assets.

III. ToC is the Game-Changer: Letting Gen Z “Earn While Playing”

A common RWA pitfall is “having assets but no users.” PlayEstates flips the script: It uses SocialFi + GameFi “gamification” to attract young users.

“Gen Z’s biggest struggle is ‘sky-high asset entry barriers,'” William notes. “Previous generations could save for a house, but today’s youth face rising prices and inflation—salaries can’t keep up.”

PlayEstates solves this with $10 minimum investments: Splitting million-dollar properties into tiny fractions, letting users “group buy” like on e-commerce platforms. Gamified interfaces visualize growth and dividends, making investing feel like “claiming quest rewards”—no more boredom.

Current users are mainly from the US (accredited investors familiar with local assets) and Southeast Asia (young people eager for global allocation). The Middle East is next on the horizon.

IV. The Future of RWA: Compliance, Liquidity, Asset Quality—None Can Be Ignored

“Traditional institutions are entering RWA now—it’s a good sign,” William says, optimistic about the industry. But he highlights key challenges: “Compliance is the foundation, liquidity is the experience, and asset quality is the core—all three are must-haves.”

PlayEstates’ roadmap is clear: Launch a mobile app in Q4 for on-the-go asset management; introduce DAO governance, letting “on-chain landlords” vote on asset operations; and add lending/portfolio features later.

“We want to make ‘money growing money’ simple,” William concludes. “Wealth accumulation shouldn’t be only for the rich—everyone deserves a chance via Web3.”

When $10 can unlock US real estate, and asset building feels like playing a game—PlayEstates might just be defining the next generation of RWA.

Read More《Odaily专访PlayEstates:让年轻人10美元当上全球房东》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

链上探索《Odaily专访PlayEstates:让年轻人10美元当上全球房东》

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”