Positive Comments: The Technological Innovation and Value of Reconstructing the Financial Ecosystem of Stablecoins Are Prominent

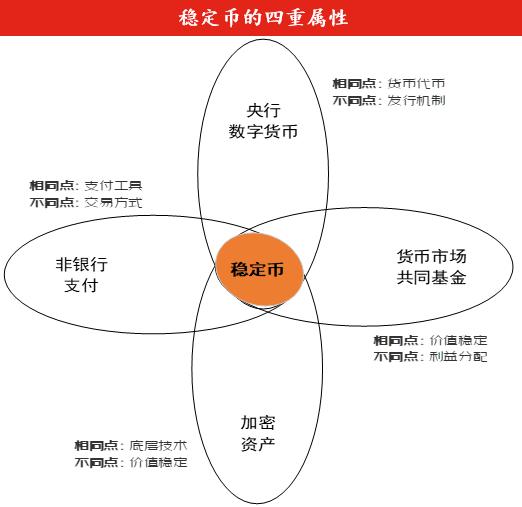

As a “composite” of crypto – assets, central bank digital currencies (CBDCs), third – party payments, and money market mutual funds, stablecoins are bringing significant innovation value to the global financial system through the integration of their technological characteristics and functional positioning.

First of all, the decentralized nature of the technological architecture drives a revolution in payment efficiency. As reported in the news, stablecoins rely on blockchain and distributed ledger technologies to achieve “payment – as – settlement.” The longest settlement time for cross – border payments is no more than 1 hour, and the average cost is less than $1. This technological advantage completely breaks the lengthy process (usually 2 – 5 days) and high cost (transaction fees can exceed 5%) of traditional cross – border payments that rely on the SWIFT system. It is of subversive significance, especially for scenarios such as cross – border trade and the capital flow of multinational enterprises. For example, institutions like VISA and Mastercard are collaborating with crypto exchanges to explore the use of stablecoins for daily consumer payments, and traditional financial institutions such as JP Morgan and Société Générale are actively issuing stablecoins, precisely because they recognize the efficiency advantage of “decentralized transactions + instant settlement.”

Secondly, the complementary nature of the functional positioning expands the boundaries of financial services. Stablecoins do not replace third – party payments or CBDCs but form a differentiated synergy. Third – party payments focus on small – value and high – frequency domestic consumption (such as WeChat Pay), while stablecoins are more suitable for scenarios such as cross – border trade and tokenized asset transactions. CBDCs are led by central banks, emphasizing legal tender status and general usability for domestic payments (such as the digital RMB), while stablecoins, relying on the flexibility of market institutions, fill the gaps in cross – border payments and financial market settlements. The “CBDC + stablecoin” hybrid systems explored by the Hong Kong Monetary Authority’s Aurum project and the UK’s Fnality project are practical verifications of this complementarity. This synergy not only improves the circulation efficiency of legal tender but also provides financial institutions with a more diverse set of tools.

Thirdly, the standardization of the reserve management mechanism enhances market trust. As the news indicates, mainstream stablecoins (such as USDC and USDT) have established a stable mechanism of “100% reserve + transparent management” through independent custody, investment in highly liquid assets (such as short – term treasury bonds and money market funds), and regular audits. Compared with the early algorithmic stablecoins (such as Luna – UST) that collapsed due to design flaws or the chaos where some stablecoins deviated from their pegs due to the misappropriation of reserve funds, the reserve management of current fiat – backed stablecoins (accounting for over 95%) has become highly compliant. Regulatory frameworks such as the US “GENIUS Act” and the EU’s “MiCA” have strict regulations on the types of reserve assets, liquidity, and audit transparency, further reducing the risk of stablecoins deviating from their pegs and gradually transforming them from “high – risk speculative tools” to “trusted payment tools.”

Finally, the rapid growth of the market size confirms the rigid demand. The scale of stablecoins has doubled from $125 billion in mid – 2023 to $260 billion in mid – 2025, and Citigroup predicts that it may reach $3.7 trillion by 2030. This growth not only stems from the settlement needs of crypto – asset trading but also reflects the actual payment needs in scenarios such as cross – border trade and RWA (real – world asset tokenization). For example, in countries with high inflation such as Turkey and Nigeria, residents use US dollar – backed stablecoins as a “substitute for hard currency.” A VISA survey shows that stablecoins are already used for currency substitution, salary payments, etc., all of which reflect their essential attribute as a “value – stable payment tool.”

Negative Comments: The Potential Risks and Regulatory Challenges of Stablecoins Cannot Be Ignored

Although stablecoins demonstrate significant innovation value, the collision between their technological characteristics, operating mechanisms, and the existing financial system still brings multiple potential risks. We need to be vigilant about their impact on financial stability and monetary sovereignty.

Firstly, the difficulty in regulatory coordination may lead to systemic risks. The cross – border nature of stablecoins conflicts with the different regulatory requirements of various countries. For example, the US and the EU have strict restrictions on the investment scope of stablecoin reserve assets (such as short – term treasury bonds and central bank deposits), but the regulatory frameworks in some emerging market countries are not yet perfect, which may become “regulatory loopholes.” If stablecoin issuers take advantage of regulatory arbitrage and invest reserve funds in high – risk assets (such as Tether’s early investment in Bitcoin and bank loans), once the market fluctuates or the issuer defaults, it may trigger a chain reaction. In addition, the “payment – as – settlement” feature of stablecoins, while improving efficiency, weakens the central bank’s ability to monitor capital flows and may facilitate illegal activities such as money laundering and terrorist financing. Although the news emphasizes that “the risks will be reduced after regulatory improvement,” there is still a natural contradiction between the anonymity of the technology and the penetrability of regulation.

Secondly, it poses a threat to the monetary sovereignty of countries with weak currencies. As mentioned in the news, Zhou Xiaochuan once warned that “US dollar – backed stablecoins may lead to dollarization in other countries.” In countries with severe depreciation of their local currencies, such as Turkey and Argentina, US dollar – backed stablecoins have partially replaced the local currency for daily payments and savings, weakening the effectiveness of the central bank’s monetary policy. For example, a VISA survey shows that 35% of respondents in Turkey use stablecoins for “currency substitution.” If this “substitution of private currency for sovereign currency” continues to expand, these countries may lose their ability to regulate the currency and even face a financial sovereignty crisis.

Thirdly, the “centralized dependence” in reserve fund management still has hidden dangers. Although the current stablecoin reserves are held by independent institutions and invested in low – risk assets, the credit risk of the issuers has not been completely eliminated. If the issuer (such as Tether or Circle) goes bankrupt due to poor management or the custodian institution (such as the Bank of New York Mellon) makes an operational error, stablecoin holders may face the risk of being unable to redeem their tokens. Historically, the collapse of Luna – UST in 2022 triggered a chain of sharp declines in the crypto market. Although the current mainstream stablecoins are mainly backed by fiat currency, the promise of “100% reserve” depends on the compliance of the issuer. If regulatory enforcement is not in place (such as auditors colluding with the issuer to fabricate data), the authenticity of the reserve funds cannot be guaranteed.

Fourthly, technological security risks may impact market stability. Although the public blockchains on which stablecoins rely have the advantage of decentralization, problems such as smart contract vulnerabilities, private key loss, and hacker attacks have not been completely resolved. For example, in 2023, a stablecoin was attacked due to a smart contract vulnerability, resulting in the theft of tokens worth $50 million. In 2024, a public blockchain experienced network congestion due to a flaw in its consensus mechanism, causing delays in stablecoin transfers. If these technological risks occur on a large scale, it may trigger a collapse of market trust in the “stability” of stablecoins, which in turn may impact the crypto – asset market and even the traditional financial system.

Advice for Entrepreneurs: Seize the Opportunities and Strictly Adhere to Compliance and Risk Bottom – Lines

For entrepreneurs interested in the stablecoin field, while seizing the technological dividends, they need to focus on the following aspects:

Focus on scenario innovation and deeply explore cross – border and RWA payments. The core advantage of stablecoins lies in cross – border payments and tokenized asset settlements. Entrepreneurs can develop vertical applications around these two scenarios. For example, providing “stablecoin payment acceptance + instant foreign exchange settlement” services for small and medium – sized cross – border e – commerce enterprises, or designing an automatic settlement tool of “stablecoin + smart contract” for RWA tokenized transactions such as real estate and art. It is necessary to combine real – world needs and avoid blindly chasing “crypto concepts.”

Strengthen compliance capabilities and adapt to regulations in multiple jurisdictions. The cross – border nature of stablecoins requires entrepreneurs to be familiar with the regulatory rules of major markets (such as the US, the EU, Singapore, and Hong Kong, China). For example, the US “GENIUS Act” requires that stablecoin reserves be 100% supported by US dollar assets, and the EU’s “MiCA” stipulates that issuers must hold licenses and meet capital requirements. Entrepreneurs need to establish a compliance team in advance to ensure that reserve management, user KYC (know your customer), anti – money laundering, and other aspects comply with local regulatory standards, and avoid legal risks caused by “regulatory arbitrage.”

Attach importance to technological security and build a risk prevention and control system. Stablecoins are highly dependent on technology. Entrepreneurs need to invest resources to improve their capabilities in smart contract auditing, private key management, and network security protection. They can cooperate with professional security institutions to conduct regular vulnerability scans and stress tests. At the same time, establish a triple – backup mechanism for “reserve funds – user assets – technological systems” to reduce losses caused by technological failures or attacks.

Explore cooperation models with traditional financial institutions. The development of stablecoins has attracted traditional institutions such as PayPal and JP Morgan to enter the market. Entrepreneurs can cooperate with financial institutions through “technology output + complementary scenarios.” For example, providing “stablecoin cross – border settlement interfaces” for banks or jointly developing a “stablecoin – fiat currency” rapid exchange tool with payment institutions to expand market share by leveraging the customer resources and compliance advantages of traditional institutions.

Pay attention to policy dynamics and predict regulatory trends. The regulatory frameworks for stablecoins in various countries are still being improved (such as the US “Payment Stablecoin Act” and the UK’s DLT regulatory rules). Entrepreneurs need to continuously track policy dynamics and predict regulatory directions. For example, if countries require stablecoins to be supported by central bank digital currencies (CBDCs) in the future (such as the Hong Kong Aurum project), they need to prepare in advance for the technology of CBDC – stablecoin exchange. If regulations strengthen the “penetrating requirements for anti – money laundering,” they need to optimize the user identity verification and transaction tracking systems.

In summary, as a cutting – edge innovation in fintech, stablecoins not only provide entrepreneurs with opportunities to empower finance with technology but also pose higher requirements for compliance, technology, and risk management capabilities. Only by finding a balance between innovation and stability can sustainable development be achieved in this emerging field.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”