Read More《智氪 | 华尔街为何疯抢这只的稳定币股票?》

Positive Comments: Strategic Value and Industry Opportunities Behind the Explosive Growth of the Stablecoin Market

Recently, after Circle, the “first stablecoin stock,” went public on the New York Stock Exchange, its stock price soared by 190%, and its PE-TTM reached as high as 373 times at one point. In essence, this is a concentrated bet by the capital market on the long-term value of the stablecoin market. This upsurge not only reflects the disruptive potential of stablecoins in areas such as payments and financial infrastructure but also reflects the resonance effect of the strategic layout of the US dollar hegemony and technological innovation in the digital economy era.

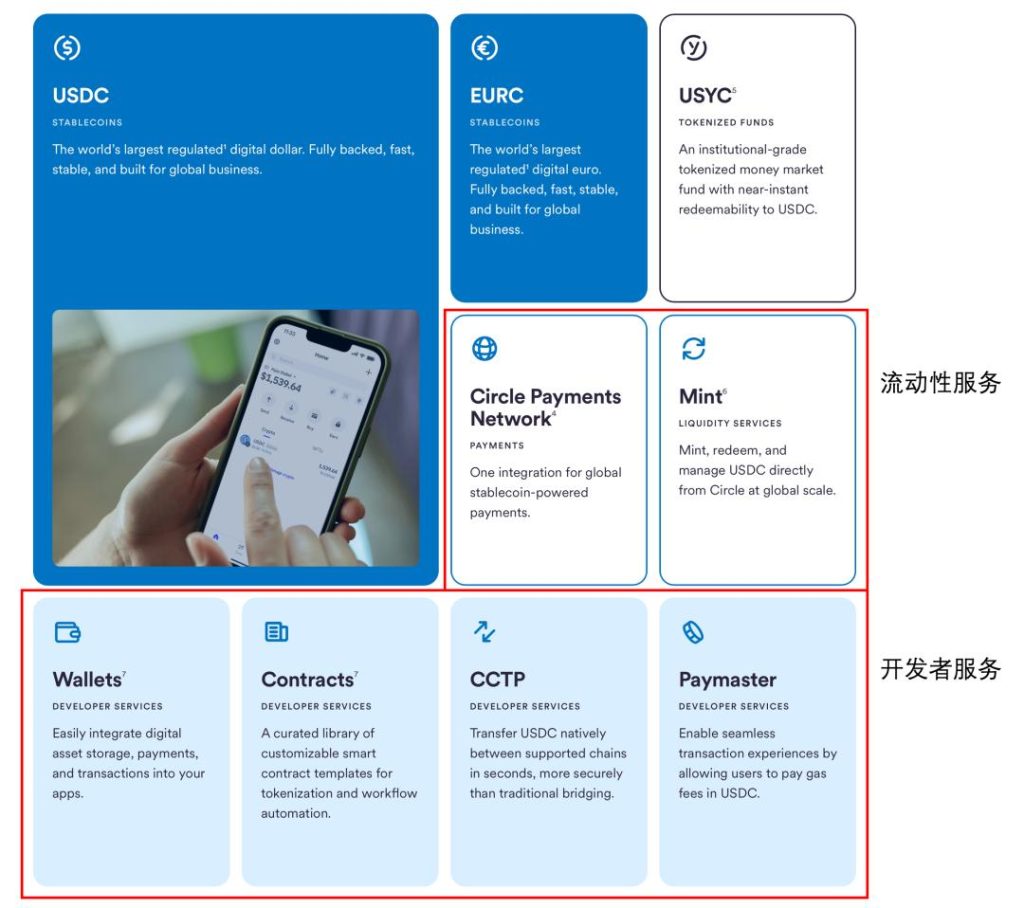

First of all, the explosive growth of the stablecoin market validates its core value as the “digital US dollar.” According to news data, in 2024, the global stablecoin trading volume exceeded that of traditional payment giants such as Visa and Mastercard, with the total market value exceeding $250 billion, and it is expected to reach $4 trillion by 2035 (with a compound annual growth rate of 32%). The underlying logic of this growth is that through the design of “100% pegging to US dollar assets,” stablecoins retain the stability of fiat currencies and the efficiency of digital currencies. Their characteristics of cross-border payment and on-chain settlement perfectly meet the global digital economy’s demand for “instant, low-cost, and borderless” payment tools. Taking USDC as an example, its technical architecture that supports issuance on multiple public chains and adapts to the trading scenarios of fiat currencies and digital currencies makes it the “blood” of emerging fields such as DeFi (decentralized finance) and NFT (non-fungible tokens). Moreover, Circle’s in-depth cooperation with platforms such as Coinbase has built a complete ecosystem for stablecoins from issuance to circulation.

Secondly, Circle’s industry status and differentiated advantages provide fundamental support for its high valuation. As one of the two oligarchs in the stablecoin market (USDC has a market share of 24%, and together with USDT, they account for 84%), Circle’s core competitiveness is reflected in three aspects: First, the leading nature of its technical infrastructure, such as the compatibility of USDC’s deposit and withdrawal architecture with traditional finance and crypto finance; second, the breadth of ecological cooperation. Binding with leading financial and technology companies (such as Coinbase) ensures the circulation scenarios of stablecoins; third, the compliance advantage. After going public, the improvement of the transparency and disclosure frequency of reserve assets has made it the “compliance benchmark” under the regulatory framework. The “GENIUS Act” passed by the US Senate clearly requires stablecoins to be 100% pegged to US dollar assets. This policy not only delineates the compliance boundaries for the industry but also pushes companies like Circle, which have long had transparent reserves, to the core area of “regulatory dividends.”

Finally, the strategic intention of the US government has injected long-term growth momentum into the stablecoin market. As mentioned in the news, the deep – seated goal of the US in promoting the development of stablecoins is to maintain the US dollar hegemony. Through the “digital currency” characteristics of stablecoins, it bypasses traditional banks and the SWIFT system and accelerates “dollarization” in emerging markets such as Southeast Asia and Africa. At the same time, the expansion of the reserve assets (US Treasury bonds and cash) of stablecoins can become a “super buyer” of US Treasury bonds, alleviating the pressure of US debt expansion. This dual – drive of “policy + market” has upgraded stablecoins from simple financial tools to national strategic tools, significantly raising the ceiling of the market scale. As the “most direct stablecoin concept stock in the US stock market,” Circle naturally becomes a scarce target for capital to seize.

Negative Comments: Hidden Worries Behind High Valuations and Potential Risks of the Business Model

Although Circle’s high valuation reflects the market’s optimistic expectations for the prospects of stablecoins, the current disconnection between its stock price and fundamentals, the singularity of its business model, and the uncertainty of the external environment still require investors and industry participants to remain vigilant.

First of all, the ultra – high valuation has deviated from the traditional financial logic and implies the risk of “bubbling.” Circle’s PE – TTM reached as high as 373 times at one point (it was still 287 times as of July 11), while its net profit in 2024 was only $156 million (a year – on – year decline of 42%), and 99% of its revenue depends on reserve income (that is, the interest on interest – bearing assets such as US Treasury bonds and cash). This valuation logic of “looking at expectations rather than performance” essentially overdraws the growth space of the next 10 – 15 years in advance. If the growth of the stablecoin market fails to meet expectations (such as stricter regulations or the emergence of technological substitutes), or if the yield of US Treasury bonds declines due to economic fluctuations (which directly affects reserve income), Circle’s valuation may face a sharp adjustment. Historically, “concept hype” in the cryptocurrency field (such as the early ICO boom) has repeatedly led to sharp declines due to unmet expectations. Circle’s high valuation needs to be vigilant against repeating the same mistakes.

Secondly, the singularity of the business model and the dependence on key partners hide potential dangers. 99% of Circle’s revenue comes from reserve income. This “rely on luck” model highly depends on two external variables: one is the issuance scale of stablecoins (the larger the scale, the more reserve assets, and the higher the interest income); the other is the yield of interest – bearing assets such as US Treasury bonds. If the growth of the stablecoin market slows down (such as USDT squeezing the market share or the entry of new competitors), or if the US Federal Reserve’s monetary policy turns, leading to a decline in the yield of US Treasury bonds (the Fed’s interest – rate cut cycle in 2024 may depress the yield of short – term bonds), Circle’s revenue will be directly under pressure. In addition, Circle’s dependence on Coinbase for distribution cannot be ignored. In 2024, the distribution fees paid to Coinbase reached as high as $900 million (accounting for 54% of the revenue), and the new distribution agreement has led to a year – on – year decline in the gross profit margin (from a higher level to 39% from 2022 to 2024). If there is a rift in the cooperation with Coinbase in the future (such as readjusting the revenue – sharing ratio or Coinbase supporting competing products), Circle’s profit margin will be further compressed.

Finally, the uncertainty of regulations and policies may reshape the industry landscape. Although the “GENIUS Act” provides a federal regulatory framework for stablecoins, the requirement of “100% pegging to US dollar assets” also limits the innovation space of issuers. For example, if the US government requires stablecoin reserves to include more high – liquidity but low – yield assets (such as cash instead of long – term bonds) in the future, Circle’s reserve income will be weakened. In addition, other countries around the world have different attitudes towards stablecoins: the EU’s “Markets in Crypto – Assets Regulation” (MiCA) restricts the cross – border use of stablecoins, China clearly prohibits cryptocurrency trading, and emerging market countries may restrict the circulation of US – dollar – denominated stablecoins out of the consideration of “de – dollarization.” This “fragmentation” of external regulations may hinder the global expansion of stablecoins, thereby affecting Circle’s growth expectations.

Advice for Entrepreneurs: Seize Opportunities While Building Risk – Resistance Capabilities

For entrepreneurs who are concerned about the stablecoin and crypto – finance fields, Circle’s case provides the following key insights:

Keep up with policy trends and build a core barrier with compliance. The implementation of the US “GENIUS Act” indicates that the stablecoin industry has entered the “regulation – driven” stage from the “wild – growth” stage. Entrepreneurs need to study the regulatory rules of the target market in advance (such as the transparency of reserve assets and the requirements for segregating user funds) and embed compliance into business design (such as regularly disclosing reserve audit reports and applying for necessary licenses). Compliance is not only a means to avoid legal risks but also an “entry ticket” to obtain institutional customers and enter the mainstream financial system.

Avoid business singularity and explore diversified revenue sources. 99% of Circle’s revenue depends on reserve interest. This model seems efficient during the market upswing but has weak risk – resistance capabilities. Entrepreneurs should expand value – added services around the “payment + finance” attributes of stablecoins. For example, provide cross – border settlement solutions for corporate customers (charge handling fees), develop stablecoin – collateralized lending products (earn interest spreads), and provide API interfaces for developers (charge technical service fees). Diversified revenue can reduce the dependence on a single revenue source and smooth the impact of market fluctuations.

Strengthen ecological cooperation and avoid being “held hostage” by key resources. Although Circle’s deep binding with Coinbase has helped its early expansion, it has also led to high distribution costs and limited bargaining power. Entrepreneurs need to build a cooperation network with “multiple channels and weak dependence.” For example, establish cooperation with multiple trading platforms and wallet service providers to avoid excessive dependence on a single channel. At the same time, improve user stickiness through technological innovation (such as developing self – owned wallets and optimizing the user experience) to reduce the distribution dependence on external platforms.

Rationally view valuations and focus on long – term value creation. Circle’s high valuation is essentially a premium given by the market to the “stablecoin track,” but entrepreneurs need to stay sober. Short – term stock price fluctuations do not represent the real value of the enterprise. They need to concentrate resources on technological R & D (such as improving the cross – chain compatibility of stablecoins and reducing transfer costs), user growth (expanding users in emerging markets), and ecological construction (cooperating with DeFi projects and real – world enterprises). Only by continuously creating real use scenarios and user value can the long – term valuation of the enterprise be supported.

Pay attention to macro variables and lay out risk hedging in advance. The stablecoin business is highly related to the yield of US Treasury bonds, the US Federal Reserve’s monetary policy, and global regulatory trends. Entrepreneurs need to establish a macro – economic monitoring mechanism. For example, hedge the risk of a decline in the yield of US Treasury bonds through interest – rate swap tools; increase the proportion of short – term bonds and cash in reserve asset allocation to improve liquidity to cope with possible redemption tides; design differentiated market expansion strategies according to the regulatory policies of different countries (such as focusing on compliant payment scenarios in Southeast Asia and cooperating with traditional financial institutions in Europe).

In short, the explosion of the stablecoin market provides historical opportunities for entrepreneurs, but the policy, market, and technological risks behind its high – growth cannot be ignored. Only by taking compliance as the foundation, innovation as the driving force, and the ecosystem as the support can entrepreneurs go more steadily and further in this “digital US dollar” race.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”