Positive Comments: Stock Tokenization Promotes Financial Democratization and Activates Market Innovation Vitality

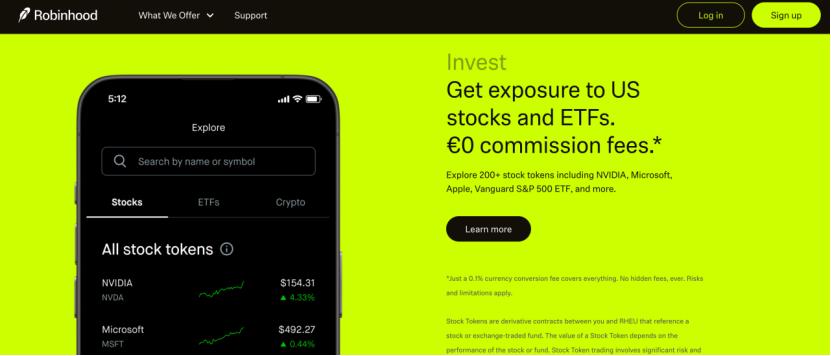

The “stock tokens” launched by Robinhood and the trend of asset tokenization have shown positive significance in the aspect of financial innovation. Its core value lies in breaking the “elite threshold” of the traditional financial market, allowing ordinary investors to have the opportunity to participate in private equity transactions previously monopolized by high – net – worth individuals, which is highly consistent with Robinhood’s brand positioning of “robbing the rich to help the poor”.

From the perspective of the trading mechanism, stock tokenization significantly lowers the investment threshold. The traditional private equity market is restricted by the qualified investor system (for example, in the EU and the US, investors are required to have investable assets of over $1 million or high incomes), and ordinary retail investors are strictly excluded. However, Robinhood uses blockchain technology to “put private equity on the chain”. Users only need to register an account to participate, and it supports trading in extremely small shares (such as 0.001 shares). This allows early – stage growth dividends of unlisted companies such as OpenAI and SpaceX to no longer be monopolized by a few institutions. This “fragmented” trading model essentially shifts the liquidity of private equity from “high – threshold, low – frequency” to “low – threshold, high – frequency”, providing retail investors with the opportunity to share the growth benefits of technology giants.

In addition, the flexibility and low – cost advantages of tokenized trading are also worthy of recognition. Traditional US stock trading is restricted by exchange hours (for example, the New York Stock Exchange is only open from 9:30 to 16:00 on weekdays), and commissions and cross – border transfer fees are relatively high. In contrast, Robinhood’s stock tokens support 24/7 trading without commissions, which is extremely attractive to retail investors who are sensitive to time or have limited funds. Data shows that Robinhood’s stock price soared by 10% in a single day after the launch of this product, reaching a record high, which indirectly confirms the market’s recognition of this model.

From a more macro – level fintech trend, stock tokenization and the rise of stablecoins together point to a new direction of “deep linkage between virtual currencies and physical assets”. Take the stablecoins deployed by JD.com and Ant Group as an example. Their characteristic of being pegged to legal tender can significantly improve the efficiency of cross – border payments (arrival within 10 seconds) and reduce costs (reduce fees by 90%), which is revolutionary for global trade and cross – border settlement of small and medium – sized enterprises. The market value of USDC issued by Circle exceeds $60 billion, and the active participation of giants such as PayPal and Amazon all verify the commercial potential of this model.

Negative Comments: Asset Tokenization Harbors Multiple Risks, and Investor Protection and Market Order Face Challenges

Although stock tokenization and stablecoins are packaged as “tools for financial democratization”, the issues of compliance, transparency, and risk transmission behind them have raised strong concerns among regulatory authorities, enterprises, and the legal community.

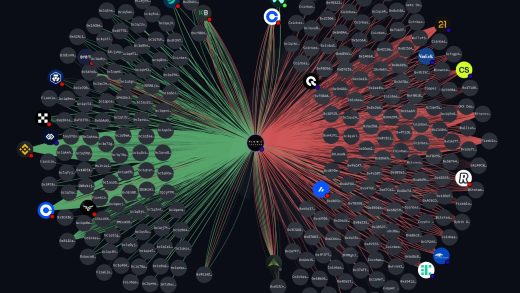

First of all, unauthorized private equity tokenization may seriously disrupt the normal operation of enterprises. Take OpenAI as an example. It is currently in a critical stage of “restructuring into a Public Benefit Corporation (PBC) and preparing for an IPO”, and its equity structure and valuation need to be highly controllable. The “OpenAI tokens” launched by Robinhood without authorization essentially involve indirectly holding OpenAI’s equity through a Special Purpose Vehicle (SPV) and tokenizing the SPV’s equity. This “two – layer isolation” structure may not only lead to a deviation between the token price and the actual equity value of OpenAI (due to factors such as SPV management fees and liquidity premiums), but also “pre – price” through secondary – market trading, affecting potential investors’ valuation judgment of OpenAI and even shaking the stability of its equity structure. OpenAI’s urgent refutation and emphasis that “any equity transfer needs to be approved” are a direct response to this kind of interference.

Secondly, the opacity of the SPV structure weakens investor protection. Legal experts point out that Robinhood’s stock tokens are essentially “token contracts that track private – market valuations” rather than direct equity holdings. Users purchase the “value rights” of the SPV, but key information such as the specific shareholding ratio of the SPV, the management fee charging standard, and the equity disposal rules is not fully disclosed. Under this information asymmetry, retail investors may mistakenly equate tokens with real equity. Once the value of the SPV shrinks due to management issues or market fluctuations, investors will face the risk of “a sharp drop in token prices but being unable to trace the underlying assets”. Kurt Watkins, an American lawyer, directly calls it a “illusory investment” based on concerns about the lack of underlying rights.

Moreover, the risk – bearing capacity of retail investors does not match the high – risk nature of private equity. Private equity, due to being unlisted, having poor liquidity, and being information – opaque, is inherently a high – risk investment. The core of the traditional qualified investor system is to “protect retail investors with weak risk – bearing capacity”. Robinhood, in the name of “democratization”, attracts retail investors to enter the market through airdrops (such as a $1 million OpenAI token promotion) and low – threshold trading, which may lead to the spread of risks from high – net – worth individuals to ordinary investors. If the valuations of unlisted companies such as OpenAI plummet due to operational problems in the future, or if the tokens experience sharp fluctuations due to market manipulation, retail investors lacking professional judgment will bear the brunt of the losses.

Finally, the potential risks of stablecoins cannot be ignored. Although the characteristic of stablecoins being pegged to legal tender reduces price fluctuations, the risk of “de – pegging” always exists. In 2022, the collapse of the LUNA coin triggered the de – pegging of the UST stablecoin, resulting in the evaporation of tens of billions of dollars in market value. In addition, the cross – border payment function of stablecoins may be used for illegal activities such as money laundering and tax evasion. The tightening of regulatory policies by various countries (such as the US Genius Act and the EU MiCA) may also limit their application scenarios. The fact that giants such as Circle’s USDC has a market value of over $60 billion and the active participation of PayPal, Amazon and other giants all verify the commercial potential of this model. JD.com and other enterprises are actively deploying stablecoins, but they need to address multiple challenges such as “license application”, “transparency of reserve assets”, and “anti – money – laundering compliance”. If ordinary investors blindly participate, they may suffer losses due to policy changes or “false cooperation” incidents (such as the recent false cooperation incident clarified by JD.com).

Suggestions for Entrepreneurs: Adhere to the Compliance Bottom Line in the Tokenization Wave, Make Good Use of Tools but Be Wary of Risks

Facing the upsurge of asset tokenization, entrepreneurs need to maintain a clear understanding. While seizing innovation opportunities, they should focus on the following points:

Unlisted companies need to strengthen equity management and proactively prevent the risk of unauthorized tokenization

If a company is in the pre – IPO stage (such as OpenAI) or plans to go public in the future, it needs to establish a strict equity transfer monitoring mechanism. For unauthorized secondary – market token trading (such as “XX tokens”), it should promptly clarify through official channels (such as issuing a statement or sending a cease – and – desist letter to the trading platform) to avoid token prices interfering with the market’s judgment of the company’s true valuation. At the same time, include a clause in the equity financing agreement clearly stating “prohibition of unauthorized equity tokenization” to legally restrict investors’ behavior.Pay attention to the compliance of tokenization tools to avoid affecting the financing or listing process

If entrepreneurs consider using tokenization tools (such as the SPV structure) to attract retail investors, they need to communicate with regulatory authorities in advance to ensure compliance with local financial regulations (such as the EU’s MiCA framework). Especially when it comes to private equity, they need to strictly comply with the “qualified investor” requirements to avoid legal disputes caused by “selling high – risk assets to non – qualified investors”. For companies that have received institutional investment, they need to negotiate tokenization plans with investors to ensure that they do not violate existing shareholders’ rights such as “pre – emptive rights” and “anti – dilution clauses” in the shareholder agreement.If deploying tokenization businesses such as stablecoins, priority should be given to building a compliance framework and an investor education system

Entrepreneurs in the stablecoin field (such as JD.com) need to focus on three aspects: First, the transparency of reserve assets (such as regularly disclosing audit reports on legal tender or gold reserves) to avoid a trust crisis caused by “de – pegging”. Second, compliance with anti – money – laundering (AML) and know – your – customer (KYC) requirements in various countries to prevent the inflow of illegal funds. Third, strengthen investor education and clearly inform investors of the “limited guarantee” nature of stablecoins (such as only promising 1:1 redemption, but the issuer may not be able to redeem in case of bankruptcy). In addition, they need to closely follow regulatory developments such as Hong Kong’s “Stablecoin Ordinance” and adjust business models in a timely manner.Be wary of “opportunistic marketing” and establish a rapid refutation mechanism

Both OpenAI’s “unauthorized tokenization” and JD.com’s “false cooperation” reflect the frequent occurrence of “riding on the coattails of hot topics” in the tokenization upsurge. Entrepreneurs need to establish a brand protection mechanism, regularly monitor market dynamics, and quickly clarify false information (such as “co – issuing tokens with XX enterprise”) through official channels to avoid damage to brand reputation. At the same time, they can prevent “opportunistic” behavior from a legal perspective by registering relevant trademarks and patents.

Asset tokenization is a “double – edged sword”. It provides new paths for financial innovation and investor participation, but also poses higher requirements for corporate compliance, investor protection, and market order. Entrepreneurs need to find a balance between “innovation” and “risk”, with compliance as the premise and user needs as the core, so as to move forward more steadily and further in this wave.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”