Read More《稳定币:别怀疑,Coinbase的iPhone时刻》

Positive Reviews: Stablecoins Inject New Impetus into Financial Innovation, Unleashing Trillion – Dollar Market Imagination

As an important innovation in the cryptocurrency field, stablecoins are evolving from “cryptocurrency trading tools” to “global financial infrastructure”. Their disruptive value to the traditional financial system and their driving role in the innovation and entrepreneurship ecosystem have gradually shown great potential.

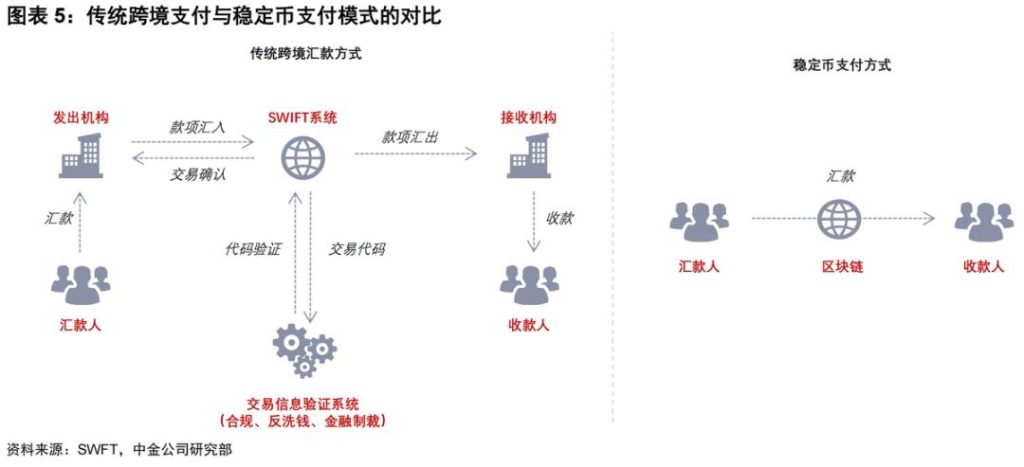

I. Solve Traditional Financial Pain Points and Reconstruct Cross – Border Settlement and Payment Efficiency

The problems of high cost and low efficiency in traditional cross – border trade and payments have existed for a long time. Under the SWIFT system, cross – border settlement requires multiple intermediary institutions, with an average cost as high as 6% and a time – consuming of 3 – 5 days. Exchange rate fluctuations further increase the implicit cost. However, stablecoins achieve instant on – chain settlement through blockchain technology, reducing the transaction cost by 99% (only requiring Gas fees and a 0.01% custody fee), which significantly improves the efficiency of capital circulation. This advantage has been verified in regions such as Latin America with high inflation and severe exchange rate fluctuations. Enterprises using stablecoins for settlement can not only avoid exchange rate risks but also save time and capital costs.

II. Empower the Integration of the Cryptocurrency Ecosystem and the Real Economy, and Expand Diverse Application Scenarios

Stablecoins are not only the “stable anchor” for cryptocurrency trading but are also penetrating into real – economy scenarios such as B2B transactions and security tokenization (RWA). Currently, 50% of spot cryptocurrency transactions are completed through stablecoins. Their “two – way smoothing” effect (promoting the growth of trading volume and reducing the outflow of funds due to market fluctuations) injects stability into the cryptocurrency market. More importantly, stablecoins are deeply integrated with e – commerce (such as the cooperation between Coinbase and Shopify), retail giants (Amazon and Walmart are exploring internal stablecoins), and stock exchanges (tokenized stocks on the xStocks platform), promoting the “tokenization of real assets” (RWA). Institutions such as Standard Chartered and Citigroup predict that by 2030, RWA will contribute 25% – 40% of the demand for stablecoins, and B2B cross – border trade will contribute 10% – 15%. This means that stablecoins are expected to be upgraded from “cryptocurrency tools” to “global commercial general media”.

III. Compliance Advantages and Scarcity Create Growth Dividends for Leading Enterprises

Circle’s USDC stands out due to its compliance advantage under the 《GENIUS Act》 (currently the only stablecoin fully compliant with this act), highlighting its scarcity in the context of stricter regulation. In the current stablecoin market, USDT (74%), USDC (14%), and FDUSD (8%) dominate. However, USDT may be eliminated from the US market due to compliance issues, and FDUSD is restricted by regulatory mutual recognition negotiations. USDC is expected to seize the market during the “compliance window period”. If, according to a neutral forecast, the scale of stablecoins reaches $1.4 trillion by 2030, and USDC accounts for 35% of the share (approximately $490 billion), the interest income from its reserve of US Treasury bonds alone can reach $14.7 billion (at a 3% interest rate). Coupled with transaction fees and ecosystem service fees, the growth space is huge.

Negative Reviews: Hidden Concerns Behind the Prosperity of Stablecoins – Regulation, Competition, and Global Currency Games

Although stablecoins have broad prospects, their development still faces multiple challenges. From regulatory uncertainties to changes in the market competition pattern and potential conflicts over global currency sovereignty, all may restrict their large – scale implementation.

I. The “Double – Edged Sword” of Regulation: Compliance is Both a Pass and a Shackle

The explosive growth of stablecoins highly depends on regulatory support, but the different regulatory attitudes of various countries may become a “stumbling block”. The United States promotes the compliance of stablecoins through the 《GENIUS Act》, essentially using stablecoins to absorb US Treasury bonds (such as Bison Trails “endorsing” US Treasury bonds). However, other countries have more complex attitudes towards US – dollar – denominated stablecoins. Although regions such as the European Union and Hong Kong, China, actively regulate stablecoins, they require that the reserve be based on their own national currencies. This makes non – US – dollar stablecoins difficult to promote due to poor liquidity and unstable currency values (such as the currencies of high – inflation countries), and they may ultimately become “quasi – CBDCs”, losing the global universal value of stablecoins. In addition, if the 《GENIUS Act》 is strictly enforced, USDT may be forced to withdraw from the US market. However, if traditional financial institutions (such as PayPal) issue compliant stablecoins, they may squeeze the living space of USDC with their user and scenario advantages.

II. Market Competition: It is Difficult to Break Through the First – Mover Advantage and Scenario Barriers

The current stablecoin market presents a “duopoly” pattern (USDT + USDC account for 90%). However, USDT still leads USDC in scenario coverage (exchanges, C2B shopping, and corporate salary payments) due to its first – mover promotion on exchanges such as Binance (accounting for 60% of cryptocurrency trading volume). Although USDC has better compliance, it takes time to cultivate user habits. Referring to the Chinese payment market, Alipay and WeChat Pay have occupied users’ minds through “guaranteed transactions” and “social scenarios”. It is difficult for later entrants (such as Douyin Pay) to break through. For USDC, if it cannot quickly expand new scenarios such as B2B trade and RWA, or if traditional financial institutions (such as banks) launch stablecoins based on their existing customer base, its “compliance scarcity” may be diluted.

III. Global Currency Games: US – Dollar – Denominated Stablecoins May Intensify the Controversy over “US Dollar Hegemony”

The expansion of US – dollar – denominated stablecoins is essentially an extension of the US dollar in the digital field. If they are widely used in scenarios such as cross – border trade and RWA, it may further strengthen the global settlement status of the US dollar, triggering concerns of other countries about “currency sovereignty”. For example, if emerging market countries rely on US – dollar – denominated stablecoins for settlement, it may weaken the status of their domestic currencies. Economies such as the European Union may hedge against risks by restricting the circulation of US – dollar – denominated stablecoins and promoting euro – denominated stablecoins (which require euro reserves). This game may lead to the fragmentation of the stablecoin market and limit the realization of its global universal value.

Advice for Entrepreneurs: Seize the Window Period and Build Core Barriers with Compliance, Scenarios, and Technology

The explosion of the stablecoin market provides opportunities for entrepreneurs, but they need to focus precisely on compliance, scenarios, and technology to avoid blind following.

I. Prioritize Compliance and Seize the Regulatory “Entry Ticket”

Regulation is the core threshold for stablecoins. Entrepreneurs need to closely monitor the progress of acts such as the 《GENIUS Act》 to ensure that the issuance, reserve, and information disclosure comply with regulatory requirements (such as 100% high – liquidity asset collateral). For non – US – dollar stablecoins, they can explore cooperation with local central banks (such as issuing stablecoins pegged to low – inflation national currencies) or focus on cross – border trade within regions (such as Southeast Asia and Latin America) to avoid the risks of global currency games.

II. Deeply Cultivate Vertical Scenarios and Build a “Necessary” Ecosystem

Scenarios are the key to users’ minds. Entrepreneurs can develop customized stablecoin solutions around niche scenarios such as B2B cross – border trade (such as small and medium – sized foreign trade enterprises), RWA (such as tokenization of real estate and artworks), and people’s livelihood payments (such as cross – border remittances). For example, for high – inflation countries in Latin America, a combination of “stablecoins + exchange rate hedging tools” can be launched. For small and medium – sized e – commerce enterprises, a stablecoin payment channel can be connected, and account period management services can be provided to enhance user stickiness through “scenario binding”.

III. Technology Optimization and Security Assurance are the Foundation

The core competitiveness of stablecoins lies in “stability” and “efficiency”. Entrepreneurs need to invest in technology R & D to improve the on – chain transaction speed (such as optimizing the Gas fee mechanism), reduce settlement delays, and strengthen smart contract audits and the transparency of reserve assets (such as real – time disclosure of US Treasury bond holdings). At the same time, they can explore multi – chain compatibility (such as Ethereum and Solana) to expand the user coverage and avoid the risk of network congestion on a single chain.

IV. Ecosystem Cooperation is More Important than Competition, and Bind Core Partners

The large – scale implementation of stablecoins depends on ecosystem collaboration. Entrepreneurs can cooperate with exchanges (such as Coinbase), e – commerce platforms (such as Shopify), and traditional financial institutions (such as payment company Stripe) to quickly acquire customers through “scenario access + user incentives”. For example, cooperate with B2B platforms to launch “cashback for stablecoin settlement” or bind a profit – sharing mechanism with RWA issuers to accelerate market penetration with external traffic.

Conclusion

The rise of stablecoins is a typical case of the integration of fintech and the digital economy. It not only carries the ideal of reducing global financial frictions but also faces the real challenges of regulation, competition, and currency games. For entrepreneurs, seizing the “compliance window period”, deeply cultivating vertical scenarios, and building technological barriers are the keys to breaking through in this “digital currency revolution”. In the future, whether stablecoins can be upgraded from “cryptocurrency tools” to “global financial infrastructure” depends on the joint promotion of technological innovation, regulatory wisdom, and global cooperation.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”