Crypto Market Cooling in June 2025? CEX Spot Trading Volume Plunges 27% – Bitcoin vs. Altcoins: A Tale of Two Extremes!

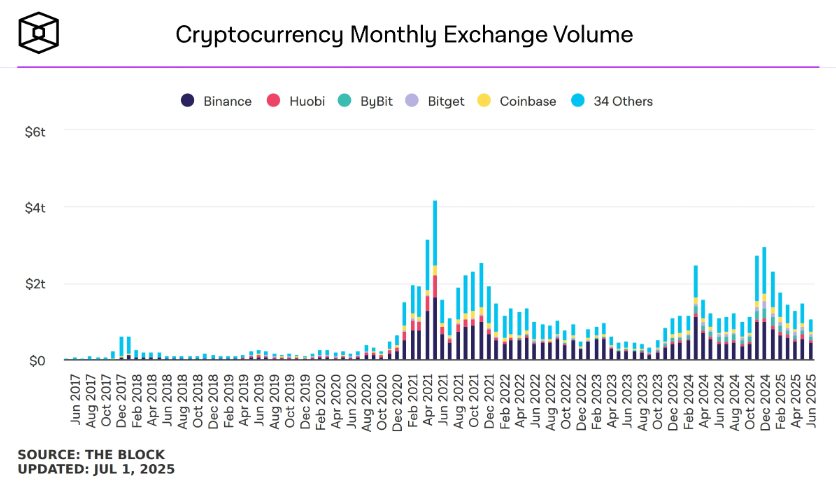

According to the latest data from The Block, centralized exchange (CEX) spot trading volume dropped to $1.07 trillion in June 2025, a sharp 27% decline from May’s $1.47 trillion, hitting a nine-month low since September 2024. This isn’t just a short-term blip—it reveals a “structural split” in the crypto market: Bitcoin stands firm, while altcoins spiral downward. Min Jung, an analyst at Presto Research, put it bluntly: “While Bitcoin stays stable near all-time highs, most altcoins like Ethereum (ETH) are still down nearly 40% from their peaks.” Behind this? A “battle of investment preferences” between institutions and retail investors.

I. June CEX Volume: A “Rollercoaster Dive”

As the crypto market’s “barometer,” the plunge in CEX trading volume directly signals a cool-down in market activity. What does a 27% drop—from $1.47 trillion in May to $1.07 trillion in June—mean? Simply put, trading enthusiasm has “faded.” This shift may stem from changing investor behavior, market restructuring, and a more glaring sign: Bitcoin and altcoins are “going their separate ways.”

II. Bitcoin: Backed by Institutions, Sitting Pretty

Why is Bitcoin “untouched” amid the volume slump? The key lies in its “digital gold” status and institutional “support.” On-chain data shows Bitcoin consistently accounts for ~55% of CEX trading volume—solidly holding “half the market.”

Institutions are “buying the dip”: Companies like MicroStrategy keep adding Bitcoin via bond issuances, and spot ETFs continue to see inflows. These “big spenders”’ long-term bets have made Bitcoin the market’s “stabilizer”—low volatility and a safe-haven appeal make it the institutional top pick.

III. Altcoins: Retail “Sitting Out,” No Hot Trends

Altcoins, though, are struggling. ETH is down 40%, with Solana (SOL) and Cardano (ADA) also “tumbling.” Ethereum’s transaction volume and active addresses dropped明显 in June, showing user engagement has “cooled off.”

Why?

– No new “hype”: The 2021 DeFi and NFT booms once fueled altcoins, but June 2025 lacks fresh “narratives.” Layer 2 solutions (e.g., Optimism, Arbitrum) have improved efficiency but failed to spark excitement.

– Retail “scarred”: Retail investors were altcoins’ “backbone,” but the 2021-2022 crash left many burned. Add complex altcoin operations (e.g., DeFi protocols, NFT speculation), and new users are deterred—participation is stuck.

IV. Institutions vs. Retail: Market “Vibe” Shifts

Min Jung’s analysis hits the nail on the head: “The market is driven by institutions buying Bitcoin, while retail interest in altcoins stays low.” CEX volume once relied on retail’s short-term speculation and leverage trading—now, leverage has dropped, and spot trading dominates, likely due to institutions’ “buy-and-hold” strategies. Even decentralized exchange (DEX) volume hasn’t grown, shrinking overall liquidity and “making things worse” for altcoins.

V. What’s Next? Three Key Signals

- Bitcoin may keep “leading”: With ongoing institutional inflows and its safe-haven role, Bitcoin’s “top spot” is secure short-term.

- Altcoins need a “new story”: Ethereum upgrades (e.g., sharding) or Web3/metaverse booms could help altcoins “recover.”

- Retail “return” is critical: Lowering entry barriers, simplifying user experience, and more education might draw retail back in; new trends—like past DeFi/NFT manias—could reignite enthusiasm.

Conclusion

June’s volume drop exposes crypto’s “split”: Bitcoin is propped up by institutions, while altcoins suffer from absent retail. The market’s next move depends on tech innovation, retail confidence, and liquidity recovery. For investors, understanding these shifts is key to seizing opportunities (and remember—crypto is volatile; invest wisely)!

Read More《加密CEX现货交易量创九个月新低,机构与散户分化加剧》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

![Founder’s Q&A “[Analysis] The Fecal Waste Disposal Industry Chain: How Does a Truckload of Fecal Water Create a Value of 300 Yuan?”](https://aiwiselnk.com/wp-content/themes/dashscroll/img/thumb-medium.png)