I. Industry Risk Analysis

(1) Policy Risk

In the electronic glass industry, the adjustment risks at different stages of the policy cycle are significant: Environmental protection policies in the mature stage (such as VOCs emission restrictions) require enterprises to continuously upgrade their technologies; Fiscal subsidy policies entering the recession stage (such as preferential policies for photovoltaic glass) may lead to profit fluctuations; Emerging industry supporting policies (such as the localization of display glass) are still in the formation stage, with risks of a lagging technical certification system and inconsistent standards. Entrepreneurs not only face the pressure of technological transformation investment due to the stricter implementation of existing policies but also need to cope with the sharp increase in compliance costs caused by the frequent changes in market access rules during the trial – and – error period of policies in emerging fields.

(2) Economic Risk

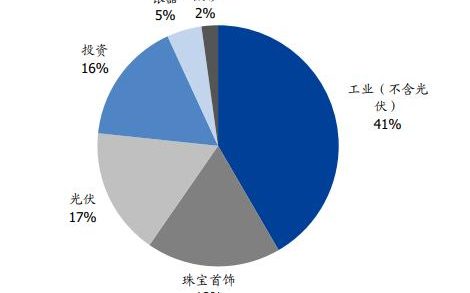

The electronic glass industry currently faces the risk of a structural contraction in demand due to economic cycle fluctuations. The sluggish global consumer electronics market has led to a slowdown in the capital expenditure of panel manufacturers, resulting in a decline in the growth rate of orders for upstream glass substrates. Meanwhile, the production capacity expanded in the past two years is gradually being released, creating pressure of oversupply. At the same time, the Fed’s interest – rate hike cycle has pushed up the costs of importing equipment and overseas financing. Coupled with the cross – border competition from alternative materials such as photovoltaic glass, small and medium – sized enterprises are squeezed by both intensified price competition and narrowing profit margins. The continuous R & D investment required for technological iteration is more likely to cause cash – flow disruptions during an economic downturn.

(3) Social Risk

The electronic glass industry faces the risk of an inter – generational consumption gap. Millennials and Generation Z are more willing to pay a premium for interactive experiences such as intelligent and flexible displays, but the traditional middle – aged and elderly groups have limited acceptance of high – value – added products, leading to a sharp increase in market education costs. At the same time, driven by global low – carbon policies, environmental protection standards are constantly being updated. Young consumers are more sensitive to recyclable materials and carbon footprints, forcing enterprises to shorten the technology upgrade cycle. However, the pressure of supply – chain transformation does not match the short – term benefits, resulting in an inter – generational value conflict in technology route selection. Emerging enterprises are prone to fall into the dilemma of a mismatch between R & D investment and market returns.

(4) Legal Risk

The stricter environmental protection supervision requires electronic glass enterprises to upgrade their wastewater and waste – gas treatment facilities. The investment in new environmental protection equipment accounts for about 20% of the total investment. The high patent barriers have intensified the risk of technology imitation. Industry leaders have initiated several cross – border patent litigation cases, claiming over tens of millions of dollars in compensation. Product yield indicators have been included in the mandatory certification system. If the lead content does not meet the standard of <0.1% in the “Administrative Measures for Pollution Control of Electronic Information Products”, enterprises will face collective claims from terminal manufacturers. Cross – border supply – chain contracts are affected by changes in international trade terms. Recently, three raw material procurement disputes have been triggered due to the revision of INCOTERMS 2024.

II. Entrepreneurship Guide

(1) Suggestions on Entrepreneurial Opportunities

Currently, entrepreneurial opportunities in the electronic glass industry are concentrated in three major fields: flexible displays, intelligent sunroofs for new – energy vehicles, and AR/VR optical components: Develop ultra – thin flexible curved glass technology (UTG) to fill the gap in the folding – screen mobile phone market; Develop glass modules with self – dimming, explosion – proof, and integrated sensing functions for the transparent sunroofs of new – energy vehicles; Customize lightweight, low – refractive – index, and highly transparent glass lenses for VR headsets to solve the problem of heavy equipment. Small and medium – sized teams can focus on the deep processing of special glass, the improvement of equipment processes, and B – end customized solutions in the industrial chain. Through differentiated innovation, they can avoid the monopoly of giants and quickly verify their business models by combining scenario – based needs (such as radiation – proof glass for medical equipment).

(2) Suggestions on Entrepreneurial Resources

Entrepreneurs in the electronic glass industry should prioritize the integration of industry – university – research resources to achieve technological breakthroughs. They can connect with special subsidy and equipment leasing policies through industrial parks to reduce heavy – asset investment. They should target the new – energy and display panel industrial chain clusters, establish strategic cooperation with upstream substrate material suppliers to lock in raw material supply, and embed themselves in the alternative supplier system of downstream terminal manufacturers to obtain order resources. They should introduce engineer teams with precision manufacturing experience, jointly build R & D centers with university laboratories to increase patent reserves, and obtain tax incentives and policy support by applying for high – tech enterprise qualifications. They should integrate cross – border logistics and overseas distribution resources and establish a differentiated supply chain for the building – integrated photovoltaics and in – vehicle display segments in the European and American markets.

(3) Suggestions on Entrepreneurial Teams

When forming a team in the electronic glass industry, it is advisable to give priority to core members with both a background in materials science and experience in process development, and be paired with composite talents familiar with precision equipment manufacturing and industrial policies and regulations. Members with the ability to integrate resources in the downstream display panel, photovoltaic, or automotive industrial chains should be mainly recruited. The team should be kept small (3 – 5 core members) and establish a joint R & D mechanism with scientific research institutions such as the Shanghai Institute of Ceramics, Chinese Academy of Sciences. The founder must personally manage key data such as raw material formulas and production yields. At the same time, full – time personnel should be assigned to connect with the application window for new – material industrial policies of the Ministry of Industry and Information Technology. Equity should be used to bind the technical backbones of equipment manufacturers to form a process moat.

(4) Suggestions on Entrepreneurial Risks

Entrepreneurs in the electronic glass industry should first lock in technological patent barriers and jointly build joint laboratories with universities or scientific research institutions to reduce R & D risks. They should lock in the procurement prices of raw materials such as quartz sand through long – term agreements to hedge against international price fluctuations. They should plan in advance for environmental protection processes (such as lead – free coating) and obtain ISO14064 certification to avoid production – line reset due to tightened policies. They should establish flexible production lines to accommodate diverse orders for photovoltaic glass, in – vehicle displays, etc., to hedge against the fluctuations in the demand of a single customer. They should introduce local government industrial guidance funds to share equipment investment and adopt a “production based on sales” model to reduce inventory backlog. They should focus on the technological iteration nodes of downstream panel manufacturers and organize quarterly customer demand seminars to dynamically adjust product parameters.