Global Listed Companies Surge into Crypto Wave: Five Tracks to Decode the New Capital Narrative

Cryptocurrency is sweeping the global capital market like never before! From trading giants like Coinbase to “corporate Bitcoin buyers” such as Meitu and MicroStrategy, and then to “mining + on – chain financial complexes” represented by Galaxy and Marathon – more and more listed companies are turning crypto assets and blockchain technology into a new engine driving their stock prices to soar.

What’s the capital logic behind this boom? Odaily scanned 44 representative listed companies worldwide and summarized five key tracks based on their core crypto businesses. Let’s take a look at the players and gameplay of these tracks!

I. Crypto Trading Platforms: The “Transport Hub” of the Market

They are the gates connecting users to the crypto world, providing core services like trading and custody.

- Coinbase (COIN) : The compliant elder brother in the US, founded in 2012. It not only supports Bitcoin trading but also co – founded the stablecoin USDC with Circle. As of the first quarter of 2025, it holds 9,267 BTC and over 130,000 ETH.

- Bakkt (BKKT) : The “regular army” under ICE, the parent company of the New York Stock Exchange, dedicated to institutional players. In June this year, it announced that it may use raised funds to buy Bitcoin in the future and also plans to issue bonds to purchase coins, showing great ambition.

- Robinhood (HOOD) : The stock App famous for “zero commission” has now made remarkable progress in its crypto business. In May, it submitted a 42 – page proposal to create a federal framework for “tokenized real – world assets”; in June, it also spent 200 million US dollars to acquire the European exchange Bitstamp, gaining more than 50 licenses at once.

- Guotai Junan International (1788.HK) : The first Chinese brokerage in Hong Kong that can legally trade Bitcoin! It just got approval from the Hong Kong Securities and Futures Commission in June, and from now on, customers can directly trade BTC, ETH and USDT on its platform.

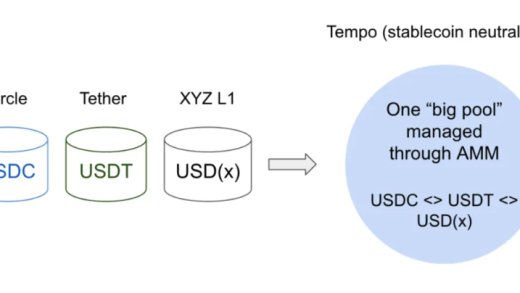

II. Stablecoin Issuers: The “Bridge” Between Traditional and Crypto

The stablecoins they issue are pegged to fiat currencies and are the “hard currency” in the crypto market.

- Circle (CRCL) : One of the parents of USDC, it soared 168% on its first day of listing this year with a valuation of 6.8 billion US dollars. USDC is the second largest stablecoin in the world, equivalent to “US dollar cash” in the crypto world.

- JD Digits Chain Technology (9618.HK) : JD’s blockchain subsidiary is testing Hong Kong dollar and US dollar stablecoins, with the sandbox test in the second phase, which may be used for cross – border payments and online shopping in the future.

III. Crypto Asset Heavyweights: “Digital Gold” on the Balance Sheet

They treat cryptocurrencies like Bitcoin as a “piggy bank” and tell market value stories by hoarding coins.

- MicroStrategy (MSTR) : The “first Bitcoin stock”, holding nearly 580,000 BTC. Since it started buying coins in 2020, its stock price has risen 43 times! CEO Michael Saylor is simply the “number one fan” of Bitcoin.

- Tesla (TSLA) : Musk’s Tesla bought 1.5 billion US dollars of Bitcoin in 2021 and even accepted Bitcoin for car purchases (later stopped). Although it sold most of it later, it sparked the trend of corporate coin hoarding.

- Meitu (1357.HK) : Meitu, which became popular worldwide with its photo editing App, began buying Bitcoin and Ethereum in 2021, treating digital assets as strategic reserves.

- SharpLink Gaming (SBET) : A “model of counterattack” for game companies! When it was on the verge of delisting last year, it announced to hoard Ethereum, raised 425 million US dollars, and its stock price soared 17 times. Now it is the listed company with the most ETH holdings (more than 180,000).

- ATIF (ATIF) : Even more adventurous! It plans to raise 100 million US dollars to buy Dogecoin (DOGE) and become the first US stock company to重仓 a “meme coin”.

IV. Blockchain Technology and DeFi Pioneers: “Infrastructure Maniacs” of Future Finance

They are not just buying coins, but building the infrastructure for blockchain technology and decentralized finance (DeFi).

- Galaxy Digital (GLXY) : Founded by former hedge fund tycoon Mike Novogratz, its business covers trading, asset management, lending, and it also helps people stake Bitcoin and Ethereum. It holds 12,800 BTC with a floating profit of 26%.- New Huo Technology (1611.HK) : Former Huobi Technology, a “top student” in Hong Kong compliance, can provide fiat + virtual asset custody. Recently, it also cooperated with HashKey Exchange to engage in Hong Kong – Macau integrated asset custody.

- DeFi Technologies (DEFT) : It issues cryptocurrency exchange – traded products (ETPs), allowing traditional investors to buy BTC and ETH like buying stocks. It also invited the former CEO of Deutsche Bank as an advisor to become more “high – end”.

V. Crypto Mining Companies: “Unsung Heroes” of Computing Power

They mine Bitcoin with computing power and are the “cornerstone” of the crypto network.

- Marathon Digital (MARA) : A US mining giant, the second largest BTC holder after MicroStrategy (more than 49,000), mined 950 BTC in May, accounting for 6.5% of the global Bitcoin network’s computing power.

- Riot Platforms (RIOT) : Another US mining company, mined 514 BTC in May, holds more than 18,000, with a computing power of 33.5 EH/s.

- Bitdeer (BTDR) : A company founded by Wu Jihan, co – founder of Bitmain, self – mined 196 BTC in May, and also built data centers in Norway, Thailand and other places to engage in “mining + AI”.

- Canaan Inc. (CAN) : A well – known Chinese mining machine brand, sells Avalon series mining machines, expands its business to the US and Canada, and also engages in AI and blockchain solutions.

Conclusion: This Bull Market is Not Just “Speculating on Coins”

From MicroStrategy’s “Bitcoin Treasury” to SharpLink’s “Ethereum Counterattack”, listed companies are turning crypto assets into a valuation “magic wand”. This is not a simple fluctuation of coin prices, but the “collective embrace” of traditional capital for the crypto narrative. Understanding these tracks may help you seize the “red envelope” of the crypto market this summer!

Read More《加密成为上市公司股价新引擎,44家巨头布局图谱全解析》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

Latest

- Startup Commentary”The Incomplete Evolution History of Bathing Centers”

- Startup Commentary”Starting from 358,800 yuan, Maserati Slashes Prices Drastically to Survive”

- Startup Commentary”Monopoly: Always the Best Business”

- Startup Commentary”A PE Giant Spent $6.6 Billion on a Crematorium”

- Startup Commentary”In a Low-Sports Year, Social Assets Still Hold Great Value”