Read More《说好的消费降级,为何小米YU7 3分钟卖掉20万台?》

Positive Reviews: The Hot Sales of Xiaomi YU7 Reflect the “Value Reconstruction” Logic in the Era of Consumption Hierarchy

In the current context where “consumption downgrade” has become an annual buzzword, the data of 200,000 pre – orders for Xiaomi YU7 within 3 minutes is like a “value verification bullet” fired into the consumer market. It not only breaks the stereotyped perception that “consumption downgrade = comprehensive contraction” but also reveals the underlying logic of the new consumption era – consumption doesn’t disappear; it’s just redistributed. Downgrade doesn’t mean simply lowering prices but precisely matching value with demand.

I. Accurately Target the “Hierarchical Downgrade” Demand and Solve the Dilemma of Consumption Decision – Making

As mentioned in the news, the target customer group of YU7 is the upper – middle class and middle – class families in the “waist of the pyramid”. This positioning itself is a profound understanding of the essence of consumption downgrade. The core of consumption downgrade is not “not consuming” but “not paying for premium”. The upper – middle class used to pay more than 30% brand premium for the logos of luxury brands like BBA. However, under economic uncertainty, they are more willing to pay for the technological value of “500,000 – level experience at a 300,000 – level price”. Middle – class families, within their limited budgets, upgrade the rigid demand of “family car” from “just usable” to “one – step – in – place”, using 2 – 3 years of family income to exchange for the comprehensive value of “advanced intelligent driving + luxury configuration + long – term use”.

This accurate insight into “hierarchical downgrade” enables YU7 to avoid the trap of “low – price involution” and instead build differentiated competitiveness through “high – end configuration at an affordable price”. Configurations such as the 800V high – voltage platform, 700TOPS computing power intelligent driving hardware, and zero – gravity seats, which are standard across all models of YU7, often require an additional price of over 100,000 yuan in traditional fuel – powered cars or competing models from new – energy vehicle startups. This “configuration leapfrogging” strategy essentially transforms the “saving” in consumption downgrade into “saving on the most important things”, ensuring that every penny of the user is spent on meeting core needs.

II. Drive by Both Brand Trust and Product Strength to Build a Moat for “Deterministic Consumption”

Against the backdrop of increasing economic uncertainty, “certainty” has become the scarcest consumption resource. The popularity of Xiaomi YU7 is due to its dual – wheel drive of “brand trust + product strength verification”, which tightens the safety valve for users to avoid being “ripped off”.

On the one hand, the brand image of “ultra – high cost – performance” that Xiaomi has accumulated through its mobile phones and IoT ecosystem provides a natural trust endorsement for its car – making business. Users believe that Xiaomi’s supply – chain integration ability can avoid the routine of “high price, low – end configuration”. Lei Jun’s declaration of “putting his life’s reputation on the line” for car – making further transforms the sincerity of his personal IP into product credibility. This trust doesn’t come out of thin air. The successful delivery of Xiaomi SU7 and the positive feedback from the first – batch of owners have verified the ability to “fulfill promises” through actual experience, making the consumers of YU7 no longer “triers of new things” but “followers”.

On the other hand, the product strength of YU7 lives up to its claims. Configurations such as the 800V high – voltage platform that can recharge 620 kilometers in 15 minutes, intelligent driving hardware with lidar and high computing power, and the sky – screen PHUD are all tangible and comparable core values. This “transparent configuration” strategy reduces the user’s decision – making cost. There’s no need to study complex optional packages, and there’s no need to worry about the risk of “configuration reduction”. The basic version offers a high – end experience.

III. The Perfect Integration of Emotional Value and Rational Calculation to Stimulate Consumption Impulse

In the era of consumption downgrade, users’ decision – making logic has shifted from “paying for face” to “paying for value”, but it doesn’t mean the disappearance of emotional factors. On the contrary, when rational value is satisfied, emotional value often becomes the key to detonate the desire to buy. The success of YU7 lies in the deep – seated binding of the rational label of “cost – performance” with emotional needs such as “aesthetic expression”, “social currency”, and “group resonance”.

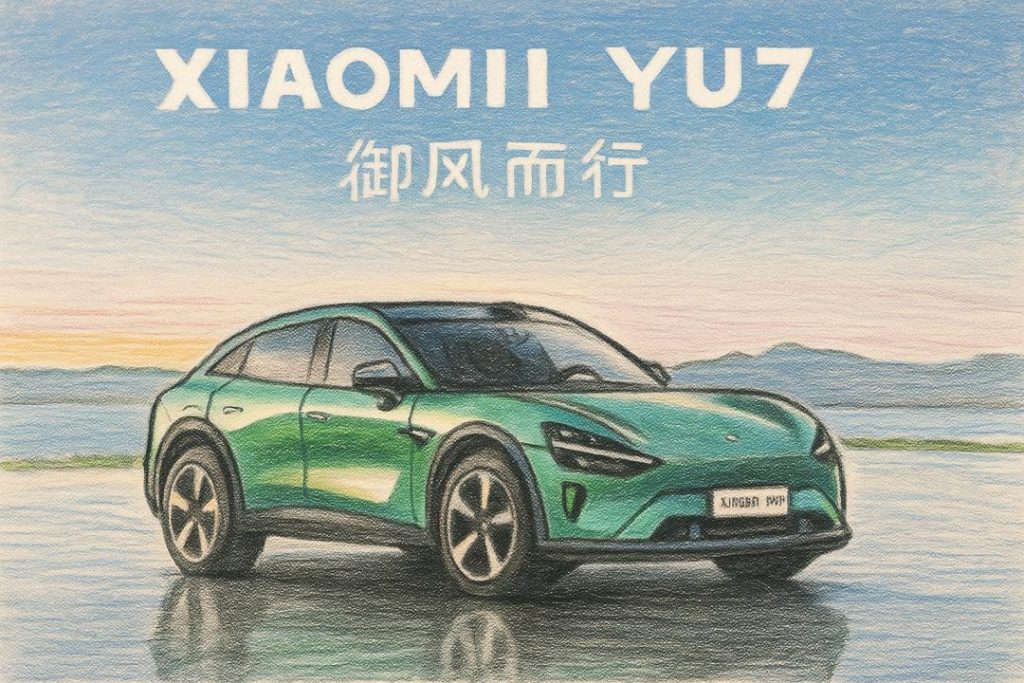

From the perspective of product design, the sleek coupe – SUV shape and nine nature – inspired color schemes make the car – selection process a carrier of personal expression. In terms of social attributes, owning a YU7 represents a user portrait of “being tech – savvy, having good taste, and being rational and smart”, becoming a topic of conversation in social situations. Regarding the marketing rhythm, strategies such as “time – limited benefits”, “order transfer premium”, and “first – order battle reports” stimulate users’ sense of urgency through FOMO (fear of missing out), transforming “consumption” into an emotional experience of “participating in a collective carnival”. This combination of “rational satisfaction + emotional resonance” makes users not only “think they should buy” but also “want to buy”.

Negative Reviews: Hidden Worries and Market Challenges Behind the Hot Sales of YU7

Although the hot sales of Xiaomi YU7 demonstrate strong market appeal, the potential risks behind it also deserve our attention. From order conversion to supply – chain pressure, from intensified competition to user expectation management, every link may become a variable affecting long – term reputation and market position.

I. Pre – order Data ≠ Final Sales Volume. Be Vigilant about the Conversion Risk under High Expectations

The “200,000 pre – orders within 3 minutes” and “289,000 pre – orders within 1 hour” mentioned in the news are essentially “intention orders” after users pay a 5,000 – yuan deposit, not final transactions. In automobile consumption, the conversion rate of pre – orders to formal deliveries is usually affected by multiple factors: first, users’ satisfaction with the actual delivery experience (such as delivery cycle and vehicle quality); second, the dynamics of market competitors (such as other brands launching more competitive models); third, changes in users’ own financial situations (such as adjustments to car – buying budgets due to economic downturn).

Xiaomi was criticized by users for the delivery cycle of SU7 due to production capacity issues before. If the delivery of YU7 is delayed because of the surge in orders, it may trigger a “cancellation wave”. In addition, although the “order transfer at a premium” on second – hand platforms can boost the data in the short term, it may also attract a large number of “speculative orders”. These users don’t really have a car – buying need but try to make a profit by reselling orders. Once the market enthusiasm cools down or the official cracks down on order speculation, these orders are likely to be cancelled, ultimately affecting the actual sales volume.

II. The Supply Chain and Production Capacity are Under Pressure, and Quality Control and Delivery Experience are Facing a Severe Test

The hot sales of YU7 pose extremely high requirements for Xiaomi’s supply – chain management and production capacity planning. Automobile manufacturing involves tens of thousands of parts, and a shortage in any link may lead to delivery delays. Previously, popular models such as Tesla Model 3 and BYD Han have caused user dissatisfaction due to slow production capacity ramping up. Although Xiaomi SU7 has verified a certain production capacity, the order volume of YU7 far exceeds that of SU7 in the initial stage. The supply stability of core components such as its 800V high – voltage platform and lidar will directly affect the delivery rhythm.

More importantly, high sales volume means greater quality control pressure. When the production capacity is fully utilized, will the quality inspection standards of the production line be relaxed? Users’ trust in “Xiaomi’s car – making” is based on the premise of “not being ripped off”. If there are quality problems with the delivered vehicles (such as bugs in the intelligent driving system or abnormal noises from the seats), even if they are low – probability events, they may cause long – term damage to the brand reputation due to the amplification effect of social media.

III. Intensified Market Competition Casts Doubt on the Sustainability of the “High – end Configuration at an Affordable Price” Model

The success of YU7 largely depends on the differentiated strategy of “high – end configuration at an affordable price”, but this model may face challenges in the highly competitive new – energy vehicle market. On the one hand, traditional automakers (such as BYD and Geely) and new – energy vehicle startups (such as Li Auto and XPeng) have accelerated their layout in the mid – to large – sized coupe – SUV market, narrowing the configuration gap with YU7 through technological iteration (such as the 800V platform) and price cuts (such as launching sub – brands). On the other hand, as battery costs decrease and intelligent driving technology becomes more popular, the threshold for “high – end configuration” will gradually lower, and users’ definition of “high – end configuration” will also rise. If Xiaomi fails to maintain its technological leadership, the advantage of “affordable price” may be diluted.

In addition, the “high – end configuration at an affordable price” model requires extremely high cost – control ability. Although Xiaomi has strong supply – chain integration ability, the profit margin in the automobile industry is much lower than that in the mobile phone industry. If Xiaomi over – squeezes the profit margin to maintain cost – performance, it may affect R & D investment (such as intelligent driving algorithms and battery technology), ultimately falling into a vicious cycle of “low price – low profit – low innovation”.

IV. The Double – Edged Sword Effect of User Expectation Management

Xiaomi has successfully stimulated users’ sense of surprise through the strategy of “setting high expectations + releasing at a low price”, but it has also raised users’ expectations for the product. When users buy the 300,000 – level YU7 with the expectation of a “500,000 – level experience”, any flaw in the experience (such as the intelligent driving system not meeting expectations in complex road conditions or the infotainment system lacking smoothness) may be magnified into a negative evaluation of “not matching the description”.

For example, the “700TOPS computing power” mentioned in the news is a top – level configuration for intelligent driving hardware, but the actual intelligent driving experience also depends on algorithm optimization. If the intelligent driving functions of YU7 (such as urban NOA) fail to meet users’ expectations of a “500,000 – level luxury car” due to the immaturity of the algorithm, users may turn from “surprised” to “disappointed”. This gap between “expectation and experience” is more likely to trigger negative word – of – mouth than a “mediocre delivery”.

Advice for Entrepreneurs: Learn the Survival Rules in the New Consumption Era from the Hot Sales of YU7

The success and hidden worries of Xiaomi YU7 provide multi – dimensional inspiration for entrepreneurs. In the era of consumption hierarchy and value reconstruction, enterprises need to find a balance between “rational value” and “emotional experience”, “short – term popularity” and “long – term reputation”, and “user expectations” and “actual delivery”.

I. Deeply Understand the “Hierarchical Downgrade” Demand and Be a “Precise Value Matcher” Instead of a “Price – Involution Fighter”

The essence of consumption downgrade is “value screening”. Users will cut out consumption with “high premium and low marginal benefit” but will concentrate resources on “upgrading core needs”. Entrepreneurs need to break out of the mindset that “low price = competitiveness” and clarify “which needs can be downgraded and which needs must be upgraded” through user research (such as the consumption scenarios, pain points, and value rankings of segmented customer groups).

For example, for the “family car” needs of middle – class families, the core values may be “safety + space + intelligent driving” rather than the “brand logo”. For the “technology exploration” needs of the upper – middle class, the core values may be “technological leadership + scarce experience” rather than the “absolute price”. Enterprises need to build product strength around these core values and replace “low – price, low – end configuration” with “high – end configuration at an affordable price”.

II. Build a Dual – Link of “Trust – Verification” and Accumulate Brand Moat with Long – Termism

The trust foundation of Xiaomi YU7 comes from the 20 – year accumulation of the “ultra – high cost – performance” mindset in the mobile phone business and the user feedback verification after the delivery of SU7. For entrepreneurs, brand trust can’t be established overnight. It needs to be built through long – term interaction of “promise – fulfillment”.

Specifically, it can be divided into two steps: first, “break through in a single point”, achieve “ultra – high value” in a certain segmented field (such as the “performance – price ratio” of Xiaomi mobile phones) to form initial trust; second, “extend the scenario”, expand the trust from a single product to the brand through the successful delivery of related businesses (such as Xiaomi’s expansion from mobile phones to cars). At the same time, the “verification mechanism” of user feedback should be emphasized. The positive word – of – mouth of the first – batch of users is the best marketing, and the quick solution of negative problems (such as the compensation plan after the delayed delivery of SU7) is the “repair agent” for trust.

III. Balance “Emotional Value” and “Rational Value” and Avoid the Trap of “Being Emotional for the Sake of Emotion”

The success of YU7 lies in the deep integration of emotional value (design, social attributes, group resonance) and rational value (configuration, price). Entrepreneurs need to avoid two extremes: one is only talking about rational value and ignoring users’ emotional needs (such as products with powerful functions but ugly designs); the other is over – packaging emotional value and ignoring the essence of the product (such as “internet – famous products” with flashy marketing but poor quality).

It is recommended that enterprises clarify the weights of “core rational value” (such as functions to solve users’ pain points) and “additional emotional value” (such as aesthetics, social attributes) during the product design stage to ensure that emotional value serves rational value. For example, the nine color schemes of YU7 are emotional values, but the premise is that its core configurations such as the 800V platform have met users’ rational needs.

IV. Be Wary of the “High – Expectation” Trap and Establish a Dynamic Balance Mechanism between “Expectation and Experience”

Xiaomi has stimulated users’ sense of surprise through the strategy of “setting high expectations + releasing at a low price”, but entrepreneurs need to note that user expectation management is a double – edged sword. It is recommended to adopt the “progressive disclosure” strategy: before the product launch, moderately release core values (such as technical parameters) but avoid over – promising (such as “absolutely perfect” or “industry – leading”). After delivery, make up for the “experience gap” of users through “beyond – expectation details” (such as additional service benefits, continuous OTA upgrades).

In addition, a closed – loop of “expectation monitoring – feedback – adjustment” should be established. Through methods such as user research and social media sentiment analysis, monitor the gap between users’ expectations and actual experiences in real – time, and promptly adjust the product optimization direction (such as giving priority to solving the most dissatisfied intelligent driving functions of users) or marketing language (such as avoiding exaggerating immature technologies).

V. Strengthen Supply – Chain and Quality Control Abilities and Transform the “Blockbuster” into the Cornerstone of “Sustained Success”

The hot sales of YU7 pose extremely high requirements for the supply chain and production capacity. Entrepreneurs need to plan in advance a “blockbuster response plan”: first, establish long – term cooperation relationships with core suppliers (such as signing supply guarantee agreements) to avoid delivery delays due to parts shortages; second, establish a flexible production capacity mechanism (such as cooperating with contract manufacturers) to quickly expand production when orders surge; third, strictly adhere to quality control standards (such as adding more quality inspection links) to avoid product quality decline due to “rushing production”.

At the same time, the full – process management of the “delivery experience” should be emphasized. From order confirmation, production progress synchronization, delivery time communication to after – sales support, every link needs to be optimized with the user as the center. For example, Xiaomi can push the vehicle production status in real – time through the APP and provide personalized delivery ceremonies (such as a car – handover party for owners) to transform “delivery” into an opportunity to enhance user stickiness.

Conclusion

The hot sales of Xiaomi YU7 are essentially a victory of “value reconstruction”. It proves that in the era of consumption downgrade, users don’t reject consumption; they just reject paying for “worthless premiums”. Enterprises are not without opportunities; they just need to more precisely match users’ “rational needs” and “emotional desires”. For entrepreneurs, the successful experience and potential risks of YU7 are not only a “mirror” reflecting the opportunities in the new consumption era but also a “ruler” measuring the real capabilities of enterprises in terms of product strength, brand power, and supply – chain management. Only by considering both rationality and emotion, short – term popularity and long – term reputation, can enterprises stand firm in the wave of “value reconstruction”.

More

Startup Commentary”Did those cities that went viral really make money from tourism?”

Startup Commentary”Sports Venues Yet to Open Raise 140 Million in Funding with Social Concept”

Startup Commentary”Sports Brands Flock to Sponsor College Competitions”

Startup Commentary”How has the ubiquitous Bluetooth technology become a “familiar stranger”?”

Startup Commentary”AI Pets: Making VCs and Users Go Crazy?”

Startup Commentary”County-level consumption doesn’t rely on the “Brahmins””

Latest

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”