Positive Reviews: New Residential Regulations Drive High – Quality Transformation of the Industry and Activate New Market Momentum

In 2025, the concept of “good houses” was written into the government work report for the first time, marking that China’s real estate industry has officially shifted from “scale expansion” to “quality upgrade”. The implementation and centralized enforcement of new residential regulations have not only reshaped the market supply – demand structure but also promoted profound changes in the underlying logic of the industry. Its positive significance is reflected in the following three aspects:

I. Standardized Improvement of Residential Quality and Substantive Protection of Consumers’ Rights

The implementation of the national mandatory standard “Residential Project Specification” has fundamentally raised the “bottom – line standard” for residential buildings. For example, increasing the floor height from 2.8 meters to 3 meters solves the pain point of the “oppressive feeling” in traditional residences; the mandatory direct lighting requirements for kitchens and bedrooms avoid long – standing design defects such as “dark kitchens and bathrooms”; the mandatory installation of elevators in residential buildings above the 4th floor and the specification of car sizes not only meet the aging – friendly needs of an aging society but also solve the practical problem of stretcher passage. The upgrade of these hard indicators essentially changes “living quality” from an “optional configuration” to a “must – have”, so that consumers no longer have to compromise on basic living needs.

The refinement of local policies further fills the implementation gaps of central regulations. Zhejiang’s new regulations on floor area ratio calculation encourage real – estate enterprises to optimize the apartment layout design (such as increasing open – space areas) by adjusting the rules for calculating half of the area of bay windows, balconies, and equipment platforms. At the same time, by increasing the actual usable area ratio (the actual usable area ratio of new – regulation projects in Shenzhen can reach up to 108%, far exceeding the 70% – 80% of traditional projects), it directly enhances the actual living experience of homebuyers. Jiangsu’s “Nine Actions for Improving Residential Quality” innovatively introduce mechanisms such as “pre – viewing by homeowners” and “participation in individual – unit acceptance”, shifting “quality supervision” from being dominated by real – estate enterprises to “homeowner participation”, and reducing delivery disputes from the source. If the goal of “reducing complaints about engineering quality defects by 30% by 2027” can be achieved, it will completely change the long – standing industry problem of “emphasizing sales and neglecting after – sales service”.

II. Accelerated Optimization of Market Structure and Positive Interaction between Upgrading Demands and High – Quality Supply

The market data in the first month after the implementation of the new regulations (May 2025) confirm the market appeal of “good houses”: the sales volume of improved and high – end products increased by 1 – 2% year – on – year, while the sales volume of rigid – demand products below 90 square meters decreased by 2.2%; in Guangzhou, new – regulation projects accounted for 50% of the total supply and 70% of the total subscriptions in the city; in Chengdu, new – regulation projects were sold out as soon as they opened, and the sales conversion rate of new projects remained above 90%. These data show that with the growth of residents’ income and the transformation of housing demand from “having a place to live” to “having a good place to live”, the market has shifted from being “price – driven” to “quality – driven”.

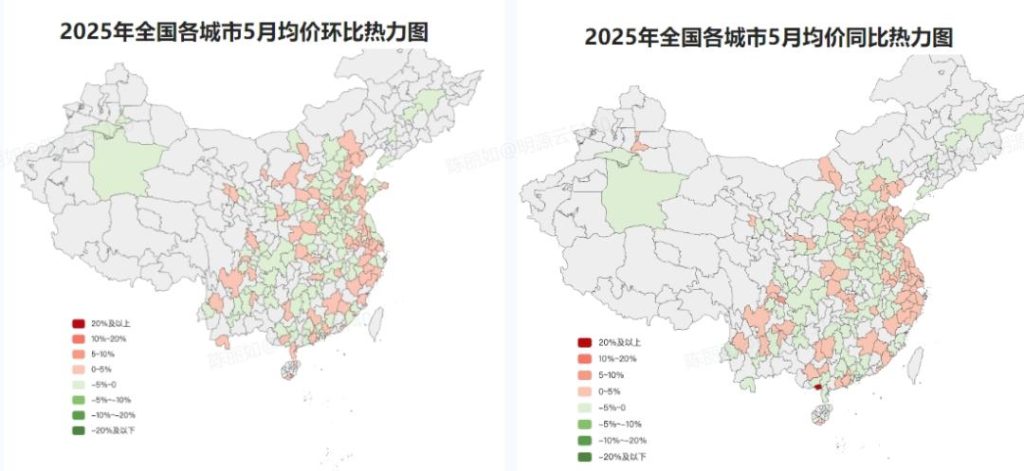

What is more noteworthy is the counter – trend performance of new – regulation products in terms of selling prices. When the average price of new houses in most cities decreased month – on – month, the average selling prices in provincial capitals in East China and Sichuan and Chongqing increased instead due to the increased supply of new – regulation products. This phenomenon breaks the traditional logic of “only by reducing prices can products be sold”, proving that the “quality premium” has been accepted by the market – homebuyers are willing to pay a higher price for a higher actual usable area ratio, a more reasonable apartment layout, and more complete supporting facilities (such as elevators and lighting). The formation of this positive cycle of “quality – price” not only provides profit margins for real – estate enterprises but also offers a feasible path for the industry to get rid of the “high – turnover, low – profit” model.

III. Industry Competition Returns to Product Strength, Promoting the Transformation of Real – Estate Enterprises towards “Long – Termism”

Institutions such as CITIC Securities point out that the real – estate industry has entered the stage of “product – strength competition”, and this judgment is strengthened under the background of the new regulations. Leading real – estate enterprises such as China Resources, China Overseas Land & Investment, and Huafa improve their competitiveness through differentiated designs such as green buildings and intelligent systems, which is essentially building a “product moat”. For example, green buildings can reduce long – term energy consumption costs, and intelligent systems (such as whole – house smart systems) can meet the digital needs of young families. These designs not only conform to policy orientations (such as the “dual – carbon” goal) but also can precisely match the “hidden needs” (such as health and convenience) of the upgrading customer group.

For the industry, this change in the competition logic is of far – reaching significance. In the past, real – estate enterprises’ competition relied on “land acquisition costs”, “financing capabilities”, and “turnover speed”, resulting in serious product homogenization; now, “good houses” have become the core competitiveness, forcing real – estate enterprises to shift from “emphasizing marketing” to “emphasizing R & D”. For example, Jiangsu’s encouragement of “customized and personalized design” and “improvement of whole – house smart levels” essentially requires real – estate enterprises to be like technology companies, continuously innovating products to meet user needs. This change can not only improve the overall technological content of the industry but also promote the in – depth integration of the real – estate industry with the construction, intelligent, and environmental protection industries, injecting new momentum into economic growth.

Negative Reviews: The New Regulations Accelerate Industry Differentiation, and Potential Risks Need to Be Watched Out

There is no doubt about the positive significance of the new residential regulations. However, during the implementation process, potential problems such as intensified market differentiation, increased survival pressure on small and medium – sized real – estate enterprises, and cost transfer have emerged, which need to be rationally examined.

I. Existing Projects Are Hit Hard, and Some Real – Estate Enterprises Face Cash – Flow Crises

The high actual usable area ratio (over 90%) and more optimized apartment layout designs (such as direct lighting and elevator configuration) of new – regulation projects “crush” traditional existing projects. Taking Shenzhen as an example, after the launch of new – regulation projects, the actual usable area ratio of traditional projects is only 70% – 80%. In contrast, with “a smaller living area at the same price” and “poorer basic configurations”, existing projects have to “sacrifice price for volume”. If real – estate enterprises with a high proportion of existing projects (especially small and medium – sized ones) cannot quickly digest their inventories, they may face the risk of cash – flow rupture.

What is more serious is that the price reduction of existing projects may trigger a “chain reaction”. For example, if a large number of existing projects in a certain area reduce their prices, it may drive down the prices of surrounding second – hand houses, leading to “rights – protection” actions by homeowners; if the price reduction is too large, it may also affect the credit ratings of real – estate enterprises and further push up financing costs. This market shock caused by the “generational gap” between new and old products requires policy – level guidance (such as subsidies for the renovation of existing projects) or active responses from real – estate enterprises (such as accelerating product upgrading); otherwise, it may intensify the instability of the local market.

II. Small and Medium – Sized Real – Estate Enterprises Lack Product Strength and Face the Risk of Being Eliminated from the Market

The new regulations put forward higher requirements for real – estate enterprises’ design, construction, and cost – control capabilities. For example, Zhejiang’s new regulations on floor area ratio calculation require real – estate enterprises to optimize the design of bay windows and balconies to increase the actual usable area ratio, which requires a more professional apartment layout R & D team; Jiangsu’s “pre – viewing by homeowners” mechanism requires real – estate enterprises to disclose quality details during the construction stage, which requires stricter project management capabilities. Leading real – estate enterprises can quickly adapt to the new regulations with their advantages in funds, talents, and experience (such as China Resources and China Overseas Land & Investment have launched differentiated products such as green buildings and intelligent systems), but small and medium – sized real – estate enterprises may find it difficult to meet the requirements of the new regulations due to insufficient R & D investment, weak design capabilities, and difficulties in supply – chain integration, and may ultimately be eliminated from the market.

The research report of CITIC Securities also confirms this trend – “Small and medium – sized real – estate enterprises that cannot meet the new standards will face market elimination”. If the industry concentration accelerates towards leading enterprises, it may lead to a weakening of market competition, which is not conducive to the diversity of product innovation in the long run.

III. Quality Upgrade May Push Up Development Costs, and Some Costs May Be Transferred to Consumers

The requirements of the new regulations for residential quality (such as increasing the floor height, mandatory installation of elevators, and extending the waterproof warranty period to 10 years) will directly increase development costs. For example, increasing the floor height from 2.8 meters to 3 meters will increase the consumption of building materials (such as concrete and steel bars); improving the elevator configuration standard (such as the car size needs to meet the passage of stretchers) will increase equipment procurement costs; extending the waterproof warranty period requires real – estate enterprises to use higher – quality materials or purchase additional insurance.

Although new – regulation products in some cities have achieved a “counter – trend increase in selling prices” due to the supply – demand relationship, if the increase in costs exceeds the premium space acceptable to the market, it may lead to two results: one is that real – estate enterprises compress their profits, affecting their long – term investment willingness; the other is that they transfer the costs to consumers, pushing up housing prices, which conflicts with the goal of “housing is for living in, not for speculation”. For example, if the supply of new – regulation products in a certain city is insufficient while the upgrading demand is strong, real – estate enterprises may raise prices in disguise through “bundled decoration” or “increasing the price of parking spaces”, harming the rights and interests of consumers.

Advice for Entrepreneurs: Seize the Opportunity of Quality Upgrade and Break through in the Differentiated Market

In the face of the industry transformation brought about by the new residential regulations, real – estate enterprises and entrepreneurs in related industrial chains need to grasp the following key strategies:

I. Focus on the Core of “Product Strength” and Build Differentiated Competitive Advantages

The new regulations are essentially a policy – based expression of “user needs”. Entrepreneurs need to shift from “selling houses” to “selling a lifestyle”. For example, for the upgrading customer group, they can focus on optimizing the “health attributes” (such as green buildings and low – noise design), “intelligent attributes” (such as whole – house smart systems and community service platforms), and “social attributes” (such as shared spaces and neighborhood activity areas); in response to local policy orientations (such as customized design in Jiangsu), they can explore a “small – batch, personalized” apartment layout R & D model to meet the needs of segmented customer groups (such as the “dual – master – bedroom” design for multi – generation families).

II. Existing Projects Need to “Actively Seek Change” to Avoid Passive Price Reductions

Entrepreneurs with existing projects can enhance their competitiveness through “minor renovations + value packaging”. For example, to solve the problem of a low actual usable area ratio, they can optimize the interior design (such as customized storage spaces); to solve the problem of insufficient lighting, they can use mirror decorations and light – colored walls to improve the visual effect; at the same time, they can strengthen the promotion of the “price advantage” (such as “lower total price in the same area”) to attract price – sensitive rigid – demand customer groups. In addition, they can consider cooperating with decoration companies and home – furnishing brands to launch “decoration packages” and “home – appliance packages”, and enhance the attractiveness of the projects through additional services.

III. Small and Medium – Sized Real – Estate Enterprises Need to “Compete in a Dislocated Manner” to Avoid Direct Confrontation with Leading Enterprises

Small and medium – sized real – estate enterprises can focus on “regional in – depth development” or “segmented markets”. For example, in third – and fourth – tier cities, they can develop “localized” products combined with local cultural characteristics (such as traditional courtyard designs); in segmented fields, they can focus on vertical tracks such as “aging – friendly residences” (such as barrier – free design and medical supporting facilities) and “youth communities” (such as shared office spaces and social facilities), avoiding direct competition with leading real – estate enterprises through precise positioning. In addition, they can cooperate with design companies and construction contractors through the “joint development” model to share R & D costs and quickly improve their product strength.

IV. Pay Attention to Cost Control and Balance “Quality” and “Profit”

Quality upgrade should avoid “upgrading for the sake of upgrading”. Entrepreneurs need to establish a “cost – value” evaluation system, giving priority to investing in aspects with strong user perception and large premium space (such as the actual usable area ratio, lighting, and elevator configuration), and reducing redundant costs that users are not sensitive to (such as unnecessary high – end decorations). At the same time, they can reduce development costs through supply – chain optimization (such as centralized procurement of high – quality building materials) and improvement of construction techniques (such as prefabricated buildings to reduce labor costs), ensuring that “quality improvement” does not lead to a “significant decline in profits”.

V. Strengthen “User Participation” to Build Trust and Reputation

Learning from Jiangsu’s experience of “pre – viewing by homeowners” and “participation in individual – unit acceptance”, entrepreneurs can actively invite potential customers to participate in product design (such as apartment layout voting), construction supervision (such as open – site days), and delivery acceptance (such as pre – inspection of houses), establishing trust through transparent and interactive methods. This can not only reduce delivery disputes but also transform “user feedback” into a basis for product optimization, forming a positive cycle of “demand – product – reputation”.

Conclusion:

The new residential regulations in 2025 are both a “stress test” and a “transformation opportunity” for the real – estate industry. They require real – estate enterprises to transform from “scale expanders” to “quality service providers” and from “short – term arbitrageurs” to “long – term value creators”. For entrepreneurs, the key to seizing the “good – house” opportunity lies in understanding the essential changes in user needs, building competitiveness with product strength as the core, and finding their own survival and development space in the differentiated market.