Read More《跨境支付通来了!央行、香港金融管理局联合启动→》

Positive Reviews: Cross – border Payment Connect – A Milestone Breakthrough in the Integration of People’s Livelihood Convenience and Finance

The “Cross – border Payment Connect” launched on June 22, 2025, marks a crucial step in the interconnection of financial infrastructure between the Chinese mainland and Hong Kong. This payment system interconnection mechanism jointly promoted by the People’s Bank of China and the Hong Kong Monetary Authority not only directly addresses the “pain points” of cross – border payments for residents in both regions but also injects new impetus into economic and trade cooperation, RMB internationalization, and the consolidation of Hong Kong’s status as an international financial center from a macro perspective.

I. People’s Livelihood Convenience: An Upgrade from “Cumbersome” to “Smooth” Experience

The long – standing problems of traditional cross – border payments, namely “slow speed, high cost, and complicated procedures,” have been plaguing residents in both regions. For example, when parents on the mainland pay tuition fees for their children studying in Hong Kong, they often need to submit certification materials at bank counters, and the money arrives in 2 – 3 working days with a handling fee as high as 1% – 3% of the remittance amount. Hong Kong residents traveling north for medical treatment or consumption also face problems such as complex recipient account information and delayed arrival of funds. The “Cross – border Payment Connect” achieves three core breakthroughs by connecting the mainland’s online inter – bank payment clearing system with Hong Kong’s “Faster Payment System”:

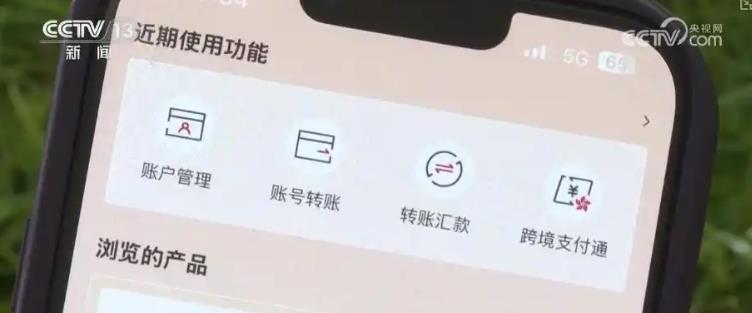

Firstly, Online payment channels. Users can initiate remittances by simply entering the recipient’s mobile phone number or bank account through mobile banking or apps, completely getting rid of the physical restrictions of offline counters.

Secondly, Real – time arrival and low cost. Facilitated remittances within a certain amount under current accounts (such as tuition fees for studying abroad and medical fees) support real – time arrival. And since the payment infrastructure is directly connected, the intermediate links are reduced, and the transaction cost is significantly lowered.

Thirdly, Simplified material requirements. Individuals do not need to submit business background materials (such as study certificates and medical bills) when handling facilitated remittances, greatly improving the efficiency of small – value and high – frequency payments.

This model of “mobile phone number transfer + real – time arrival + zero materials” precisely covers the most urgent demand scenarios of residents in both regions. According to statistics, in 2024, personal small – value remittances (below 100,000 RMB per transaction) accounted for over 60% of cross – border remittances between the mainland and Hong Kong, and people’s livelihood scenarios such as studying abroad, medical treatment, and salaries accounted for nearly 80%. The launch of the “Cross – border Payment Connect” directly responds to these high – frequency demands and is a model of “people’s livelihood finance.”

II. Economic Integration: Promoting “Two – way Acceleration” of Economic and Trade and People – to – People Exchanges between the Two Regions

Payment is the “lifeblood” of economic and trade activities. The improvement of payment efficiency will directly drive the coordinated economic development of the two regions. On the one hand, the Cross – border Payment Connect provides a more convenient tool for capital circulation for small and medium – sized enterprises and individual operators. For example, mainland cross – border e – commerce sellers can pay for goods to Hong Kong suppliers, or Hong Kong small and micro – enterprises can remit money back to mainland purchasers through online channels quickly, shortening the capital turnover cycle and reducing financial costs. On the other hand, the convenience of people – to – people exchanges will further stimulate consumption potential. When Hong Kong residents travel north for tourism and medical treatment, and mainland residents travel south for shopping and studying, the elimination of payment “stumbling blocks” will directly promote the growth of consumption scale. According to data from the Hong Kong Tourism Board, in 2024, the average consumption per mainland tourist visiting Hong Kong was about HK$8,000. If a 10% increase in consumption is brought about by the improvement of payment efficiency, it can bring more than HK$10 billion in additional income to Hong Kong’s retail, catering and other industries.

III. Strategic Significance: “Dual – wheel Drive” of RMB Internationalization and Hong Kong’s Financial Center

Another profound meaning of the “Cross – border Payment Connect” lies in promoting the cross – border use of the RMB. The mechanism supports bilateral local currency (RMB and Hong Kong dollars) and bilateral RMB remittances, which means that mainland residents can directly remit RMB to Hong Kong, and Hong Kong residents can also remit RMB to the mainland. This will expand the use scenarios of the RMB in Hong Kong (such as Hong Kong residents’ consumption and investment on the mainland) and enhance the liquidity and acceptance of the RMB in the offshore market.

At the same time, this measure is another “practical move” by the central government to support Hong Kong in consolidating its status as an international financial center. Through the interconnection of payment systems, Hong Kong’s role as a “super connector” is further strengthened. The connection between its “Faster Payment System” and the mainland’s payment network not only attracts more international financial institutions to participate in the mainland market through Hong Kong but also provides a broader business expansion space for Hong Kong’s fintech companies (such as e – wallets and cross – border payment service providers). As Governor Pan Gongsheng said, “This is an important milestone in deepening financial cooperation.” The complementary advantages of Hong Kong’s financial infrastructure and the huge market demand on the mainland will inject new impetus into its long – term prosperity.

Negative Reviews: Risks and Challenges behind Efficiency Improvement Need to Be Anticipated

Although the “Cross – border Payment Connect” has broad prospects, as a cutting – edge practice of cross – border financial innovation, it still faces multiple potential risks and needs to be dynamically optimized during operation.

I. Cross – border Regulatory Coordination: The “Cross – domain Dilemma” of Anti – money Laundering and Compliance

There is a natural tension between the convenience of cross – border payments and the regulatory requirements of anti – money laundering (AML) and counter – financing of terrorism (CFT). In traditional cross – border remittances, banks prevent illegal capital flows through strict “know your customer” (KYC) and transaction background reviews (such as requiring contracts and invoices). However, the “facilitated remittance” of the “Cross – border Payment Connect” allows individuals not to submit business background materials. Although it improves efficiency, it may also be exploited by criminals to cover up illegal capital transfers (such as gambling and money laundering) through small – value and high – frequency remittances of “breaking large amounts into small ones.”

In addition, there are differences in regulatory rules between the mainland and Hong Kong. For example, the mainland implements the “three principles of business operation” (know your customer, know your business, and conduct due diligence) for cross – border RMB remittances, while the regulation of Hong Kong’s “Faster Payment System” focuses more on payment efficiency and user experience. How to achieve the “soft connection” of regulatory standards between the two regions after interconnection (such as information sharing and risk warning linkage) to avoid regulatory arbitrage is a key challenge for the long – term and stable operation of the mechanism.

II. Technical Security: The Stability of System Interconnection and the Risks of Cross – border Data

The “Cross – border Payment Connect” relies on the direct connection of the payment systems between the mainland and Hong Kong. The complexity of the technical architecture and potential vulnerabilities may affect the service stability. For example, if one of the systems is delayed due to a cyber – attack or operation and maintenance failure, it may lead to the failure of cross – border remittances or the retention of funds. In addition, user information (such as mobile phone numbers and bank accounts) needs to be transmitted between the two systems, and the security of cross – border data flow (such as personal information protection and data sovereignty) also needs to be focused on.

Although the Hong Kong Monetary Authority emphasizes that “participating institutions need to do a good job in internal management and risk prevention,” the technical capabilities of small and medium – sized banks or payment institutions may become a shortcoming. The first – batch of participating institutions are mainly state – owned large – scale banks and leading banks in Hong Kong, with relatively sufficient technical reserves. However, if the scope of participation is expanded to small and medium – sized institutions in the future, how to ensure that the system security and anti – attack capabilities of all institutions meet the standards and avoid systemic risks caused by the vulnerabilities of individual institutions is a problem that needs continuous attention.

III. Market Inclusiveness: The “Participation Gap” of Small and Medium – sized Institutions and Users

Currently, there are only 12 institutions in the first – batch of participants (6 from the mainland and 6 from Hong Kong), mainly large – scale banks. Small and medium – sized banks and Internet banks (such as MYbank and Webank on the mainland and virtual banks in Hong Kong) have not been included, which may result in some users (such as long – tail customers relying on small and medium – sized banks) being unable to enjoy the facilitated services. In addition, although the mechanism supports “reasonably determining the limit according to the transaction scenario,” the specific limit standards are set by participating institutions themselves. If some institutions set too low limits (such as only 10,000 RMB per transaction) to control risks, it may weaken the user experience and deviate from the original intention of “facilitation.”

Suggestions for Entrepreneurs: Seize the Opportunity of Payment Facilitation and Strictly Abide by the Bottom Lines of Compliance and Security

The launch of the “Cross – border Payment Connect” provides new growth opportunities for entrepreneurs in cross – border related fields, but they also need to balance innovation and risks in business expansion. The following are specific suggestions:

I. Focus on Cross – border People’s Livelihood Scenarios and Optimize User Service Experience

Entrepreneurs can develop supporting service products around scenarios such as studying abroad, medical treatment, and salaries covered by the “Cross – border Payment Connect.” For example:

– In the field of study – abroad services: A one – stop platform of “cross – border payment + study – abroad consultation” can be launched. Taking advantage of the real – time arrival of payments, value – added services such as “payment progress tracking + school confirmation” can be provided for parents.

– In the field of cross – border medical care: Cooperate with medical institutions on the mainland or in Hong Kong to develop an “online consultation + cross – border payment” platform to solve the pain points of cost settlement for Hong Kong residents traveling north for medical treatment or mainland residents traveling to Hong Kong for medical treatment.

– In the field of flexible employment: For part – time and freelance workers between the mainland and Hong Kong (such as cross – border e – commerce customer service and design outsourcing), provide services such as “salary payment + tax consultation” to reduce the salary payment cost of enterprises through payment facilitation.

II. Strengthen Compliance Awareness and Establish a Cross – border Risk Prevention and Control System

Entrepreneurs need to attach great importance to anti – money laundering and data security compliance:

– Understand the regulatory rules of both regions: Familiarize yourself with the “Business Rules of the Cross – border Inter – bank Payment System” on the mainland and the “Payment Systems and Stored Value Facilities Ordinance” in Hong Kong, and clarify the scope of application of “facilitated remittances” (such as only for current accounts and prohibited for capital accounts).

– Establish a dynamic risk control mechanism: Analyze user transaction behaviors (such as frequency, amount, and counterparties) through big data, and automatically issue warnings for abnormal transactions (such as multiple small – value remittances in a short period) to avoid becoming a channel for illegal funds.

– Protect user data: When using cross – border payment services, strictly follow the “Personal Information Protection Law” (on the mainland) and the “Personal Data (Privacy) Ordinance” (in Hong Kong) to ensure the compliance of cross – border transmission of user information (such as desensitization through privacy – preserving computing technology).

III. Pay Attention to Technical Adaptation and Choose Reliable Payment Partners

When connecting to the “Cross – border Payment Connect” service, entrepreneurs should give priority to participating institutions with strong technical capabilities and a sound risk control system (such as the first – batch state – owned large – scale banks or leading banks in Hong Kong) to avoid business interruption caused by the instability of the cooperation partner’s system. At the same time, they can explore cooperation with fintech companies and use technologies such as blockchain and smart contracts to optimize cross – border payment processes (such as automatic verification of transaction background and real – time reconciliation) to further enhance user trust.

IV. Participate in Market Cultivation and Promote the Expansion of Payment Scenarios

Entrepreneurs can actively cooperate with participating institutions to explore new application scenarios of the “Cross – border Payment Connect.” For example, in response to the “cross – border elderly care” demand between the mainland and Hong Kong (such as Hong Kong elderly people receiving elderly care on the mainland and their children paying alimony in Hong Kong), promote institutions to include “alimony” in the scope of facilitated remittances. Or for the “small – package direct mail” scenario of cross – border e – commerce, jointly develop a combined payment function of “payment for goods + freight” with payment institutions to reduce the operation cost of sellers.

Conclusion

The launch of the “Cross – border Payment Connect” is a crucial step for the financial cooperation between the mainland and Hong Kong to move from “pipeline connection” to “mechanism integration.” It not only brings “tangible” convenience to residents and enterprises in both regions but also puts forward higher requirements for regulatory coordination and technical security. For entrepreneurs, this is both an “opportunity” to expand cross – border business and a “touchstone” to test their compliance and innovation capabilities. Only by seizing the opportunity and strictly abiding by the bottom lines can they gain an advantage in the wave of cross – border economic integration.