Positive Reviews: The Business Model Innovation of Laopu Gold Redefines the “Luxury” Path of Gold Consumption

Against the backdrop of domestic consumption downgrade and the cooling – off of high – end luxury brands, Laopu Gold has defied the odds with a ten – fold increase in its stock price in one year and a compound revenue growth rate of 157% (from 2022 to 2024), becoming the gold jewelry enterprise with the highest market value in the Hong Kong stock market. Its success is not accidental. By precisely breaking through the pain points of the traditional gold jewelry industry and deeply exploring the “luxury – oriented” path, it has opened up a new track for differentiated growth in the gold consumption market.

I. The “Fixed – price” Model Breaks the Industry’s Involution and Reconstructs the “Emotional Value” of Gold Consumption

The traditional gold jewelry industry has long been trapped in the low – profit dilemma of “pricing by weight”. Since the price of gold raw materials is transparent (anchored to the Shanghai Gold Exchange (SGE) price), it is difficult for brand owners to increase profits through cost control. Moreover, the homogenization of product design (such as zodiac – themed and “good – luck” themed “commodity – like” products) makes consumers more concerned about the hedging property, which ultimately leads to “a race to the bottom in processing fees” – the average gross profit margin of the industry is only about 15%, and brands can only rely on channel expansion (opening franchise stores) to maintain growth.

Laopu’s “fixed – price” model completely subverts this logic. All its products (pure gold and pure gold inlaid products) are priced by piece, directly incorporating added values such as craftsmanship, design, and culture into the price. The gross profit margin is stable at around 40% (far higher than the 15% of traditional weight – priced gold and the 35% of the industry’s “fixed – price” products). More importantly, this model strengthens the “emotional value” by downplaying the investment property of gold. Consumers are no longer buying “a hedging metal” but an “emotional carrier” that embodies ancient craftsmanship, Buddhist culture, and a sense of blessing ritual.

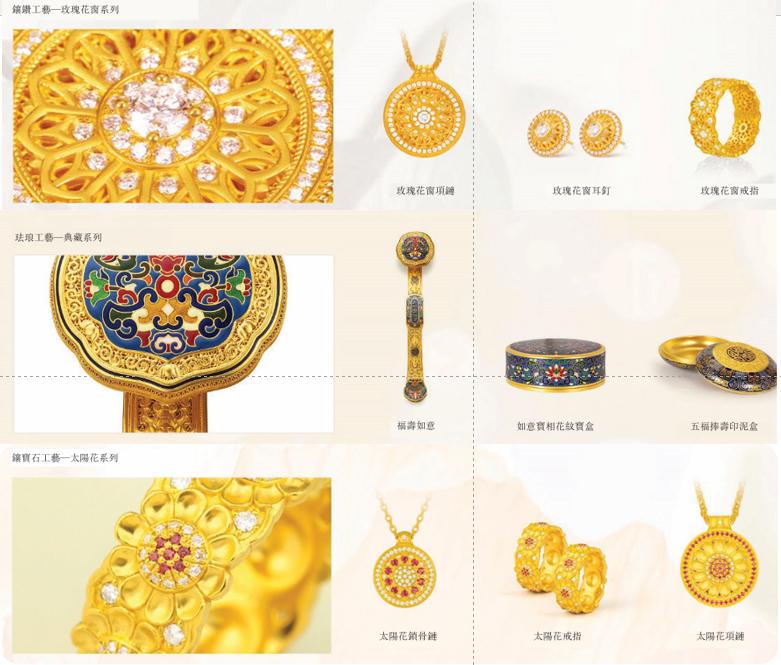

Take the pure gold inlaid products launched in 2019 as an example. By combining pure gold with gemstones, enamel, and jade, it enhances the visual hierarchy and design premium. The gross profit margin of these products is 8% – 10% higher than that of the pure gold series. Currently, they account for over 60% of the total, becoming the core driving force for Laopu’s profitability. This strategy of “product differentiation + premium pricing” not only breaks away from the “raw material trading” logic of traditional gold jewelry but also upgrades gold from a “commodity” to a “cultural consumer product”.

II. The Pure Direct – operation Model Controls High – end Channels, and Scarcity Shapes the Image of the “Hermès of the Gold Industry”

Traditional gold jewelry brands rely on franchise expansion (over 90% of the stores of Chow Tai Fook, Lao Feng Xiang, etc. are franchises). Although this can quickly increase the quantity, it is difficult to control the terminal pricing and service quality. Problems such as low – price cross – regional sales and false promotions occur frequently, hindering the brand’s transformation to the high – end market. In contrast, Laopu adopts a pure direct – operation model, strictly controlling the number of stores (only increasing from 18 to 36 in the past five years) and concentrating on top – luxury shopping malls in first – tier and new first – tier cities (such as SKP and Mixc), neighboring LV and Hermès.

This strategy of “opening fewer but larger stores” essentially replicates the “scarcity operation” of luxury goods. By controlling the supply (such as limited – edition products and price increases for classic styles) and providing a scenario – based experience (service standards in high – end shopping malls), it strengthens the brand’s “high – end style” and “mystery”. Data shows that in 2024, the average revenue per store of Laopu reached 330 million yuan, approaching the global average of 380 million yuan per store of Hermès, making it the “king of single – store revenue”. More notably, 85% of its growth comes from the improvement of the efficiency of existing stores rather than the opening of new stores, indicating that consumers’ acceptance of the premium under the high – end positioning continues to increase.

III. Cultural Empowerment Builds a Differentiated Barrier, Transforming from a “Collectible Brand” to a “Top New – consumption Brand”

Laopu’s predecessor was “Golden Treasure”, which dealt in Buddhist cultural products. This genetic background has deeply bound it to “culture” since its inception. Its products integrate ancient craftsmanship (such as engraving and fetal – like metalworking) with Buddhist culture (scenarios like blessing and fortune – turning). In the early days, it targeted high – net – worth collectors as its core audience, accumulating brand recognition for “craft scarcity” and “cultural value”. After independent operation in 2016, Laopu did not abandon this advantage but instead transformed it into “emotional resonance” in the mass market. Through narratives such as “ancient craftsmanship is cultural inheritance” and “gold carries blessings”, it has upgraded its products from “ornaments” to “spiritual symbols”.

This cultural empowerment not only solves the problem of “homogenization” in gold consumption but also precisely meets the needs of the new consumption era. Young consumers (especially Generation Z) are no longer satisfied with “practical functions” but pursue “meaning” and “identity recognition”. Laopu’s success essentially lies in binding “gold” with “culture” and using emotional value to offset the impact of consumption downgrade.

Negative Reviews: Under Laopu’s “Luxury Façade”, There Are Still Shortcomings in Brand Awareness and Anti – cyclical Ability

Although Laopu shows the potential of being the “Hermès of the gold industry” in terms of business model and operational efficiency, its current high growth and high valuation are still facing multiple doubts. From the controversy of “ancient craftsmanship being a rip – off” to “fake luxury”, it essentially points to core issues such as insufficient brand depth and weak anti – cyclical ability.

I. The Brand Awareness Has Not Reached the “Core Essence” of Luxury, and the Sustainability of the Premium Is Questionable

True luxury brands (such as Hermès and Cartier) have three core characteristics: global recognition (transcending regional cultures), classic designs (ever – green best – sellers), and hard – currency attributes (pricing is not affected by raw materials or economic cycles). Currently, Laopu has only achieved the “façade”:

Firstly, brand recognition is limited to the domestic market. Laopu’s cultural narratives (Buddhist culture and ancient craftsmanship) are highly dependent on the context of Chinese traditional culture and have not yet formed a globally resonant brand symbol. It is difficult for it to break through regional limitations like Hermès’ “Birkin bag” or Cartier’s “Ballon Bleu”.

Secondly, there is a lack of cross – era classic designs. Although Laopu’s products emphasize craftsmanship, the designs are still mainly focused on scenarios such as weddings and blessings, and it has not yet launched iconic single products like Cartier’s “LOVE series” that can span the aesthetic cycle. Its price – increase logic mainly relies on “the complexity of craftsmanship” and “iteration of popular series” rather than “the absolute authority of the brand logo”.

Thirdly, pricing is still restricted by the nature of gold. Although Laopu tries to downplay the investment property of gold, its inventory accounts for nearly 70% of its total assets (mainly gold raw materials), and its profitability is still strongly correlated with gold price fluctuations. During the gold price increase cycle from 2022 to 2024, Laopu’s gross profit margin was stable at 40%. If the gold price falls or fluctuates in the future, its premium ability may be tested.

II. The Gap between “Luxury – oriented” Marketing and the Actual Value May Trigger the Controversy of “Rip – off”

Laopu’s high premium (the price per gram of its products is more than 30% higher than that of its competitors) is based on the narrative of “ancient craftsmanship + cultural value”. However, some consumers believe that the premium for its craftsmanship lacks perceptible differentiation. For example, traditional gold jewelry brands (such as Chow Tai Fook and Chao Hong Ji) are also promoting technologies such as 3D hard gold and gold + enamel. Although Laopu’s “ancient craftsmanship” has historical inheritance, it is difficult for ordinary consumers to intuitively distinguish the technical barriers between it and other technologies.

More importantly, the essence of the premium of luxury goods is “brand belief” rather than simply “craft cost”. The high price of Hermès’ Birkin bag is mainly due to the “status symbol” represented by the brand, rather than the cost of leather and hand – sewing. Currently, Laopu’s premium is still supported by “craft + culture”. If consumers think that its cultural narratives are “more hype than substance” (such as the superstitious elements of “blessing” and “fortune – turning” being regarded as marketing gimmicks), it may lead to the fermentation of the “rip – off” controversy, which will in turn affect the repurchase rate and brand reputation.

III. The Expansion Bottleneck of the Direct – operation Model May Cause the Growth Ceiling to Appear Prematurely

Although Laopu’s pure direct – operation model ensures brand tone and store efficiency, it also limits the speed of scale expansion. Currently, it has only 37 stores globally, and they are concentrated in top – luxury shopping malls in first – tier and new first – tier cities. The store resources in such high – quality business districts are scarce (for example, there are only more than 10 SKP stores nationwide), and the space for future new store openings is limited.

Currently, 85% of Laopu’s growth comes from the improvement of the efficiency of existing stores. However, if the efficiency per store approaches the level of Hermès (330 million yuan vs. Hermès’ 380 million yuan), the room for further improvement will narrow. If it cannot drive growth through both “store expansion” and “improvement of single – store efficiency”, its high growth (CAGR of 157% from 2022 to 2024) may not be sustainable.

Suggestions for Entrepreneurs: Key Insights from Laopu Gold’s “Breakthrough” and “Dilemma”

Laopu Gold’s case provides valuable experience for entrepreneurs: breaking the involution in traditional industries through “model innovation + cultural empowerment”, while also warning of potential risks such as “insufficient brand depth” and “weak anti – cyclical ability”. Based on its experience and problems, entrepreneurs can focus on the following aspects:

I. Model Innovation Should Address Industry Pain Points, Rather Than Being Simply “Innovative for the Sake of Innovation”

The core of Laopu’s success lies in solving the pain points of “low profit margin and homogenization” in the traditional gold jewelry industry: increasing the premium through the “fixed – price” model and controlling high – end channels through the direct – operation model. When designing a business model, entrepreneurs need to conduct in – depth analysis of the underlying contradictions in the industry (such as cost structure, competitive landscape, and consumer demand) to find the key points of “mismatch between supply and demand”, rather than innovating blindly. For example, if entering the catering industry, one can focus on the contradiction between “standardization and personalization” and balance efficiency and experience through a central kitchen + customized services.

II. Cultural Empowerment Should Combine “Reality and Fantasy” to Avoid Falling into the Trap of “Marketing Outweighing Value”

Laopu’s cultural narratives (ancient craftsmanship and Buddhist culture) provide it with a differentiated barrier, but it is necessary to be vigilant against the excessive amplification of the “fantasy” part (such as superstitious elements). When exploring cultural value, entrepreneurs should focus on the “perceptible reality”. For example, Laopu can enhance consumer trust through process transparency (such as showing the ancient production process) and cultural traceability (such as launching co – branded products with museums). If engaging in a Chinese – style fashion brand, one can combine specific handicrafts of intangible cultural heritage (such as Su embroidery stitches and Jingdezhen porcelain – making) rather than simply using the “Chinese style” label.

III. Brand Building Requires “Long – termism”, Transforming from “Functional Recognition” to “Mental Belief”

Currently, Laopu’s brand is still at the stage of “functional recognition based on craftsmanship + culture” and has not yet formed the mental belief of “status symbol”. Entrepreneurs need to realize that the ultimate source of brand premium is the emotional recognition that “consumers are willing to pay an extra fee for the brand”. For example, one can establish long – term memory points through “creating classic single products” (such as Apple’s iPhone and Tesla’s Model S) and strengthen the sense of participation through “user co – creation” (such as NIO’s community operation), gradually upgrading from a “product brand” to a “spiritual symbol”.

IV. The Channel Strategy Should Match the Brand Positioning, Balancing “Control” and “Expansion”

Laopu’s direct – operation model is suitable for high – end positioning but also limits the scale. Entrepreneurs need to choose the channel strategy according to the brand positioning. If targeting the high – end and scarce market (such as luxury goods), direct – operation control is a necessary choice. If aiming for the mass market (such as fast fashion), the franchise or asset – light model can accelerate expansion. The key is to find a balance between “control ability” (ensuring brand consistency) and “expansion efficiency” (seizing market share). For example, a hybrid model of “direct – operation in core cities + franchising in lower – tier markets” can be adopted.

V. Risk Management Should Focus on “Underlying Variables” to Avoid Relying on a Single Cyclical Dividend

Part of Laopu’s high growth benefits from the gold price increase cycle (from 2022 to 2024), and the problem of its high inventory ratio may expose risks when the gold price falls. Entrepreneurs need to identify the “underlying variables” of the business (such as raw material prices, policy orientation, and technological trends) and establish a hedging mechanism. For example, if relying on commodities (such as coffee and gold), one can lock in costs through futures tools. If relying on policy dividends (such as new – energy subsidies), one needs to build technological barriers in advance to reduce dependence on subsidies.

In conclusion, Laopu Gold’s “journey to success” is not only a model for innovation in traditional industries but also provides double insights for entrepreneurs on “how to break through involution” and “how to avoid false prosperity”. In the complex environment where consumption upgrade and downgrade coexist, true success requires not only the courage of “model innovation” but also the patience of “brand deep – cultivation”.