Positive Comments: From “Supporting Role” to “Dual-Attribute Core Asset” under the Dominance of Industrial Demand

Since 2025, the strong performance of silver prices has broken its traditional positioning as a “supporting role among precious metals.” Looking at the data, domestic silver futures soared by 8.37% from April 22nd to June 16th, and the outer-market COMEX silver rose by 11.42% during the same period, while gold futures declined, highlighting the pattern of “strong silver and weak gold.” The core driving force behind this round of price increases comes from both the strong support of the supply – demand fundamentals and reflects the value re – evaluation of silver driven by its “industrial attribute + financial attribute,” marking its transformation from a passive role of “following gold’s fluctuations” to an active transformation into a “dual – attribute core asset.”

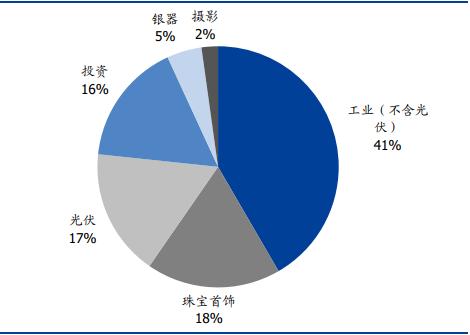

Firstly, the structural growth of industrial demand provides long – term fundamental support for silver. According to data from the World Silver Association, in 2024, industrial demand accounted for 58% of the downstream demand for silver, far exceeding that of jewelry (18%) and investment (16%). Among them, the photovoltaic field contributed 78% of the demand increment (from 2019 – 2024, the incremental demand for silver in the photovoltaic field was 3,817 tons, accounting for 78% of the total increment). Although the iterative development of photovoltaic technology has led to a marginal decline in the unit consumption of silver paste (in 2024, the silver consumption of N – type batteries was 86mg/piece, and that of P – type was 74mg/piece, lower than in 2023), the high – speed growth of global photovoltaic installed capacity (it is expected to add 930GW in 2029, with a compound growth rate of 9.3% from 2024 – 2029) has completely offset the impact of the decline in unit consumption, and the demand for silver in the photovoltaic field continues to expand. In addition, the expansion of silver’s applications in fields such as electronics (integrated circuit boards) and healthcare (antimicrobial agents) has further strengthened the “rigid demand” characteristics of its industrial attribute. This demand growth driven by emerging industries is in sharp contrast to gold’s “passive rise” that depends on risk – aversion sentiment, and has become the core logic for silver prices to be independent of gold.

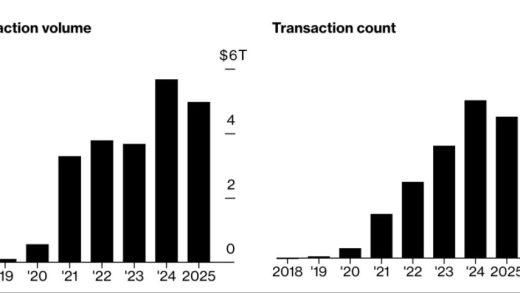

Secondly, the repair cycle of the “gold – silver ratio” provides a clear market signal for silver’s catch – up growth. Historical data shows that since 2000, the “gold – silver ratio” (the price ratio of an ounce of gold to silver) has fluctuated around a central value: before 2017, the central value was 60, and it would repair after breaking through 80; after 2017, the central value rose to 80, and it would repair after breaking through 100. After reaching a high of 105.29 on April 22nd, the current “gold – silver ratio” started to decline (falling to 95.23 on June 16th), which conforms to the historical law of “repair after breaking through the central value.” Historical experience shows that the convergence of the “gold – silver ratio” is mostly achieved through silver’s catch – up growth (for example, from 2020 – 2021, the “gold – silver ratio” fell from 122.80 to 62.97, and the increase in silver prices far exceeded that of gold prices). Currently, the support of silver’s industrial demand resonates with the “loosening of gold’s risk – aversion logic” (the easing of tariffs has led to a decline in risk – aversion demand), further strengthening the market’s expectation of silver’s catch – up growth.

Finally, the return of institutional pricing power amplifies the price elasticity of silver. Compared with gold, the silver market has a smaller scale and a higher degree of institutional participation. Since April, there has been a contradiction in the gold market between “net inflows into ETFs (retail funds) and a decline in institutional positions in futures (institutional selling).” However, after May, institutional positions gradually stabilized and rebounded, and the institutional pricing power in the precious metals market has strengthened again. Since the industrial attribute of silver can be more easily quantitatively analyzed by institutions through industrial chain data (such as photovoltaic installed capacity and electronic orders), its price is more sensitive to institutional funds, which also explains why the elasticity of silver is significantly better than that of gold in this round of price increases.

Negative Comments: The “Double – Edged Sword” of Industrial Demand and Potential Risks of Overheated Prices

Although the strong rise of silver prices is supported by fundamentals, the potential risks behind it also deserve attention. The strengthening of the industrial attribute provides long – term impetus for silver, but it also exposes it to the risks of industrial cycle fluctuations; and the rapid short – term price increase may lead to over – speculation, resulting in a temporary deviation of prices from fundamentals.

Firstly, the “strong dependence” on industrial demand may amplify the risk of cycle fluctuations. The core driving force of silver’s industrial demand comes from emerging industries such as photovoltaic and electronics, but these industries are highly volatile. The photovoltaic installed capacity is affected by policy subsidies and power consumption capacity (for example, some countries may cut subsidies due to fiscal pressure), and the electronics industry is highly correlated with the global technology cycle (such as the semiconductor boom). If the growth rate of photovoltaic installed capacity slows down in the future (for example, the predicted 930GW in 2029 is not achieved) or the electronics industry enters a downward cycle, the growth of silver’s industrial demand may stall, which will in turn impact its price support. In addition, the “double – edged sword” effect of technological iteration needs continuous attention. Although the decline in silver consumption in the photovoltaic field has been offset by the growth of installed capacity, if a disruptive technology (such as silver – free conductive materials) emerges in the future, the industrial demand for silver may face a cliff – like decline.

Secondly, the “cold” consumer end limits the sustainability of silver price increases. In contrast to the “hot” industrial demand, the consumption of silver jewelry has been mediocre. A field visit to Shuibei in Shenzhen shows that the sales volume of silver jewelry has not increased with the rise in silver prices, and merchants even dare not raise prices due to “intense competition at the consumer end.” The rapid rise in upstream silver prices has instead squeezed the profits of downstream businesses. This means that the financial attribute (investment demand) of silver has not yet resonated with its consumption attribute. If the growth rate of industrial demand slows down in the future and investment demand (such as silver ETFs) fails to take over, silver prices may face the risk of a “break in upward momentum.”

Thirdly, short – term over – speculation may lead to a deviation of prices from fundamentals. The characteristics of the silver market, such as its smaller scale (compared with gold) and high degree of institutional participation, can amplify price elasticity, but they also easily trigger the “herd effect” of speculative funds. The logic of the “gold – silver ratio” repair has been fully priced in by the market. If the subsequent industrial demand data (such as photovoltaic installed capacity and silver paste orders) fails to meet expectations, or if gold strengthens again due to a resurgence of risk – aversion sentiment, silver may face callback pressure after the “catch – up growth logic” is disproven. In addition, the high volatility of the futures market (such as the fluctuation of the implied volatility of COMEX silver options) may also intensify short – term price fluctuations.

Suggestions for Entrepreneurs: Seize the Opportunities of Industrial Transformation and Be Wary of Technological and Cyclical Risks

For entrepreneurs interested in the precious metals or industrial metals fields, the strong rise of silver in this round provides multiple insights. They need to seize the opportunities while preventing risks:

-

Focus on industrial application scenarios and layout emerging demand growth points: The core value of silver has shifted from being a “precious metal” to having a “dual – attribute of industry + precious metal.” Entrepreneurs can focus on its application expansion in fields such as photovoltaic (silver paste), electronics (conductive materials), and healthcare (antibacterial materials). For example, in response to the trend of declining silver consumption in the photovoltaic field, they can develop cost – effective substitutes for silver paste (such as silver – coated copper technology) or improve the recycling efficiency of silver paste to ensure the stable supply of the industrial chain while reducing unit consumption. In the electronics field, they can explore the application of silver as a high – precision conductive material in 5G base stations and new – energy vehicle chips to seize the technological high – ground.

-

Track technological iteration and industrial policies and dynamically adjust business directions: The high volatility of industrial demand requires entrepreneurs to be sensitive to technology and policies. They need to continuously monitor the photovoltaic technology roadmap (such as the difference in silver consumption between HJT and TOPCon batteries), the business cycle of the electronics industry (such as the semiconductor inventory cycle), and global new – energy policies (such as the impact of the EU’s “Green Deal” on photovoltaic installed capacity), and adjust their product structure or business focus in a timely manner. For example, if a certain type of photovoltaic technology (such as perovskite) becomes mainstream in the future and has lower silver consumption, they need to pre – arrange the material supply or recycling services corresponding to this technology.

-

Utilize the cyclical law of the “gold – silver ratio” to optimize investment and inventory management: For enterprises engaged in silver trading or processing, they can refer to the historical fluctuation law of the “gold – silver ratio” to optimize their inventory strategies. When the “gold – silver ratio” is at a high level (for example, more than 10% above the central value), they can appropriately increase their silver inventory or go long on silver in the futures market; when the “gold – silver ratio” repairs to a low level, they can gradually reduce their inventory or hedge against the risk of price declines. At the same time, they need to be wary of the short – term speculative sentiment’s impact on prices and avoid high inventory costs caused by chasing price increases.

-

Strengthen the linkage with the consumer end and expand the “emotional value” of silver: In response to the “cold” consumer end of silver jewelry, entrepreneurs can try to enhance the added value of silver jewelry through design innovation (such as national – style silver jewelry and smart – wearable silver jewelry) or brand marketing (such as positioning as “affordable luxury” for young consumers) to promote the resonance of demand between the consumer end and the industrial end. For example, in line with the demand of Generation Z for personalized and lightweight jewelry, they can develop small – weight, high – design silver jewelry products to lower the consumption threshold and expand the customer base.

Overall, the strong rise of silver is the result of both the upgrade of industrial demand and the repair of its financial attribute, providing innovative opportunities for entrepreneurs around the “dual – attribute of industry + finance.” However, it should be noted that the high volatility of industrial demand and the uncertainty of technological iteration require entrepreneurs to be flexible in their layout and achieve long – term and stable development through technological R & D, scenario expansion, and risk hedging.