Positive Comment: Regulatory Pressure and Capacity Reinvention — The Transformation Opportunities for Small and Medium-sized Banks Exiting the Loan Assistance Business

In November 2025, small and medium-sized banks such as Urumqi Bank, Guizhou Bank, and Longjiang Bank collectively announced their withdrawal from or contraction of the internet loan assistance business. This move may seem like a passive response to the regulatory requirements of “Document No. 9,” but in fact, it reflects the proactive choices of small and medium-sized banks in the face of industry cycle changes. In the long run, this adjustment is not only a “survival strategy by sacrificing a part” under compliance pressure but also a crucial turning point for small and medium-sized banks to return to their roots and reshape their core capabilities.

First of all, the tightening of regulations has accelerated the standardization of the loan assistance business, relieving small and medium-sized banks of the risk burden of “gray businesses.” In the past decade, the internet loan assistance business has rapidly emerged due to its ability to solve the pain points of small and medium-sized banks, such as difficult online customer acquisition and weak risk control. However, it has also given rise to problems such as high interest rates (some comprehensive costs exceed 24%), outsourced risk control, and excessive lending. For example, Bohai Bank once relied on loan assistance to boost its consumer loan scale from 8.8 billion to 112.7 billion. However, due to the tightening of policies, its scale was halved, and the non-performing loan ratio soared to 12.37%. Similarly, Shanghai Bank’s performance and valuation were dragged down after the expansion and subsequent contraction of its loan assistance business. This time, “Document No. 9” clearly requires that the comprehensive financing cost be strictly controlled below 24% and mandates the disclosure of a cooperation “whitelist,” directly cutting off the cooperation path between small and medium-sized banks and high-interest loan assistance platforms. For small and medium-sized banks, stopping such “high-yield, high-risk” businesses is essentially an active defense against potential compliance fines (such as those imposed on Ping An Bank and Shanghai Pufa Bank for imprudent loan assistance management) and the explosion of non-performing assets, clearing the way for subsequent stable operations.

Secondly, exiting the loan assistance business forces small and medium-sized banks to improve their independent digital credit capabilities and promotes the transformation of their business models from “relying on the outside” to “endogenous-driven.” Take Guizhou Bank as an example. In the third quarter of 2025, its personal comprehensive consumer loans (excluding credit cards) increased by more than 70% compared with the beginning of the year, and the increase mainly came from independent digital credit business. This change reflects that small and medium-sized banks have realized that the “traffic dividend” of the loan assistance business is unsustainable. The bargaining power of leading platforms (such as Ant and ByteDance, with the top 5 platforms accounting for 76% of the balance) is too strong, and small and medium-sized banks have difficulty in mastering customer data and the initiative in risk control during cooperation. In the long run, they will become “fund channels.” By developing independent capabilities, small and medium-sized banks can directly reach customers, accumulate data assets, and optimize risk control models, truly building a closed-loop capability of “customer acquisition – risk control – operation.” For example, some city commercial banks have been able to launch pure independent consumer loan products with “online application, instant approval, and instant lending” by building their own APPs and accessing local government data (such as social security and tax data). These products have lower interest rates than those of loan assistance cooperation products and higher customer stickiness.

Finally, against the backdrop of industry differentiation, exiting the loan assistance business helps small and medium-sized banks focus on their “local advantages” and avoid homogeneous competition with large banks and leading platforms. Currently, the “national subsidy” policy for consumer loans only covers state-owned large banks, joint-stock banks, and leading consumer finance companies. Small and medium-sized banks are at a disadvantage in terms of capital cost (the average liability cost of large banks is about 1.5% – 2%, while that of small and medium-sized banks exceeds 2.5%) and customer group quality (large banks cover high-quality customer groups, while small and medium-sized banks mostly serve the sinking customer groups). Instead of “involution” with large banks in the loan assistance market, small and medium-sized banks should deeply cultivate local customer groups: use the advantage of sinking outlets to serve the county economy and small and micro enterprise owners; develop customized products in combination with regional industrial characteristics (such as farmer loans in agricultural provinces and business loans in manufacturing clusters); and improve service efficiency through the integration of “online + offline” (such as offline contact by customer managers and online system approval). This “small but beautiful” localization strategy may become a breakthrough for small and medium-sized banks in differentiated competition.

Negative Comment: Business Disruption and Capacity Gap — The Real Challenges in the Transformation of Small and Medium-sized Banks

Although exiting the loan assistance business is a rational choice for small and medium-sized banks, they still face multiple challenges during the transformation process. The short-term pain caused by business contraction, the high cost and long cycle of independent capacity building, and the intensification of market competition may all become “stumbling blocks” on the transformation path.

Firstly, the contraction of the loan assistance business may put short-term pressure on the income of small and medium-sized banks, and there is even a risk of “business disruption.” Some small and medium-sized banks have relied on the loan assistance business to rapidly expand their consumer loan scale in the past, thereby driving the growth of interest income. For example, in 2020, consumer loans accounted for 36.3% of Bohai Bank’s personal loans, and loan assistance contributed significantly. Although consumer loans only accounted for 3% – 4% of Longjiang Bank and Urumqi Bank, the loan assistance business may have been the main entrance to their online retail business. After stopping loan assistance, if the independent digital credit business cannot fill the gap in time, the growth rate of retail loans may slow down, and interest income may decline. More importantly, the loan assistance business was an important channel for small and medium-sized banks to reach young customer groups and cultivate online user habits. After exiting, if the customer acquisition ability of their own channels (such as mobile banking) is insufficient, they may face the risk of customer loss.

Secondly, the construction of independent digital credit capabilities requires long-term investment, and small and medium-sized banks face multiple gaps in technology, data, and talent. The core of digital credit is “precise customer acquisition + intelligent risk control + efficient operation,” which requires small and medium-sized banks to have three major capabilities: First, data integration ability, which requires connecting in-bank (customer assets, transactions) and out-of-bank (government affairs, e-commerce, social) data. However, small and medium-sized banks generally lack data governance experience, and the cost of purchasing external data is high. Second, technology development ability, which requires building an intelligent risk control system (such as machine learning models and anti-fraud systems). However, small and medium-sized banks have limited technology investment (in 2024, the average technology investment ratio of city commercial banks was only 2.3%, far lower than the 3.5% of joint-stock banks) and have difficulty independently developing complex systems. Third, talent reserve, which requires recruiting algorithm engineers, data analysts, and Internet operation talents. However, small and medium-sized banks have difficulty attracting high-end talents due to their geographical location and lack of salary competitiveness. These shortcomings may lead to the situation of “high investment, slow results” in the independent business of small and medium-sized banks, and they may even fall into a vicious circle of “transformation investment – income decline – insufficient resources.”

Thirdly, with the intensification of market competition, the “local advantages” of small and medium-sized banks may be squeezed by large banks and leading platforms. On the one hand, state-owned large banks, with their low capital cost (for example, in 2025, the consumer loan interest rate of Industrial and Commercial Bank of China was as low as 3.2%) and the support of the “national subsidy” policy (the interest rate is even lower after interest subsidy), are accelerating their penetration into the county market and competing with small and medium-sized banks for high-quality customer groups. On the other hand, although leading Internet platforms are restricted by “Document No. 9,” they still cover the sinking customer groups through cooperation with licensed consumer finance companies (such as Ant Consumer Finance and Du Xiaoman Consumer Finance) due to their traffic entrances (such as Alipay and Douyin) and scene advantages (such as e-commerce and life services). If small and medium-sized banks cannot form differentiation in terms of interest rate and product experience, they may face the double squeeze of “high-quality customer groups being snatched by large banks and sinking customer groups being harvested by platforms.”

Advice for Entrepreneurs: Focus on Compliance, Deeply Cultivate the Local Market, and Build Resilience

The transformation practice of small and medium-sized banks exiting the loan assistance business has important implications for entrepreneurs in the innovation and entrepreneurship field (especially those in the fintech and inclusive finance tracks). Combining news events and industry trends, entrepreneurs can optimize their strategies from the following three aspects:

Respect regulations and plan compliance capabilities in advance: The contraction of the loan assistance business is essentially the regulatory cleanup of the “gray area.” Entrepreneurs need to realize that the compliance of financial business is the lifeline. Whether it is a loan assistance platform cooperating with financial institutions or a fintech company providing technical services, they should actively adapt to regulatory requirements (such as the 24% upper limit of comprehensive cost and the disclosure of cooperation lists) and avoid relying on “borderline” models. For example, they can adjust the product pricing model in advance and include service fees and handling fees in the comprehensive cost calculation; establish a compliance disclosure mechanism to ensure that cooperation information is transparent and traceable.

Deeply cultivate vertical scenarios and avoid direct confrontation with giants: The transformation direction of small and medium-sized banks is “localization and differentiation.” Entrepreneurs also need to avoid homogeneous competition with leading platforms. For example, for vertical scenarios such as farmer loans for the county economy, equipment loans for manufacturing clusters, and consumer loans for community services, giants are difficult to cover due to “high sinking costs” or “unfamiliarity with the scenarios.” Entrepreneurs can deeply cultivate these scenarios, accumulate industry data, and establish risk control models to form a “small but specialized” competitive advantage.

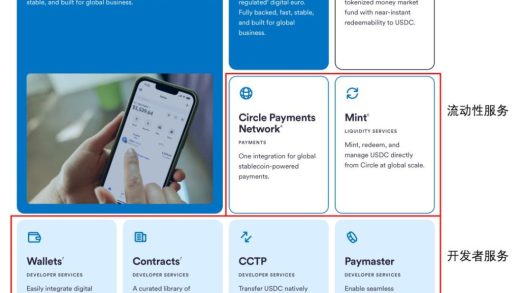

Build the composite ability of “technology + service” to empower small and medium-sized institutions: The pain point of small and medium-sized banks is “insufficient independent ability.” Entrepreneurs can provide technical empowerment around their needs. For example, develop lightweight intelligent risk control systems for small and medium-sized banks (based on the SaaS model to reduce costs), provide local data integration services (such as connecting to regional government affairs data), and train Internet operation talents. This “empowering” role can not only solve the actual problems of small and medium-sized banks but also establish a stable income source through long-term cooperation.

Pay attention to the customer lifetime value rather than short-term scale: One of the lessons of the loan assistance business is “emphasizing scale over quality,” which led to a sharp increase in the non-performing loan ratio. Entrepreneurs need to attach importance to the long-term value of customers and improve user stickiness through refined operations (such as personalized product recommendations and customer segmentation management) rather than simply pursuing short-term customer acquisition volume. For example, for small and micro enterprise owners, a comprehensive solution of “loan + supply chain finance + enterprise service” can be provided to bind customers through multi-scenario services and reduce the default risk.

In short, the withdrawal of small and medium-sized banks from the loan assistance business is an inevitable result of industry standardization and also a window for entrepreneurs to re-examine market opportunities. Only by focusing on compliance, deeply cultivating scenarios, and building empowering capabilities can entrepreneurs seize opportunities and achieve sustainable development in the transformation wave of the financial industry.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”