Positive Comments: The AI companionship track demonstrates strong growth potential, and the resonance between technology and demand activates innovation vitality

In 2025, the AI companionship track is becoming the focus of the global technology and consumer sectors with a posture of “rapid expansion + diverse innovation”. Its prosperity not only stems from the promotion of technological progress but also reflects the society’s deep – seated demand for emotional connection, bringing multiple positive values to entrepreneurs and the industry.

Firstly, the explosive growth of the market scale and continuous capital injection verify the high potential of the track. According to Grand View Research, the global intelligent companionship market reached a scale of $28.19 billion (approximately 200 billion RMB) in 2024 and is expected to expand at a compound annual growth rate of 30.8% from 2025 to 2030. Behind this growth is the dual – drive of technology and demand: the breakthrough of large – language models (such as ChatGPT) has lowered the technological threshold for AI interaction, and the surging emotional needs in scenarios such as the loneliness economy, the silver – haired economy, and parent – child education in the post – pandemic era have formed a positive cycle of “technology supply – demand release”. At the capital level, the layout of leading enterprises is more iconic. OpenAI spent $6.5 billion to acquire AI hardware startup io, ByteDance launched the companion doll “Eye – catching Package” and the smart earphone Ola Friend, and Finnish Oura completed a $200 million Series D financing (valued at $5.2 billion). These actions not only inject funds into the industry but also accelerate the implementation of technology.

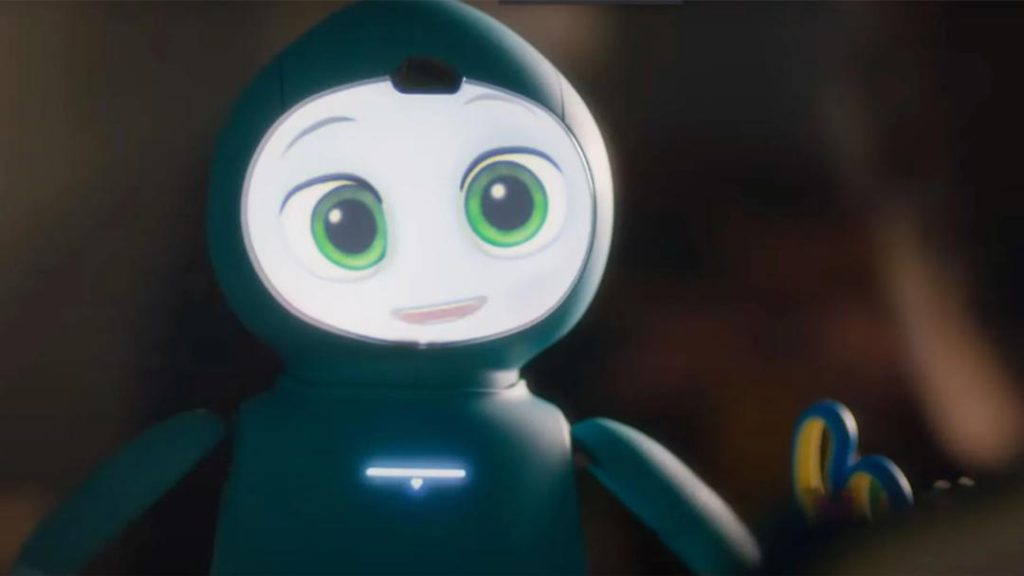

Secondly, the two – way innovation of hardware and software promotes the enrichment and refinement of the industry ecosystem. In the hardware field, AI toys have become the fastest – growing category with “low threshold + high profit”. For example, the BubblePal AI pendant of YueRan Innovation sold 250,000 units in half a year with sales exceeding 100 million yuan, and a toy factory in Dongguan has a monthly production capacity of over 200,000 units. These data reflect the strong market demand for hardware products that combine “emotion + practicality”. More importantly, the cost structure of AI toys is very attractive: the cost of the chip module is only a few to dozens of yuan, while the terminal selling price can reach 500 yuan, with a profit margin as high as 25 – 30%. This “asset – light, high – return” model has attracted a large number of small and medium – sized manufacturers to enter the market, accelerating the innovation and iteration of the industrial chain. From traditional toys to “chatty plush dolls”, AI has opened up a new battlefield of “emotional premium” for the toy industry and is even called “another revolution in trendy toys after Pop Mart”.

In the software field, AI companionship applications have shifted from the early “spiritual树洞” to “scenario – based services”, significantly enhancing user stickiness. For example, “Doudou Game Partner” with the positioning of “a great teammate for gaming” has gained 8 million users, and xAI’s “intelligent companion” model (including NSFW adult content) triggered 30 million topic discussions on the X platform within 24 hours of its launch. These cases show that AI companionship software is shifting from general emotional value to more specific and practical services. In addition, parasitic innovation (such as Japan’s “AI Man” accessing the Line platform) and in – depth exploration of vertical categories (such as more than 20 domestic products in the education companionship track) also verify the potential of niche markets. Parents pay 499 yuan for the “chicken – baby” scenario, essentially paying for the dual value of “companionship + education”. The rigidity of this demand provides stable support for the long – term development of niche fields.

Finally, the collaborative exploration of leading enterprises and small and medium – sized manufacturers lays the foundation for the long – term development of the industry. Large enterprises quickly seize the high – ground with their advantages in capital, data, and ecosystem (such as 12 AI software of ByteDance being on the list of the world’s top 100), while small and medium – sized manufacturers fill the market gaps through “micro – innovation” (such as toys derived from the wild IP of “AI Shan Hai Jing”), forming a benign ecosystem of “large enterprises build the framework, small enterprises fill in the details”. For example, the intelligent desktop device Looi of Kechu Future verified the users’ demand for in – depth companionship through “15 high – frequency interactions per day”, and the three – year sales growth of 93.6% of Enabot’s pet companion robot proved the commercial feasibility of vertical scenarios. This diversified group of innovators injects continuous vitality into the industry.

Negative Comments: There are many hidden worries behind the prosperity, and the sustainable development of the industry faces multiple challenges

Although the AI companionship track seems bustling on the surface, there are hidden crises beneath the prosperity. From product experience to business models, from data security to industry structure, multiple challenges are testing the “quality” of the industry.

Firstly, the product experience is seriously out of line with user expectations, and the label of “artificial stupidity” is hard to shake off. Users’ core complaints about AI companionship products focus on “stiff interaction” and “useless functions”. Some consumers directly say that “the AI toy bought for 499 yuan is almost garbage”, and some users even joke that “AI companionship = artificial stupidity + emotional fraud”. The root cause of the problem is that some manufacturers only use “AI” as a marketing label instead of truly investing in technology R & D. For example, although the chip cost of AI toys is low (a few to dozens of yuan), most products only have basic voice recognition functions and lack core capabilities such as emotional understanding and personalized learning. After users’ novelty fades, these products will inevitably face the risk of being abandoned. A typical lesson in the hardware field is the Moxie robot of the US company Embodied. This children’s companion robot, once named “the best invention of 2020” by Time magazine, declared bankruptcy in 2025 due to its high price ($1500 + a monthly fee of $60) and unmet functional expectations (criticized by users as “not as good as interacting with a real person”). This warns the industry that technological packaging cannot replace real user value, and the premise of “emotional premium” is “emotional authenticity”.

Secondly, the fragility of the profit model coexists with industry bubbles, and the “quick – money – making” mindset exacerbates the chaos. Currently, the high profit of AI companionship hardware mainly relies on the “information gap” – consumers’ lack of understanding of chip costs and the short – term release of “emotional impulse consumption”, but this model is not sustainable. As chip costs become more transparent (such as the “single – digit cost” disclosed by users on Xiaohongshu), consumers’ sensitivity to the “AI” label decreases. If hardware manufacturers cannot make breakthroughs in functions (such as emotional recognition and dynamic learning), they will soon fall into the quagmire of “price war”. The software field also faces difficulties. The early “copy – paste” chat companions (such as “Xingye” and “Maoxiang”) have seen a sharp decline in daily downloads due to their strong substitutability. The model of turning to “cyber porn” (such as the NSFW function of xAI) attracts traffic in the short term but faces ethical disputes and regulatory risks (such as California’s SB 243 Act requiring the establishment of a security protection mechanism), and the long – term profitability compliance is questionable. More dangerously, some manufacturers enter the market with the mindset of “making a quick buck and running away”, inducing consumption through exaggerated publicity (such as “AI toys can cultivate children’s emotional intelligence”), which ultimately damages the overall reputation of the industry.

Thirdly, data security and ethical risks have become the “Sword of Damocles” hanging over the industry’s development. Since AI companionship products involve users’ private conversations (such as parent – child communication, elderly people’s health confessions) and emotional preferences and other sensitive information, the consequences of data leakage are far more serious than those of ordinary applications. In October 2025, the AI companionship applications Chattee Chat and GiMe ChatAI exposed 43 million private conversations and 600,000 pictures of 400,000 users due to server exposure, revealing the security loopholes in the industry’s data storage and transmission. In addition, the “incitement crisis” of AI companionship hardware (such as inducing children to imitate dangerous behaviors) has attracted regulatory attention. California’s SB 243 Act has become the first regulatory law in the United States targeting AI companionship chatbots, requiring operators to establish a security protection mechanism. In the future, the compliance costs (such as data encryption and content review) globally will increase significantly, and small and medium – sized manufacturers may be eliminated due to their inability to bear the technological investment.

Fourthly, the Matthew effect of “monopoly by large enterprises + difficult survival of small and medium – sized enterprises” suppresses the innovation vitality of the industry. From the software list (the top 30 of the a16z TOP50 are all occupied by large enterprises) to the hardware layout (giants such as ByteDance and OpenAI are betting on it), large enterprises quickly harvest the market with their advantages in capital, data, and ecosystem, while small and medium – sized enterprises can only struggle to survive in “side roads” (such as parasitizing on the Line platform and focusing on game partners). This pattern may lead to increased homogenization in the industry. Large enterprises are more inclined to “safe” large – scale layouts (such as education companionship and elderly companionship), while the space for “micro – innovation” of small and medium – sized enterprises (such as combining local cultural IP with AI) is compressed, ultimately suppressing the diversity and breakthrough innovation of the industry.

Advice for entrepreneurs: Focus on user value and cross the industry cycle with “in – depth exploration + compliance”

Facing the opportunities and challenges in the AI companionship track, entrepreneurs need to abandon the “quick – money – making” mindset, take user value as the core, and make in – depth exploration in technology, scenarios, and compliance to survive the industry reshuffle and achieve long – term growth.

First, reject “concept hype” and drive product R & D with “real needs”. Avoid blindly pursuing the short – term model of “low cost + high premium”, and instead invest in technology R & D around users’ real pain points (such as the interactivity of children’s education and the emotional recognition of elderly companionship). For example, learn from the experience of Kechu Future’s Looi with “15 interactions per day” and enhance user stickiness by improving the “personalized learning” ability of AI (such as remembering user preferences and dynamically adjusting conversation strategies). Hardware manufacturers need to make breakthroughs in chip performance (such as installing lightweight large models) and interaction design (such as multi – modal perception) to avoid falling into the reputation trap of “artificial stupidity”.

Second, explore sustainable profit models and get rid of the “information gap dependence”. In the hardware field, try the “hardware + subscription service” model (such as Enabot’s pet robot) and continue to monetize through subsequent content updates (such as educational courses and emotional stories). In the software field, break out of the homogeneous competition of “copy – paste” and turn to “scenario – based services” (such as game guides and career counseling) or “vertical communities” (such as health companionship for the silver – haired group), and achieve long – term payment by deeply binding user needs.

Third, attach importance to data security and compliance construction and make early arrangements for risk prevention and control. Entrepreneurs need to establish the principle of “data minimization”, collect only necessary information, and use technologies such as encrypted transmission and privacy computing to protect user data. At the same time, closely monitor global regulatory trends (such as California’s SB 243 Act) and embed compliance mechanisms (such as age grading and content filtering) in the product design stage to avoid business interruption due to ethical disputes or legal issues.

Fourth, avoid the “front – line battlefield” of large enterprises and deeply explore niche tracks. Small and medium – sized enterprises should focus on “micro – scenarios” not covered by large enterprises, such as social training robots for special children and AI dialect companion toys combined with local culture, and establish a competitive barrier through “small but beautiful” differentiation. For example, the success of the wild IP of “AI Shan Hai Jing” (sales exceeding one million on Amazon) is precisely because it captures the niche demand of “cultural resonance”. This “IP + AI” model is worth learning from.

In short, the coexistence of “heat” and “cold” in the AI companionship track is essentially an inevitable stage in the industry’s transition from “wild growth” to “rational development”. Only by returning to user value, taking technology as the foundation, compliance as the shield, and niche exploration as the breakthrough, can entrepreneurs stand firm in the wave of “carnival and hidden worries” and become real “wave – riders”.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”