Earning $3.4 Billion While ‘Lying Down’: How Trump’s ‘Presidential Economics’ Rewrote U.S. Power Monetization Records

In August 2025, a bombshell revelation rocked U.S. public opinion: Donald Trump and his family amassed $3.4 billion in profits leveraging his presidential identity over two terms, setting an unprecedented record in American political history for monetizing power. From Mar-a-Lago membership fees to cryptocurrency hype, this game spanning physical assets, financial instruments, and the digital economy—how did it all unfold?

From Promises to Collapse: The ‘Gray Zone’ of Conflicts of Interest

In January 2017, President-elect Trump vowed at a press conference that his eldest sons Donald Jr. and Eric would ‘manage the business’ and ‘never abuse presidential authority.’ Yet these promises crumbled under the allure of power. After the January 6 Capitol riot in 2021, his law firm withdrew representation; by his second term, the Trump family abandoned the ‘no new overseas deals’ pledge, raking in profits from five major transactions in the Persian Gulf alone. Donald Jr. bluntly stated: ‘Restraint in the first term didn’t stop the criticism—no need to tie our hands anymore.’

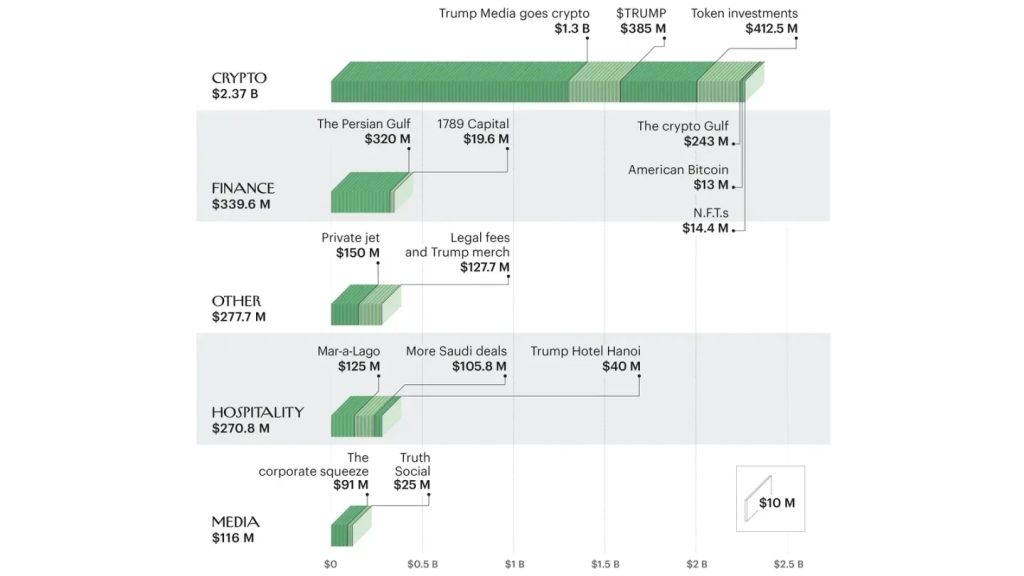

Breaking Down the $3.4 Billion: A ‘Monetization Map’ of Power

1. Mar-a-Lago: The ‘Cash Cow’ of Elite Networking

This Palm Beach estate, purchased for $10 million in 1985, became a ‘Mecca’ for the ‘Make America Great Again’ movement post-election. Membership fees surged from $20,000/year to $1 million, with annual revenue jumping from $10 million (2014) to $50 million. Over Trump’s terms, additional profits here alone hit $125 million.

2. Legal Fees & Merchandise: Direct Monetization of ‘Political IP’

- Campaign spending at Trump-owned hotels/resorts: Over $20 million; $18 million for Boeing 757 charters;

- Online store sales (e.g., ‘USA Bay’ caps): $17 million in profits;

- Licensing revenue (guitars, watches, books, etc.): $27.7 million;

- $100 million in legal fees paid via PAC using donor funds—a ‘private gift worth $100 million’.

Subtotal: $127.7 million (Total: $252.7 million)

3. Persian Gulf Deals: Power-for-Capital ‘Case Study’

- Jared Kushner’s $2 billion Saudi sovereign fund investment: ~$320 million personal profit;

- 30-year deals with Saudi real estate firm Dar Al Arkan: $105.8 million from hotel/golf course management in Oman, Riyadh, etc.

Subtotal: $425.8 million (Total: $678.5 million)

4. Private Jets & Media Settlements: The Value of ‘Hidden Gifts’

- Qatar Emir’s Boeing 747-8: ~$150 million resale value;

- Lawsuits against ABC, Meta, etc.: $91 million in settlements; Melania’s $28 million cut from Amazon documentary rights.

Subtotal: $241 million (Total: $919.5 million)

5. Crypto Frenzy: Power Leverage in the Digital Age

- NFTs: $14.4 million from Trump/Melania’s personal image NFTs;

- World Liberty Financial: $655.5 million from token sales & stablecoin USD 1 transactions;

- Meme coins TRUMP & MELANIA: $385 million from sales, fees, and ‘White House tour’ gimmicks;

- Trump Media’s crypto push: $1.3 billion in holdings.

Subtotal: $2.3595 billion (Total: $3.332 billion, final ~$3.4 billion)

Conclusion: The Perilous Line of ‘Presidential Identity Premium’

The Trump family’s $3.4 billion spans physical assets, licensing deals, and financial tools, with ‘presidential identity premium’ as the core logic. This not only shattered U.S. political records for power monetization but also blurred the line between public office and private gain—warning of democracy’s vulnerability when power becomes a commodity.

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”