Ethereum’s Decade Itch: The Ideal, Dilemmas, and Breakthrough Path of the World Computer

Ten years ago, a whitepaper ignited the dream of decentralization; today, it remains the heart of crypto—but the stage is no longer its alone.

From World of Warcraft to the World Computer: A Revolution in Rules

From mid-20th century giant mainframes to IBM’s enterprise systems, Microsoft/Apple’s PCs, and pocket-sized smartphones—each redefinition of computing reshaped humanity’s connection to the world. In 2013, 19-year-old Vitalik Buterin faced a digital injustice in World of Warcraft: Blizzard nerfed his Warlock’s skills, and no one could object. He wondered: Could a “World Computer” owned by no company, controlled by no single authority, spark the next computing revolution?

On July 30, 2015, in a small Berlin office, developers watched a block counter hit 1,028,201. Ethereum’s mainnet launched automatically. “We stared, and half a minute later, blocks started generating,” Vitalik recalled. The World Computer’s flame was lit—it embedded smart contracts into blockchain, turning ledgers into a global public computer for running programs.

Growing Pains: Bugs, Bubbles, and Scaling Breakthroughs

The fledgling network faced its first crisis in 2016: The DAO hack siphoned $50M–$60M ETH. Community split over “immutability vs. user protection,” leading to a hard fork and Ethereum Classic (ETC). The governance dilemma was laid bare.

The 2017–2018 ICO boom catapulted Ethereum, raising billions and boosting ETH prices—until the bubble burst, crashing 90% and exposing flaws: Even CryptoKitties clogged the network, revealing算力 bottlenecks.

By 2019, after exploring sharding (complex, slow) and Layer 2 solutions (Plasma, then Rollups), Ethereum settled on a “security on L1, execution on L2” scaling strategy. The World Computer began fragmenting into a multi-layered system.

Transformations and Highlights: From Burning Fees to a “Carbon-Neutral” Network

DeFi’s explosion and NFT mania (Beeple’s $69M sale) fueled growth, but high gas fees persisted. The 2021 EIP-1559 upgrade introduced “fee burning,” destroying base transaction fees as ETH. During peak demand, this even made ETH briefly deflationary, pushing its price near $4,900.

On September 15, 2022, “The Merge” replaced energy-guzzling PoW with PoS, cutting energy use by 99% and issuance by 90%. Post-merge, 300,000 ETH were removed from circulation, reinforcing scarcity. The 2024 Dencun upgrade (EIP-4844/Proto-Danksharding) slashed Rollup costs via low-cost “data blobs,” inching closer to full sharding.

Mid-Life Crisis: The World Computer’s New Challenges

A decade on, ideals meet reality—but new troubles loom.

Layer 2 Drain: Is the “Host” Being Hollowed Out?

Rollups relieved L1 pressure but trapped value on L2. A Standard Chartered report claimed Coinbase’s Base alone siphoned $50B in ecosystem value. L1 fee revenue dwindled as Arbitrum/Optimism transaction volumes often surpass mainnet—the “parts” run efficiently externally, but the “host” struggles to capture value.

Rival Chains “Stealing Market Share”

Solana lures new projects/MEMEs with high throughput; Tron dominates stablecoins (over $80B USDT); BSC splits GameFi traffic. Though Ethereum retains 56% of DeFi activity, its dominance has waned in the multi-chain era.

Governance Risks and Stagnant Apps

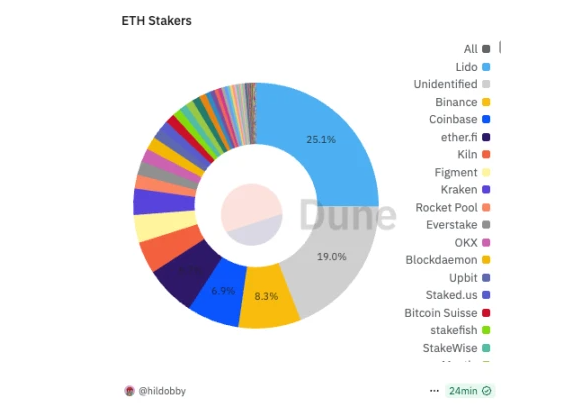

Post-PoS staking centralization: Lido controls 25% of staked ETH (vs. Binance’s 8.3%), risking security if a single entity exceeds 1/3. The Foundation faces criticism for “inaction” and opaque funding; Vitalik and early devs have stepped back, leaving governance in disarray.

Worse, the app layer is stuck: Beyond DeFi and NFTs, social (Friend.tech), gaming, and identity projects fail to scale. In July 2025, daily ETH burns dropped below 50 (vs. ~1,000 in 2021); active addresses hit 566k, new users 120k—no spark for the next app wave.

Market Underperformance

ETH hasn’t revisited its $4,900 2021 high. 2022–2024 saw it trail Bitcoin, Solana, and BNB; the 2025 ETH/BTC ratio hit a multi-year low below 0.02. While institutional “treasury buys” (ETH’s staking yields as a “yield-bearing” asset) lifted prices to $3,600, the rally lacks organic growth—more a temporary capital inflow than dev/user-driven momentum.

The Next Decade: What Programs Should the World Computer Run?

To rebound, Ethereum needs new growth engines.

Tech: Faster, More Unified

The roadmap targets 100k+ TPS across L1+L2, with cross-layer transfers as seamless as single-chain ops. Mature zero-knowledge proofs could resolve bottlenecks and draw users back.

Governance and Value Capture

The Foundation is reforming to “accelerate ecosystems, support devs” with greater transparency. Community debates L2 revenue-sharing, protocol fee/MEV tweaks to prevent L1 from devolving into a “settlement-only” layer.

Finding the Next Spark: Beyond Copying Web 2

Vitalik urges devs to look beyond Web 2, integrating wearables, AR, brain-computer interfaces, and local AI. Blockchain needs new narratives in social, identity, and AI—tech and capital alone won’t suffice; breakthrough apps must rewire habits and unlock demand.

Unfinished Journey: A Decade Itch, Still a Starting Line

“Ethereum’s first decade focused on theory; the next must focus on global impact,” said Vitalik. Next-gen apps need values and usability to attract newcomers.

The World Computer hasn’t stopped—it’s just finding direction. The next decade belongs to everyone who still believes. As Vitalik put it: “Everyone in the Ethereum community has a chance to help build the future.”

Read More《以太坊十年之痒:世界计算机的理想、困境与破局之路》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

链上探索《以太坊十年之痒:世界计算机的理想、困境与破局之路》

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”