Post-Surge Reflection: Which Phase of the Macro Cycle Are We In?

As BTC hits a new all-time high and ETH surges past $3,000, a question looms amid the crypto market狂欢: Is this rally driven by sentiment, or is it an inevitable result of the macro liquidity cycle? Recent dovish signals from Fed officials—San Francisco Fed President Daly hinting at “two rate cuts by autumn” and potential next Fed Chair Waller直言 “July should see rate cut discussions”—have thrust “liquidity” from an abstract term into a key determinant of your portfolio’s fate.

Why You Must Understand the Liquidity Cycle

Think of the global economy as a car engine; central bank liquidity is its lubricant. Too much (easy money) overheats the engine (asset bubbles); too little (tightening) seizes the pistons (recession). Notably, generational wealth is often created during the “tight-to-loose” transition—the 2021 crypto bull run, for example, was essentially a product of 2020’s global money printing spree.

2021-2025: The Liquidity Cycle Rollercoaster

Over the past five years, we’ve experienced four phases:

– Great Dovishness (2020-2021) : Zero interest rates + unprecedented QE + $16T fiscal stimulus. Global “money printers” ran at full speed, pushing M2 growth to post-WWII highs.

– Great Tightening (2021-2022) : 500 basis points of aggressive rate hikes + QT balance sheet reduction. Bond markets crashed 17%, and crypto followed with a 50% drop.

– * Plateau Phase (2022-2024)* : No more tightening加码, but high rates and QT persisted as central banks “waited and watched” to suppress inflation.

– Initial Pivot (2024-2025) : Global rate cut cycle begins. Rates remain high but start falling, with policy tilting subtly toward dovishness.

Mid-2025: Where Do We Stand?

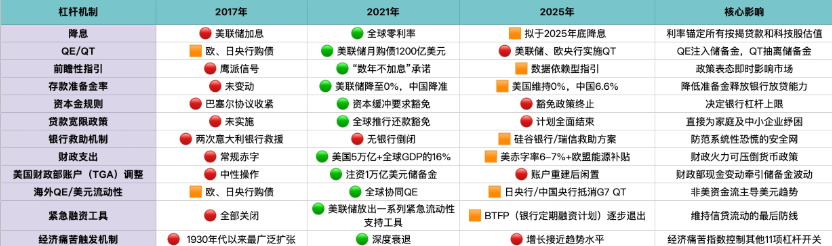

Current conditions resemble “one foot in Plateau, one testing the Pivot”: Rates stay elevated, QT continues, but Fed rhetoric betrays a dovish bias. For a quick comparison, check this “Liquidity Traffic Light” (🔴Inactive/🟠Mild/🟢Intense):

– Rate Cuts : 2017🔴(hiking), 2021🟢(zero rates), 2025🟠(mild cuts likely end-2025).

– QE/QT : 2017🔴(Fed shrinking), 2021🟢(global QE), 2025🔴(Fed QT, but Japan/China easing locally).

Four Signals to Watch for “True Dovishness”

Ignore short-term hype—these four signals matter most:

1. Inflation Target Met + Policy Shift : Fed drops “inflation-fighting” tough talk for “neutral” language—a “verbal松土” before rate cuts.

2. QT Paused : Central banks announce 100% reinvestment of maturing bonds, stopping liquidity drain and turning neutral.

3. USD Funding Stress : FRA-OIS spread above 25 bps or repo rate spikes, signaling market “cash shortages” forcing central bank intervention.

4. China RRR Cut : Reserve requirement ratio below 6.35%, releasing ¥400B base money—often the first domino in EM easing.

Bottom Line: Carnival or Building Momentum?

In short, we’re not in “full flood” mode yet. Market risk appetite will swing, but true mania arrives only when multiple green lights flash (e.g., rate cuts + QT pause). Remember: Understanding the liquidity cycle is your key to decoding wealth transfers.

Read More《暴涨后的沉思:我们正处于宏观周期的哪个阶段?》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”