After Hyperliquid, Can Bybit’s Byreal Become the New Leader of On-Chain DEXs?

As the crypto market landscape becomes clearer, DEXs (Decentralized Exchanges) have emerged as a key focus for platforms. Following Hyperliquid’s rise, Byreal—incubated by top CEX Bybit—has burst onto the scene with staggering hype: its public testnet attracted over 100,000 registrations in less than 3 days, and its first IDO oversubscribed by 22.5x. Born in the Solana ecosystem, can this ‘rising star’ take the lead in the on-chain DEX race?

CEXs Accelerate ‘On-Chain Shift,’ Byreal Becomes Bybit’s Critical Move

Current crypto platforms are largely divided into two paths: off-chain compliance (e.g., Circle/Kraken pursuing IPOs, traditional finance pushing ETFs) and on-chain decentralization (e.g., Hyperliquid-like DEXs, token launchpads). As a fast-growing CEX, Bybit is betting on both—expanding into tokenized US stocks via xStocks while launching Byreal to capture DEX market share, aiming to create a ‘CEX+DEX’ synergy ecosystem.

Byreal: A ‘Hybrid’ of CEX Liquidity and DeFi Transparency

Bybit CEO Ben Zhou highlighted Byreal’s core strengths:

– CEX+DEX Synergy: Merging CEX-level liquidity with DeFi transparency to deliver ‘hybrid finance’体验.

– Efficient Trading Engine: RFQ (Request for Quote) + CLMM (Concentrated Liquidity Market Making) routing, focusing on low slippage, MEV resistance, and high-speed transactions—critical for Solana users.

In short, Byreal aims to leverage Bybit’s capital and user base to offer on-chain trading as smooth as centralized platforms.

Reset Launch: Innovative IDO Model Sparks Frenzy

Post-testnet launch, Byreal quickly introduced its ‘Reset Launch’ IDO model, debuting with Fragmetric—a Solana re-staking protocol backed by Solana’s founder and $12M in funding. The results were striking:

– Target: 2,199 bbSOL (~$360k); Actual: 49,587 bbSOL (~$8.18M), 22.5x oversubscribed.

– Retail-Friendly: A participant investing 0.45 SOL (~$68) earned ~$200, 300% returns.

This ‘fixed-price tiered fundraising’ lowers barriers for small users, contrasting Hyperliquid’s project-focused ‘auction listing’ model and better aligning with retail demand.

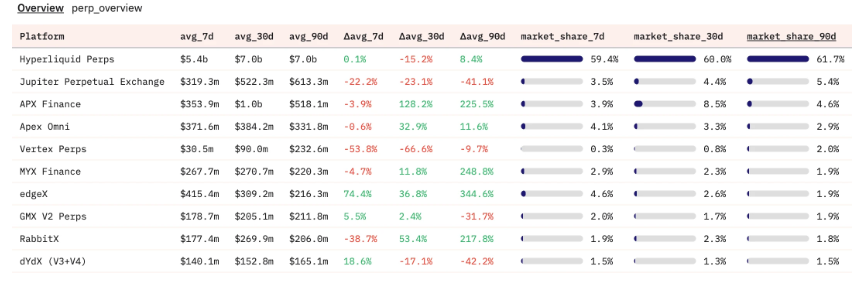

Rapid User Growth, but Hyperliquid Still Leads

To date, Byreal has ~278k testnet users, while Hyperliquid boasts 527k users (Dune data). Though trailing in scale, Byreal’s growth potential is massive, backed by Bybit’s 10M+ user base.

Key to Future Success: Wealth Effect, Ecosystem Integration, and Token Expectations

Byreal’s ability to challenge Hyperliquid hinges on three factors:

1. Sustained IDO Wealth Effect: Fragmetric’s token underperformed post-IDO (with the team apologizing for communication gaps), demanding long-term value from future projects.

2. Bybit Ecosystem Integration: Following Binance Alpha’s积分 linking its main exchange and on-chain生态, Byreal needs to list热门 tokens and design trading incentives to connect CEX/DEX liquidity.

3. Token Issuance Expectations: Despite regulatory constraints, a native token remains a major user driver—requiring clarity from Bybit/Byreal.

Notably, Byreal has partnered with compliant platform xStocks to offer tokenized trading of Tesla, Apple, etc., expanding from ‘crypto-only’ to ‘traditional finance + crypto’ and building a differentiation barrier.

Byreal’s mainnet is set for Q3 2025. With Hyperliquid dominating 60% of on-chain perpetual contract market share, whether this ‘CEX-backed DEX’ can break through with innovative mechanisms and ecosystem synergy will be a top crypto market story in H2.

Read More《3天10万用户,Bybit亲儿子Byreal掀翻Hyperliquid的DEX王座?》

This content is AI-generated and does not constitute investment advice. Please exercise your own rational judgment.

- Startup Commentary”Three post-2005 entrepreneurs are reported to have secured a new financing of 350 million yuan.”

- Startup Commentary”Retired and Reemployed: I Became Everyone’s “Shared Grandma””

- Startup Commentary”YuJian XiaoMian Breaks Issue Price on Listing: Where Lies the Difficulty for Chinese Noodle Restaurants to Break Through in the Market? “

- Startup Commentary”Adjusting Permissions of Doubao Mobile Assistant: AI Phones Are a Flood, but Not a Beast”

- Startup Commentary”Moutai’s Self – rescue and Long – term Concerns”